The transition to retirement can be an exciting time. Shifting to additional leisure and time for the things you enjoy is a positive change for many. But it can also be quite scary. Now more than ever, retirees are reliant on their personal savings and investments standing the test of time to make ends meet. With more time on your hands you may also focus more on the movements of your investment portfolio or your overall asset values, feeling the pain of short-term losses more acutely than when you had a steady paycheck. As the market free falls, you wonder, “what if I lose it all?”

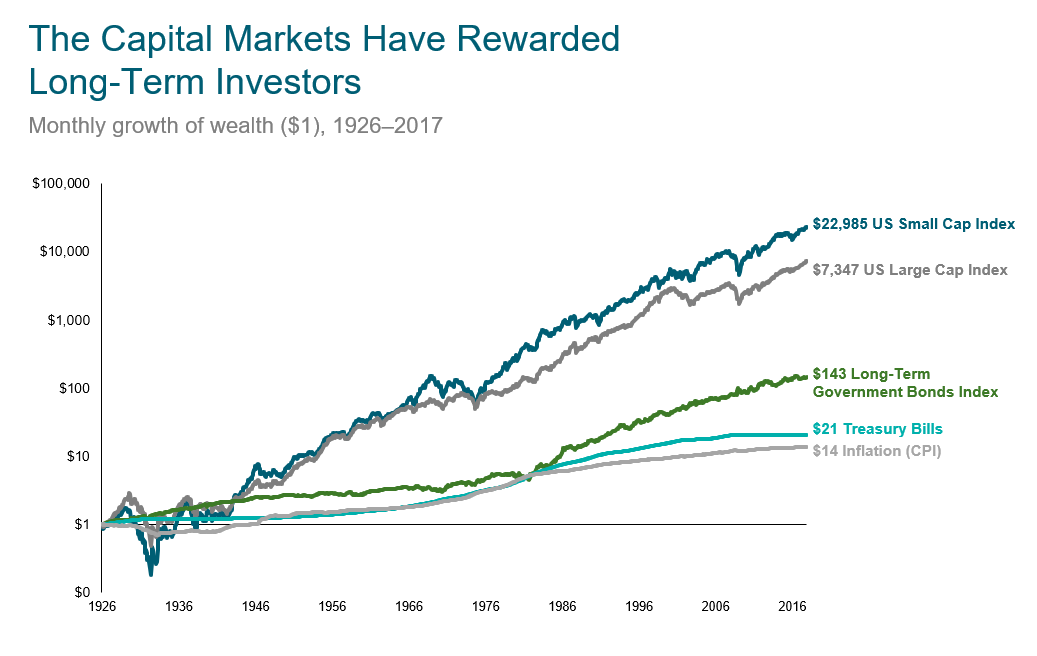

It’s a common fear and not surprising considering 30% of Americans are “constantly stressed about their finances.” Losing it all might mean living on a very fixed income of Social Security and (maybe) pension income with no savings left or becoming reliant on your adult children to supplement your standard of living. These are not easy things to think about and this is where having a plan in place is so beneficial. Investing for the long term means there are going to be bumps along the road.

A helpful analogy for stock market volatility is turbulence when flying on an airplane. The following example from Advisor Perspectives highlights this similarity:

“All of us who fly have experienced turbulence, which can range from unnerving to downright frightening. When asked about their flights, many travelers will comment on the amount of turbulence they encountered. But we know from years of FAA research that turbulence rarely causes injury or death. Instead, pilot error and other human errors are the leading causes of plane crashes. What if the FAA had listened to passengers to determine the risk of flying? Rather than meticulously studying each accident and uncovering the true cause, the FAA would have spent considerable time trying to reduce turbulence, as requested by passengers, thus missing the critical role of human error in accidents.

By focusing on short-term turbulence, they would have actually made flying more dangerous. But they did not and as a result we have just experienced the safest year in commercial flight since the dawn of the jet age.”

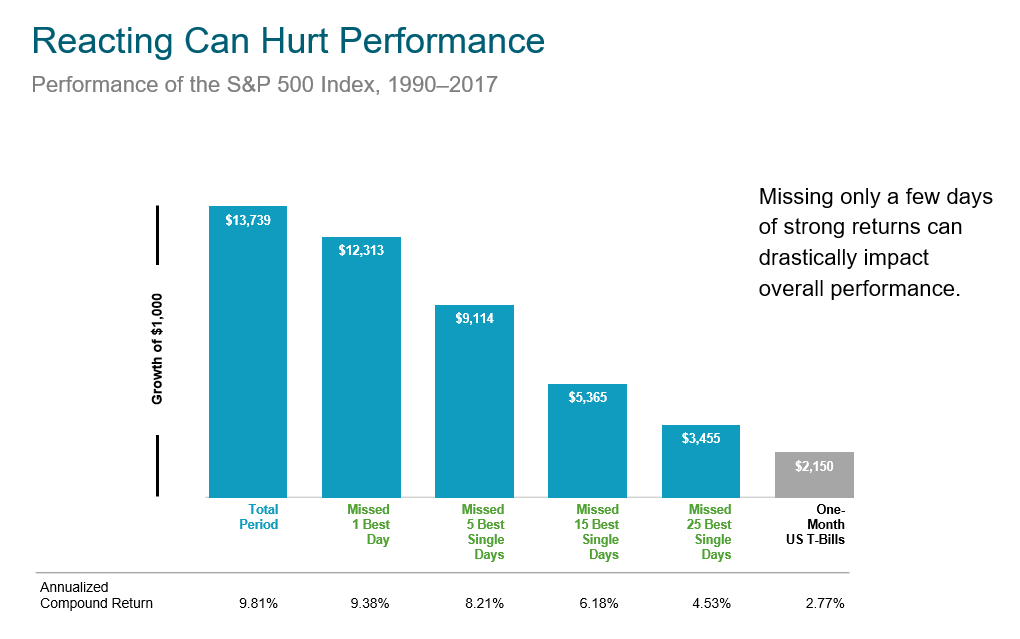

Investing in the stock market can create the same emotions our body experiences during flight turbulence. In times of losses and volatility it can feel safe to move all of your money to cash and “wait until things look better,” but this presents its own challenges as you are simply trading market risk for the risk that you lose purchasing power over time. That’s the challenge with market timing—you have to be right twice. You have to know precisely when to sell and when to buy back in. Bad timing decisions lead to wealth destruction, not wealth creation, because it’s an entrenched system of buying and selling at inopportune times.

While we know that the equity risk premium allows for higher long-term returns, in retirement we may feel like there is no time left to weather market losses. This is where knowing your risk capacity and utilizing diversification can put short term market movements into perspective. If you are not sure if your retirement portfolio is allocated appropriately or feel you might be taking too much risk, working with a fee only financial advisor to evaluate your long-term plan can give you the confidence to maintain your strategy in good times and bad.