Most of us feel like we have a sound process for investing, that is until curveballs are thrown our way. Then, emotions like envy, greed, and fear take over, making us feel like we need to abandon our long-term investing process for the short term. We do this by taking impulsive actions like:

- Timing the market

- Buying what’s hot

- Selling what’s plunging

However, the investors who do well, in the long run, are the ones who stay the course, focusing less on reactionary changes and more on well-defined targets that you can plan for.

In this week’s episode, we talk about the importance of planning for cash flow needs over the next five years and how to reframe your thinking about making short-term changes to your investment strategy.

Life Events That Will Require Available Money in the Next Five Years

Whether you’re retired or still working, there will always be certain planned life events that you’ll need to pay for out of savings and investments because they are beyond your income. This includes events like:

- Your child’s college tuition payments or wedding

- A down payment on a primary or second home

- The installation purchase of a business

- A balloon payment on a mortgage that can’t be refinanced

- Expected cash flow withdrawals for known spending needs

- Assisted living or nursing care costs

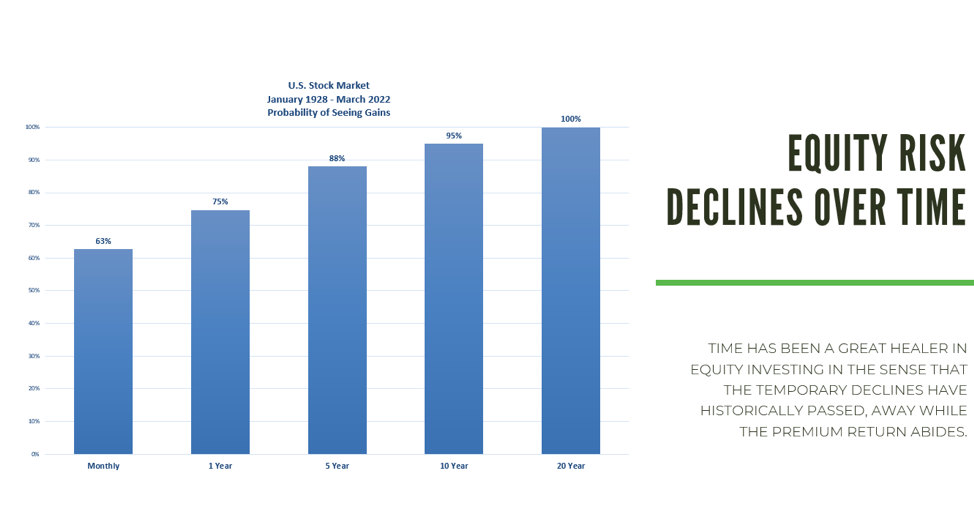

While the odds are heavily in your favor if you keep that money invested, as seen in the graph below, you may not want the funds for these events to be exposed to temporary market declines.

Having cash and bonds in your portfolio can help you take care of those more immediate needs without losing sight of your long-term strategy.

Navigating the Long Term

The long term is really just a bunch of short terms that you have to put up with over the years. And, your belief in your long-term strategy isn’t enough to get through them. At times you’ll need to convince your loved ones to stick with it during tough times.

While it’s hard to know how you might react to market declines, remember that a long-term strategy is less about time horizon and more about flexibility. Your odds of success tilt in your favor when you mix a long-time horizon with a flexible end date.

“Staying the course means thinking and acting for the long term even when it doesn’t feel right in the short-term.” – Ben Carlson

Suppressing Volatility Also Suppresses Return

As we mentioned above, your known capital needs highlight the importance of bonds and cash vehicles in a portfolio. However, what can happen is the tendency to extend this philosophy beyond known needs in the next 5 years in an effort to “reduce risk.”

We see this manifest in a number of ways:

- Wanting to eliminate market exposure at retirement or within 5 years of retirement

- Accumulating large sums of cash at the bank “just in case” or “for a rainy day”

- Assuming “long term” no longer applies once you reach a certain age

But remember, anything that suppresses volatility also suppresses return. In turn, this suppresses:

- Lifetime purchasing power

- Ability to meet your goals

- Leaving a legacy for your loved ones

- Donating to causes that are meaningful to you

As Jack Bogle once said, “There’s no escaping risk, instead we must decide what kind of risk you wish to take.”

Your Portfolio Strategy Is Just One Piece of the Plan

Remember that formulating your portfolio strategy is just one piece of a financial plan. When putting a plan together, the portfolio is the last step, as you formulate how much you need, how much risk is appropriate, and what the right path is for you in the long run.

Working with a financial advisor can give you a neutral, third-party perspective when you feel the urge to make reactionary decisions in the short term.

If you find yourself wondering if it’s time to change your long-term investing strategy, ask yourself what you expect you’ll need to withdraw in the next five years. If you’re holding onto cash or high-quality bonds beyond that amount, it might be a good time to reach out to a fee-only financial advisor to talk about the best next steps for you.

Outline of This Episode

- [2:04] Life Events That Will Require Available Money in the Next Five Years

- [7:55] Navigating the Long Term

- [10:28] Suppressing Volatility Also Suppresses Return

- [18:49] Your Portfolio Strategy Is Just One Piece of the Plan

Resources & People Mentioned

- Educated by Tara Westover

- How Your Money Memories Can Impact Your Retirement Decisions – Episode 155

- How to Do Long Term by Morgan Housel

- Let the Compounding Commence by David Booth