That is a question asked by many investors today.

One way to analyze this question is look at previous situations in US history when bond yields reached levels seen today.

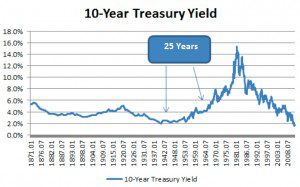

As noted in the chart, the previous treasury yield low points occurred around 1900 and 1941. Similar to today, these low points occurred after a massive buildup of debt in the early 1870s and late 1920s.

The result was interest rates stayed low for an extended period of time and when they did increase, it occurred gradually. For example, it took almost 25 years from 1941 to 1966 for the 10-year Treasury yield to exceed 5%.

The one material difference between now and then is the amount of Federal Reserve intervention, also called Quantitative Easing (“QE”). Time will only tell what impact that may have on future interest rates.

The summary is don’t be surprised to see an extended period of time of low interest rates given the deleveraging of the global economy. That being said since starting bond yield is a good indicator of future returns and because current yields are below inflation one must consider the loss of purchasing power over the next 10 years.

Related posts:

During these time periods it is important to work with a financial advisor to structure your portfolio appropriately.