On August 14, 1935, President Franklin D. Roosevelt signed the Social Security Act into law as part of his commitment to protect Americans from the “the hazards and vicissitudes (misfortunes) of life”. Today, about 69 million Americans per month will receive a Social Security benefit, and about half of recipients age 65 and older depend on Social Security for half of their income.

If you’ve ever worried about Social Security “running out,” you’re not alone. It’s a common concern we get questions about, especially given all the current headlines and the fact that Americans are living much longer. Let’s take a closer look at what’s really going on and why there’s more reason for confidence than fear.

The Big Question: Is Social Security Going to Run Out?

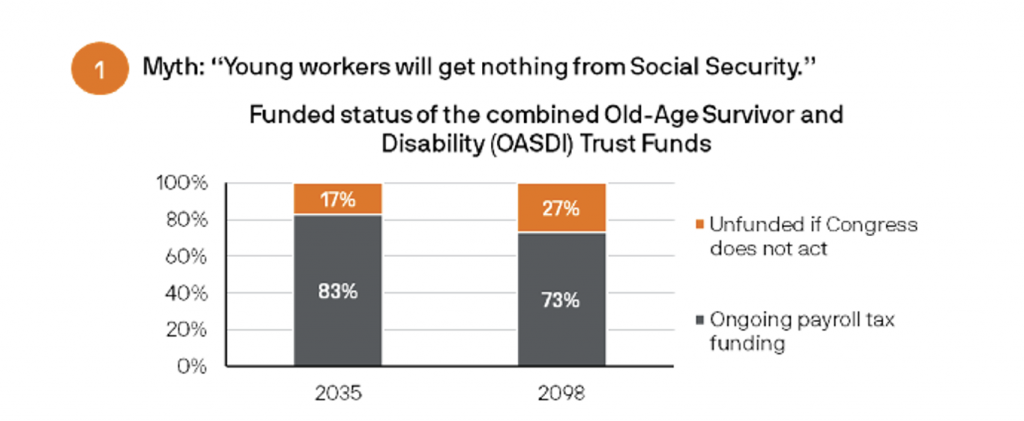

The short answer is no! Social Security isn’t going to disappear. Rather, if no changes are made, the program will only be able to pay about 80% of scheduled benefits starting in the early 2030s. That’s based on the ratio of workers paying into the system versus retirees drawing from it (see chart below).

What Happened the Last Time Social Security Was in Trouble?

History shows that the last time Social Security faced a funding challenge, lawmakers took action. In the early 1980s, President Reagan and congressional leaders worked together on a bipartisan solution to keep Social Security funded for decades. Many of the solutions offered back then are also applicable to today’s projected funding shortage.

Proposed strategies to strengthen the system today include:

- Increasing the payroll tax

- Extending coverage to more workers

- Raising the cap on earnings subject to payroll tax

The chart below goes into more detail as to how much of the gap each proposal would make up for:

None of these are easy decisions, politically speaking, but that’s actually a reason for optimism. Social Security is one of the most politically protected programs in the U.S., especially for voters nearing or in retirement.

As you can see, 66% of voters in 2022 fall in that category and would likely have a major influence on electing officials who support measures to fully fund Social Security. It’s safe to say that cutting benefits is extremely unpopular on both sides of the aisle, making it unlikely for current or near-retirees to face sudden reductions.

What Else Can I Do?

Take a deep breath. Resist the urge to act on what could happen and focus on the laws and processes currently in place.

As things stand, if you claim your benefits at age 62, your monthly benefit could be reduced by up to 30%. If you wait until full retirement age (67), you’ll receive 100% of your benefit. For every year after full retirement age until age 70, your benefit will grow by 8% per year. Not to mention, Social Security benefits typically receive an annual cost of living increase to keep up with inflation.

Social Security may be facing long-term challenges, but history, economics, and politics all point to one thing: it’s likely not going away. While adjustments will probably be needed to keep the program sustainable, soon-to-be retirees are unlikely to see drastic cuts.

There’s no one-size-fits-all answer when it comes to timing Social Security. The best decision comes from understanding how it fits into your overall financial plan that considers your life expectancy, income needs, and retirement goals.

If you have any questions, reach out to our team of advisors for help.