As one individual once told me, their investment portfolio is like an untended garden. An interesting, but accurate analogy. Without enough water and care the plants/flowers in the garden will never grow.

The same can be said about your investment portfolio. Without a well-executed plan it may not grow to reach your own goals (i.e. retirement, college, second home, etc.).

Similar to growing a garden, managing an investment portfolio is a process, not a one-time decision. An effective investment strategy involves discipline, research and a defined process.

Why does it matter?

Without pensions and an unknown future for Social Security, your investment results will help determine how much you can spend and how long you need to work. Therefore, blindly picking investments is also an investment strategy but not one I recommend.

Learn more about the Financial Symmetry Investment Strategy Here

Developing a Strategy

Where to start? Below are my core investment beliefs to help your own strategy that I and other experts recommend.

- Equities for the long term and high quality bonds/cash for short-term cash needs: Your portfolio should be customized based on your expected cash flows (risk capacity) and risk tolerance.

- Research driven investment process: A research driven process can’t control short-term outcomes, but can improve your odds of success over the long term.

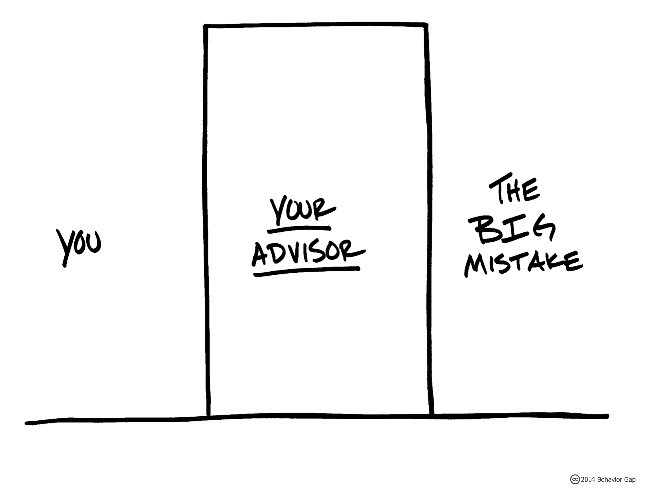

- Control your emotions: People suffer from behavioral biases (i.e., overconfidence, loss aversion, hindsight bias, etc.) impacting their ability to make smart financial decisions (i.e., buying high and selling low). Vanguard’s Advisor Alpha paper noted that financial advisors can add ~1.5% annually to investment returns by minimizing these mistakes.

- Asset allocation determines long-term returns: While many focus on finding the perfect investment, the better approach is to determine your appropriate asset allocation and stick with it in good and bad markets.

- Mean reversion exists: Asset classes (U.S. stocks, international stocks, bonds, etc.) can become under/overvalued and you should tilt your portfolio toward asset classes with the highest expected return.

- Diversification: Often called “the only free lunch in investing” because it is the best way to minimize risk while not reducing expected return.

- Tax efficiency: You spend after-tax returns not pre-tax, so you should optimize your portfolio for your tax situation.

- Select high quality investments at a reasonable cost: Common characteristics to look for in investment options include: independence, experience, reasonable cost and an ethical company culture.

- Develop a written investment plan: Create a document that details how often you’ll rebalance, review your holdings and track your performance.

Measuring Performance

Now that you’ve developed your own investment strategy how will you measure performance? Very few investors track their actual returns. I compare it to a golfer who doesn’t keep score. Everyone remembers the birdie, but people easily forget the triple bogey (bad investment). Without measuring your performance versus different benchmarks you’ll never know whether you have a successful strategy.

Finally, if you don’t have the time, interest and knowledge to do all this maybe it is time to work with a fee-only financial planner like Financial Symmetry. Unlike leaving your garden untended, the risk of making a big mistake on your investment portfolio is too large not to have a plan in place.

This blog post originally appeared on Nasdaq.