In recent weeks, several Wall Street market strategists have warned of lower expected returns for U.S. stocks over the next decade. Current valuations have been a common basis for these pessimistic views.

The difficulty of predicting the absolute level of future stock returns over any period, particularly short periods, is well documented (see Welch and Goyal, 2021). However, we know that research has shown some relation between current valuation ratios and future returns and the equity premium (see Campbell and Shiller, 1998, and Fama and French, 2000).

It’s a simple concept. Higher-than-normal prices versus company fundamentals, like earnings or book values, tend to be followed by lower-than-average returns and lower-than-normal prices versus fundamentals tend to be followed by higher-than-average returns.

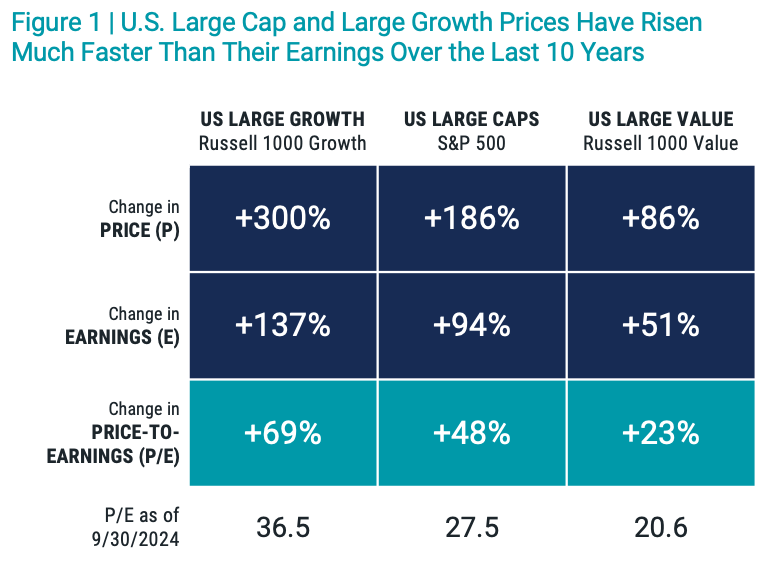

So, while strategists may point to the research and the 48% increase in the price-to-earnings (P/E) ratio for the S&P 500® Index over the last 10 years, we believe there’s far more to the story for investors to consider and caution that discipline and sound investment principles like diversification remain paramount. We explain what investors need to know.

Growth Stocks Have Driven Higher Valuations for U.S. Large-Cap Stocks

A reality that may be overlooked when reading grim headlines about future returns is that not all stocks have contributed equally to the rise observed in broad market valuations. Since the focus of the recent predictions has been on U.S. large-caps, we start there, offering insight into how valuations have changed over the last 10 years across the market and within style segments.

The analysis, shown in Figure 1, highlights that the increase in the P/E ratio for US large-cap stocks has been driven much more by large-cap growth stocks than value stocks. Over the period, the P/E ratio for large-cap growth stocks increased by 69% versus only 23% for large value stocks.

As with any ratio, changes in the numerator (in this case, price) and denominator (earnings) can influence them. Digging deeper into these components helps explain what’s happening within large-caps.

Growth stocks tend to trade at higher multiples because of higher future growth expectations. However, while their earnings have grown 137% over the past 10 years — probably higher-than-expected growth — the price has advanced by much more — a 300% increase over the same time. In comparison, price and earnings growth were much closer for large value stocks at 51% and 86%.

This difference between the price increase and earnings growth has driven current valuations among large growth and value stocks. While we can’t know what will happen in the future, it appears large growth investors are baking in unusually high expectations for future earnings growth, which may or may not materialize.

Data from 10/2014 – 9/2024. Source: Morningstar, Bloomberg.

