Do you have a child going to college next year? Have you filled out the FASFA yet?

Many people feel they earn too much money to qualify for financial aid so they don’t complete the FASFA. That could be a mistake as we’ll discuss the reasons why below.

Background

October 1st is the first day that students can fill out the Free Application for Federal Student Aid, otherwise known as the FASFA, in order to receive aid for the 2019-2020 school year. Although you have until June 30th to complete the FASFA it is a bit of a first-come-first-served system so we recommend you complete it as soon as possible.

Many don’t realize that the U.S. Department of Education gives over $120 billion in federal grants, loans and work-study funds to more than 13 million college students, making it the largest provider of student financial aid in the country.

Reasons to Complete the FASFA

-

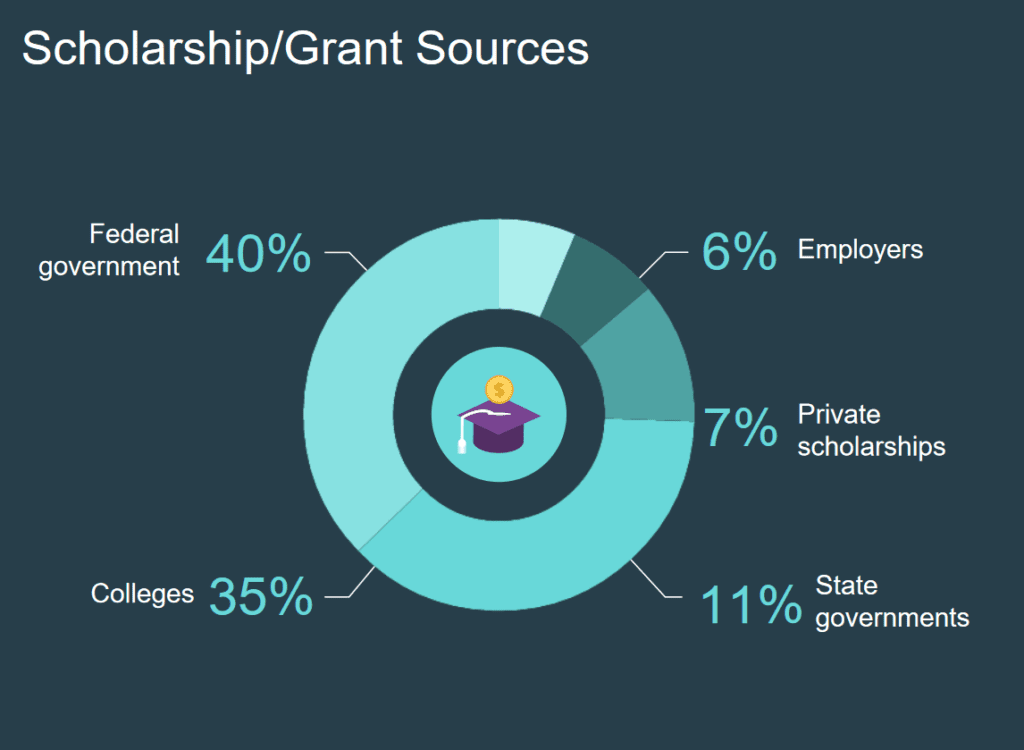

- Qualify for Merit Scholarships – some schools require the FASFA to be completed to qualify for merit scholarships. Also, as noted in the graph below the majority of aid comes from the colleges/federal government not private scholarships.

Source: http://www.twincitiesepc.org/assets/Councils/Minneapolis-MN/library/Sept27-2016-Wills-Chris-Presentation.pdf - Your Situation May Change – you may not qualify for aid initially, but what if you lose your job? Completing the FASFA is required to enter an appeal process due to a change in your financial condition.

- Access to Federal Direct Loans – studies have shown students that pay a portion of college do better academically than those that don’t. Everyone who completes the FASFA will have access to Federal Direct Unsubsidized Loans.

- Two Kids in School at Same Time – having more than one child in college at the same time can have a dramatic effect on your eligibility for financial aid.

- It’s Free – the FASFA takes the average student around 30 minutes to complete according to the U.S. Department of Education. There is no cost and well worth the time if your family saves money.

- Qualify for Merit Scholarships – some schools require the FASFA to be completed to qualify for merit scholarships. Also, as noted in the graph below the majority of aid comes from the colleges/federal government not private scholarships.

Below are links to tips on filling out the FASFA to avoid mistakes.

Tips on the 6 trickiest FASFA questions

Twelve Tips for Filling Out the FASFA, CSS Profile

Summary

Finally, reminder to complete the FASFA every academic year. Eligibility for student aid does not carry over from one academic year to the next. As your situation changes (income, assets, etc.) so does the likelihood of receiving aid.

To learn more about all aspects of savings for and paying for college check out our previous blog posts/podcasts below.

7 Insider Tips for Picking Your Best College

Great Options to Save for Your Child’s College Education

Strategies to Maximize your Child’s Financial Aid Eligibility