Yourself?

Your retirement accounts?

Somebody else?

I recently came across an article by USA Today discussing a survey that indicates Millennials and Gen X individuals are worried about their finances when they reach their retirement years.

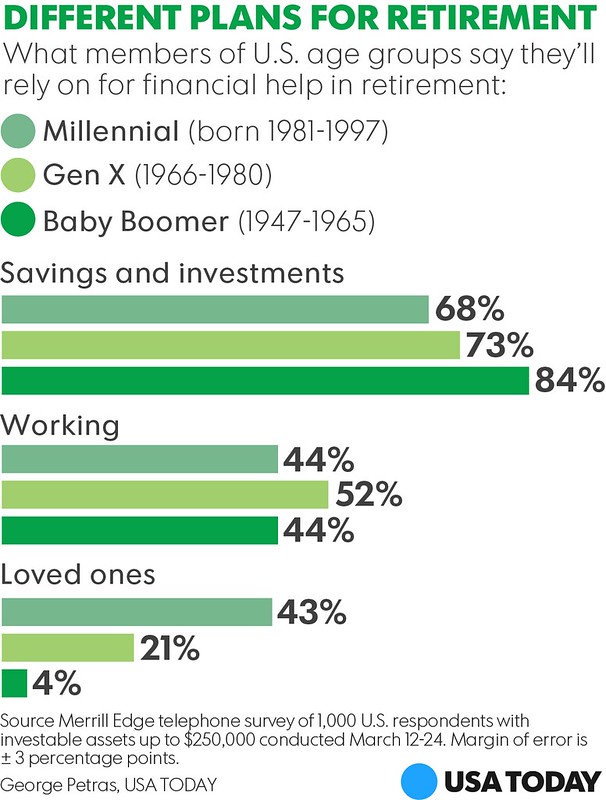

From the article an interesting bar graph was displayed showing where certain generations expect to rely on for financial help in retirement.

While “Savings and Investments” was by far the highest category, the “Loved Ones” category stood out to me. While only 4% of the Baby Boomer generation said they would rely on loved ones, a whopping 43% of Millennials stated they WOULD rely on loved ones!

Family Got Your Back?

I find this statistic to be an interesting one and wonder the basis of this assumption by 43% of these individuals.

Have they discussed this assumption with their loved ones?

What if their loved ones had not planned to leave an inheritance or financially support them during retirement?

Even if they have a goal to do so, do the loved ones have an actual financial plan that would aide them in providing this inheritance?

Lastly counting on loved ones for financial support in retirement could be detrimental if the loved ones use all of their investments to cover higher than expected medical costs or through senior housing and retirement communities.

Take Control of Your Retirement

Ultimately you should have another source of financial support in retirement such as a 401k or other investment savings.

The earlier you are able to start saving or increase savings in your retirement accounts the higher likelihood of having an adequate amount retirement savings to support you financially in retirement.

Walking through a financial plan with a CERTIFIED FINANCIAL PLANNER™ professional can help determine how best to reach your goals whether that be saving for retirement or planning to leave an inheritance for loved ones.