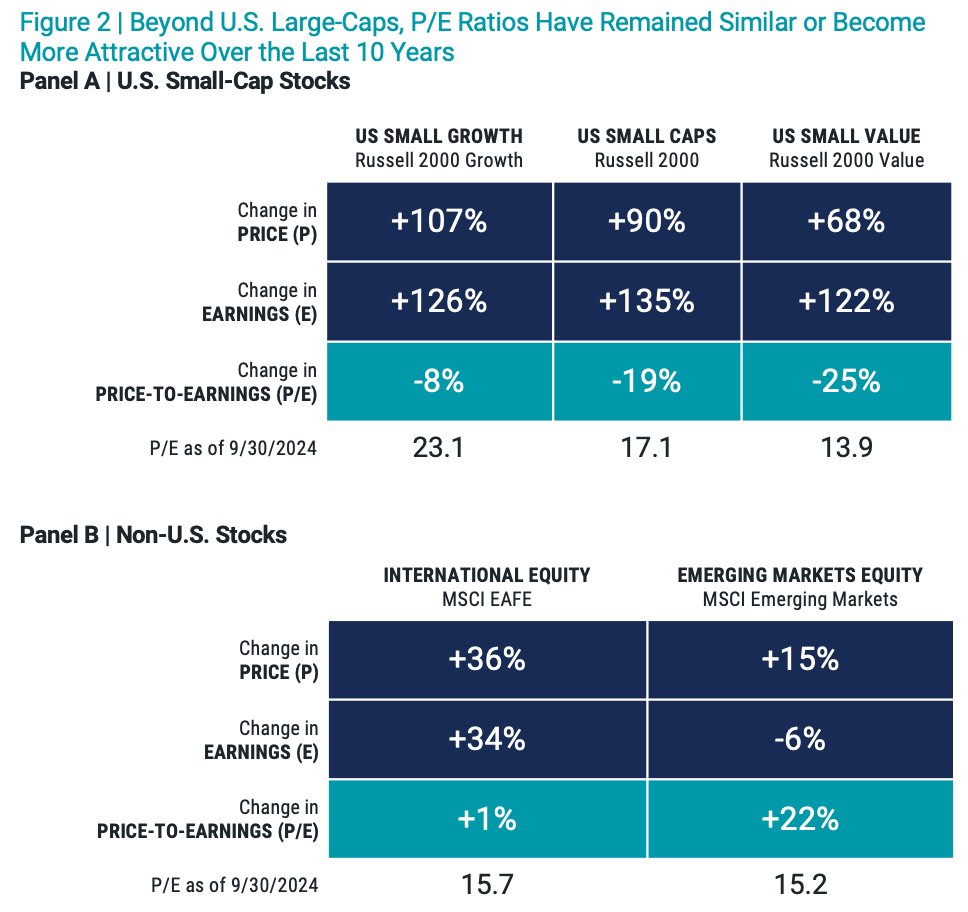

Looking Beyond U.S. Large-Caps

If we extend our purview, we observe that other areas of the global market have also seen much smaller changes to their P/E ratios than for the S&P 500 and U.S. large growth stocks over the 10-year period. In many cases, P/E has even declined. Figure 2 presents the same data shown in Figure 1 but for U.S. small-cap indexes (Panel A) and non-U.S. market indexes (Panel B).

Within U.S. small-caps, P/E declined by -19% for the broad small-cap index (Russell 2000® Index). P/E for small value stocks declined even more, at -25%, while small growth stocks’ P/E fell by -8%. Interestingly, earnings growth across all three small-cap indexes was higher than the growth rate for the S&P 500 but with much smaller corresponding price increases (lower change in price than change in earnings for each index).

For non-U.S. stocks, the P/E for international developed stocks was essentially flat over the decade, and for emerging markets stocks, the increase was 22% — still much lower than for the S&P 500 and U.S. large growth stocks.

Data from 10/2014 – 9/2024. Source: Morningstar, Bloomberg.

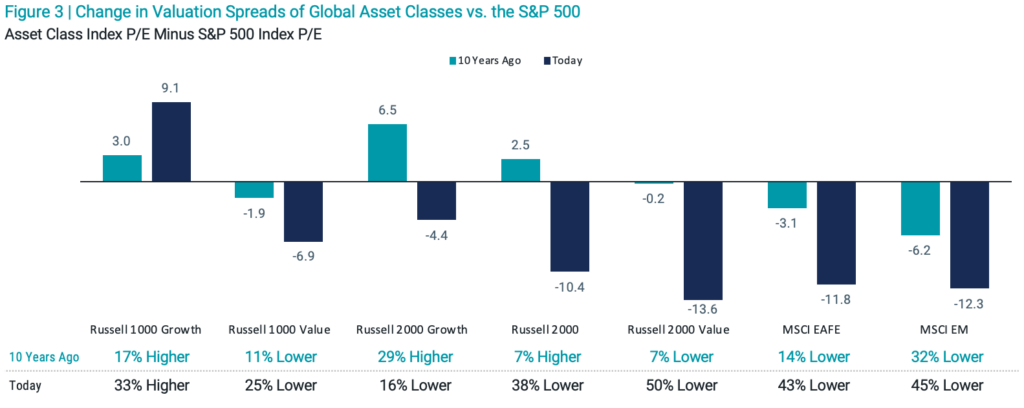

Different Look, Same Story

Figure 3 presents similar data as Figures 1 and 2 through a different lens. What can be implied from the prior exhibits is made explicit here through relative valuation spreads. While there are typically differences in valuations among asset classes (e.g., U.S. market P/E tends to be higher than the P/E for non-U.S. markets), over the last 10 years the difference between P/E ratios of the S&P 500 Index and other asset classes has widened. Valuations for all asset classes became more attractive relative to the S&P 500, with one exception — U.S. large-cap growth stocks.

Why does this matter? Think back to what we said about the research into valuations and future returns. Investors that consider and emphasize more attractive valuations within their portfolios are expected to fare better over time and on expectation, even more so when we see wider valuation spreads than normal.

Data from 10/2014 – 9/2024. Source: Morningstar.

A Note on Valuations Within Asset Classes

While valuations across asset classes offer information to investors, we should also be careful just to take the surface asset class valuations as being assigned to all stocks within a representative index. Even in the commonly mentioned broad categories like U.S. large-caps and U.S. large growth stocks, we observe differences in valuation ratios. Not all stocks that are given these labels are the same.

Figure 4 demonstrates that U.S. large-cap growth stocks show meaningful dispersion in valuations among companies within the large growth index. At the 80th percentile, we find a P/E ratio of 53.5 versus only 14.8 at the 20th percentile. The key takeaway is that elevated valuations in the aggregate for a given asset class aren’t necessarily a reason to avoid that area of the market entirely.

There are still potential diversification benefits from holding stocks across markets and asset classes. However, we can do better by considering differences in valuations within these asset classes to target or emphasize companies that offer higher expected returns going forward.

Data as of 9/30/2024. Source: Bloomberg.

Final Thoughts

We know that reading negative headlines about where the market is headed can be disconcerting, but don’t lose sight of the fact that people predict bad news for the market with relatively high frequency. They’re very often wrong, so maintaining discipline is important.

We can take comfort in knowing that if we diversify across markets and asset classes, we are ensured of having exposure to those segments of the market that offer attractive relative valuations. Also, if one area of our portfolio disappoints compared to expectations, then other parts of our portfolio may do better. That’s the power of diversification.

If we also remain aware of those differences in valuations and intentionally emphasize more attractive stocks and deemphasize less attractive ones, we can expect that to drive even better outcomes over the long term. If you have questions or want to talk with an advisor, please contact us today.

Source: Avantis Investors is an investment advisor registered with the Securities and Exchange Commission.