As we did last year, Financial Symmetry has covered several current events on our blog throughout 2016, and here is our view of the top 10 most memorable stories of the year.

1.Trump: In case you were living under a rock during 2016, Donald Trump faced off with Secretary of State and former First Lady, Hillary Clinton, in an unparalleled Presidential race of 2016. The entire election had astonishing amounts of media coverage worldwide. It was the 58th presidential election the U.S. has experienced, and one that will not easily be forgotten. While both Clinton and Trump had devout supporters, there were many Americans that found themselves unimpressed by both candidates. Ultimately, and to the shock of many, Donald Trump won on November 8th, 2016. His platform consisted of issues including having strong immigration laws, building a wall along the border of Mexico, renegotiating US trade laws with other countries and repealing the Affordable Care Act. Donald Trump will be the wealthiest and oldest president that the United States has ever had. He will also be the first president without any prior political or military experience. We provided commentary just after the election to clients on what may be to come for a Trump Presidency.

2. Reaction to the US Election: The 2016 U.S Presidential election outcome was a surprise to most observers. The stock market reacted strongly as futures fell by more than 5 percent before midnight ET when it started to become apparent that Hillary Clinton could lose to Donald Trump. However, by the time the nation woke up to the news that Donald Trump had indeed been chosen to be our 45th President stock futures had recovered and by the close of the day’s trading the S&P 500 was actually up over 1%. The volatile reaction by the market underscores the futility of trying to project how events will impact things in the short term. Keeping a long term focus allows for the uncertainty of immediate circumstances to give way to the steadier hand of market fundamentals.

3. Brexit: Prior to the US election, the surprise vote by Britain to leave the European Union (“Brexit”) was the biggest economic story of the year. The vote made the U.K. the only nation that aims to quit the economic and political bloc in its six-decade history. Similar to the US election the results were a surprise as many polls forecasted the U.K. would stay in the European Union. As a result, financial markets reacted violently to the news with the S&P 500 fell 5.3% over the next two days, its sharpest selloff in 2016. Here is a link to our view of the event on the day of the announcement. Next steps is the official start of Brexit, which is expected to begin by the end of March 2017 and will result in a two-year negotiation process primarily focused on immigration and trade.

4. Olympics: In August the world’s attention centered on the Olympic Games in Rio de Janerio, Brazil. Brazil, a country amidst their worst economic downturn since the Great Depression, a recent suspension of their President Dilma Rousseff, and battling terrorist threats and concerns over the Zika virus.Despite Brazil’s recent struggles, going into the games the benchmark stock index (Ibovespa) and currency were near the highest in more than a year, gaining 33% in 2016 after being down 38% over the last 5 years. Historically the S&P 500 has averaged a 1.75% gain from the opening to closing ceremonies of the last 20 Summer Olympics dating back to 1928. Since 1984 the benchmark indices of the host countries averaged a 1.74% gain from opening to closing ceremony. The best performer during the games as host country was a 9.41% S&P 500 return in 1984 with Los Angeles as host and the worst being China in 2008 with a 7.69% decline during their host in Bejing.

5. Apple vs. FBI for Data from Terrorists: In February, Apple was ordered by a judge via a complaint from the FBI, to unlock the San Bernandino shooter’s Iphone from December 2015 to access any data that could be helpful in preventing other similar attacks. But Apple refused to unlock the phone. From there a nearly two-month long stalemate occurred between the FBI and Apple until the FBI found a third party contractor to unlock the iPhone. For many Americans, this dilemma raised concerns over privacy and to what extent the government’s reach extends to corporations. The ultimate result means there is no legal precedent established for how far a government agency can go to access corporate records but raised some interesting questions that will continued to be debated.

6. Worst Start to a Year for US Stocks Ever: After the first 28 days of 2016, the S&P 500 index had turned in its worst start in history, a 10.5% loss to start the year. This is easily forgotten for many with the market now up over 10% in late December. But there are great lessons in remembering our thought process in moments like this. For the average investor, fear can result in detrimental actions in situations such as this. We sent a Market Commentary to clients in early February referencing a chart displaying intra-year declines going back 36 years displaying how volatility like this is normal. Actually, since the low point in February 11th, the S&P 500 has seen a 26.5% return through the highest close of 2016 so far. The takeaway is you’ll never know the exact moments when prices are the cheapest or the most expensive, but a disciplined strategy can help you stick in when the going gets the toughest.

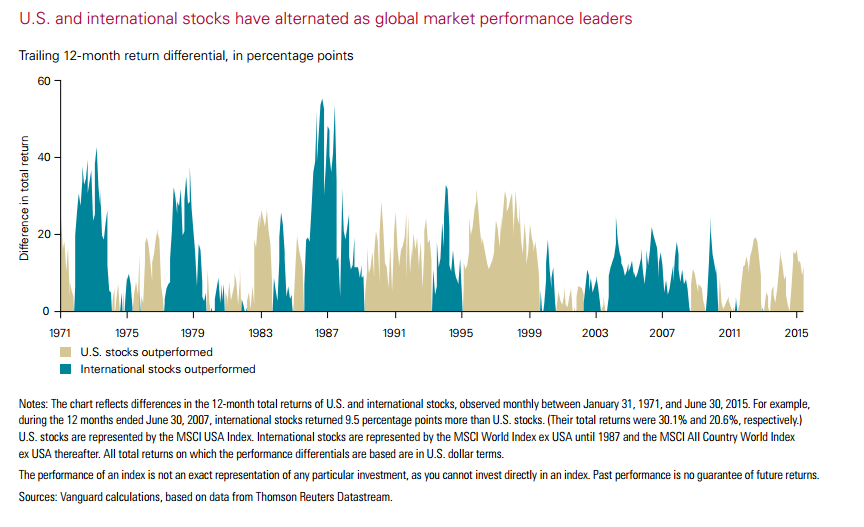

7. US Stock Market Outperformance Continues: After a relatively lackluster 2015, 2016 provided much more excitement for the US stock market. Following early year losses, another dip for stocks following the Brexit vote in June and a surprising Trump rally, US stocks have rallied strongly leading into the last few weeks of the year.Through 11/30 the S&P 500 with dividends returned 9.79%. Small cap US stocks have done even better, returning 15.35%. The Santa Claus rally has lifted asset prices further. This marks the 7th straight year that US stocks have outperformed other asset classes.

While asset prices could continue to rise further, historical cycles would argue for a return to the mean at some point. Proceed with caution and stay diversified.

8. The European Migrant Crisis Continues: Europe is dealing with a major migrant crisis that became an issue in 2015 and has continued throughout 2016. Migration numbers have increased significantly over the past two years as many individuals and families are travelling to Europe by boat and foot, often through dangerous situations, seeking refuge from persecution, war and violence in their countries of origin. Many of the migrants are refugees from countries in North Africa and the Middle East. Some of the top countries that have had citizens flee include Syria, Iraq, Somalia, Afghanistan, Sudan and the Democratic Republic of Congo. Over 5,000 people died in 2016 while trying to cross the Mediterranean Sea to Europe by boat. Around 360,000 people arrived in Europe by sea in 2016, which is a lot, but much lower than the 1,015,078 that arrived in 2015. The vast number of people migrating has created problems for many European countries as they do not have the capacity to help all of the migrants. The number of asylum applications that European countries are receiving has skyrocketed. Multiple agreements and laws have been put into place to help the situation, and the United Nations is assisting with its 10-Point Plan of Action for refugee protection and mixed migration.

9. End of Bond Bull Market?: It’s possible the biggest story remembered from 2016 could be this one. A little surprising in a year where most stories were dominated by the terms Trump and Brexit. But on July 8th, 30 year US Treasury bonds hit a low of 2.10%. Before that, we’d seen a 45-year decline on both the 30 yr and 10 yr US bonds since they topped out at just over 15% in 1981. This has many investors worried about bond prospects going forward. But length of time matters in this discussion. We addressed this in 2013, when we explained how it took 25 years from the last time we saw a low point in bond yields during the 1940s for the 10 year bond to surpass 5%. History has shown that money will still be made with bonds in a rising rate environment. But this is where a diversified strategy matters. Spreading risk within a disciplined strategy is the best medicine for staying focused on the things that matter most and have the highest impact. That is what you can control: savings, spending, and investing in your core competency.

10. Financial Symmetry Launches Podcast and Small Business 401(k) Service: 2016 was not only the year we celebrated our 15th year of serving clients, but we also launched our new small business 401(k) service and a podcast. One of the bigger news makers of 2016 involved the importance of working with a fiduciary financial advisor. But many still don’t realize how important this role is as it relates to your 401(k). For years, 401(k)’s have been chocked full of high costs that now is getting more attention. To better serve our clients, we now offer a unique hourly fee model to implement a lower cost high quality plan to small businesses.In the ever changing landscape of technology, 2016 saw continued growth in podcast listeners. We saw this as a great opportunity to provide a new way for clients to receive pertinent info from us when they don’t have time to read an article. We’ve received great feedback so far from the Financial Symmetry podcast and look forward to providing more great info through this medium in 2017.

Copyright: cienpies / 123RF Stock Photo