As we did last year, Financial Symmetry has covered several current events on our blog throughout 2013, and here are what we think the Top 10 Economic Stories of the Year have been:

As we did last year, Financial Symmetry has covered several current events on our blog throughout 2013, and here are what we think the Top 10 Economic Stories of the Year have been:

Government Shutdown

This October the government shut down for the first time since 1995 as Congress was unable to pass a spending bill for the new fiscal year. The shutdown raised uncertainty in the economy and left thousands of government employees furloughed and wondering when their next paycheck would come. Investors were concerned that the lost income to federal workers and subsequent cut back in personal spending could significantly hurt economic growth. This fear and uncertainty caused many to wonder if they should make changes to their investment strategy.

This October the government shut down for the first time since 1995 as Congress was unable to pass a spending bill for the new fiscal year. The shutdown raised uncertainty in the economy and left thousands of government employees furloughed and wondering when their next paycheck would come. Investors were concerned that the lost income to federal workers and subsequent cut back in personal spending could significantly hurt economic growth. This fear and uncertainty caused many to wonder if they should make changes to their investment strategy.

Ultimately Congress passed legislation to reopen the government on October 16th and granted back pay to federal workers who were on unpaid leave during the shutdown. The latest news is that the shutdown resulted in a delay of when you can file your tax return:

http://money.cnn.com/2013/12/18/pf/taxes/2014-tax-season/

The market rallied strongly following the resolution, bringing year to date gains on the S&P 500 to nearly 30% through the end of November. In our view, the message to investors was clear-don’t let short term changes in current events influence your investment strategy. Maintaining a diversified, long term approach that is appropriate for your situation helps prevent knee-jerk investment moves based on negative headlines.

Photo Credit: Shan213

IRS Targeting

Last spring the IRS came under fire after it had been discovered that they were targeting political groups that were applying for tax-exempt status. Initial reports were that groups associated with the Tea Party were being singled out, but further investigation revealed that the targeting extended to some liberal-leaning groups as well. The criticism from Congress and the general public grew loud enough that several high ranking IRS officials were forced to either resign or retire from service.

http://www.reuters.com/article/2013/05/15/us-usa-irs-idUSBRE94E02J20130515

Bitcoin

Many of you have probably heard of Bitcoin by now, but for those of you that have not, it is a virtual currency. You can use Bitcoins to buy things over the internet, even illegal items since it promises anonymity. Some people view it as a new form of currency, but it is not backed by anything, unlike the US dollar which is backed by the US Government.

Its creator(s) have remained anonymous and specific details surrounding the history of the virtual currency remain fuzzy. The price of this virtual currency has increased from a value of $13 in January to over $1,200 recently and then back down to approx. $600. Even with the recent drop, this is still a return of 4,500% in one year. The origin of Bitcoin is still not known, but it is believed to have been started in 2008/2009 by a man named Satoshi Nakamoto. Bitcoins are created by solving complex math puzzles as there are a finite number of them – 21 million. People can also buy Bitcoins on an exchange anonymously.

Its creator(s) have remained anonymous and specific details surrounding the history of the virtual currency remain fuzzy. The price of this virtual currency has increased from a value of $13 in January to over $1,200 recently and then back down to approx. $600. Even with the recent drop, this is still a return of 4,500% in one year. The origin of Bitcoin is still not known, but it is believed to have been started in 2008/2009 by a man named Satoshi Nakamoto. Bitcoins are created by solving complex math puzzles as there are a finite number of them – 21 million. People can also buy Bitcoins on an exchange anonymously.

What is the value of a Bitcoin? That is uncertain. Remember the tulip mania in the 1600’s or when gold was going to $5,000? Last we checked gold is less than $1,200 and the tulip mania didn’t end well.

The summary is if something seems too good to be true, it probably is. How is the US government handling this? Too early to tell, but China recently barred its banks from making Bitcoin transactions. In addition, theft of Bitcoins has been rising lately with over 100,000 Bitcoins being recently reported stolen. It is common for thieves to use malware that infect the victim’s PC.

As financial planners our focus is on investing in assets with an expected return such as stocks or bonds and not something where you are dependent on what the next person is willing to pay for that item (speculation) such as Bitcoin.

Photo Credit: btckeychian3

US Stock Performance

Remember how things felt a year ago? The level of uncertainty and fear was very high as the political stalemate over the fiscal cliff went right down to the wire. Expected slow growth, tax increases and spending cuts all seemed to be a recipe for a tough year for stock returns. Fast forward a year later and the US stock market continues to set daily all-time highs and has enjoyed over a 29% return through late December. In fact, the US stock market (S&P 500) is on pace to deliver the best calendar year return since 1997!

This is yet another reminder of the importance of diversification and sticking to a strategy. We take great care in designing a customized investment strategy for each of our clients based on risk tolerance, risk capacity and expected cash flows from their financial plan. This allows us to tune out much of the daily chatter and fear that can cause emotional reactions which are typically harmful to a long-term strategy. We are now approaching the 5 year anniversary of the last bottom we had in March 2009, and even though US stocks are getting more expensive, unemployment continues to fall and inflation remains low. We will continue to monitor our strategies with our investment research and make moves accordingly for our clients.

Edward Snowden and Privacy

The 1998 movie “Enemy of the State” gave us a dramatized view of the power the NSA could have with the surveillance of citizens. One of the bigger stories of this year dealt with a real NSA scandal when Edward Snowden divulged what officials call the largest and most damaging compromise of classified information in US history. Snowden, who was an NSA contractor, downloaded 1.7 million documents from NSA computer networks which contained info on surveillance requests that led to US spying success around the world. The most polarizing tactic exposed by Snowden was the fact that most American’s telephone calls were being logged and recorded by the NSA. The consequences from this admission are still being uncovered by Congress, Corporate America, and around the world. In addition, reputations of companies that provided computer support to the NSA have been tarnished and surveillance reforms are now a hot-button topic in Washington. Only time will tell the ultimate impact of this admission, but there’s no doubt Snowden’s revelation has elevated the conversation on levels of privacy and government surveillance.

Yellen Nominated as Fed Chairwoman

In October President Obama nominated Janet L. Yellen to lead the Federal Reserve System and replace Ben Bernanke after his second term. Yellen is currently the Fed’s vice chairwoman and would be the first woman to lead the central bank. The stock market rallied on the announcement in hopes that stimulus would not be quickly withdrawn under Yellen, if confirmed.

The consensus view is that Yellen will “generally maintain the policies of the current chairman, Ben S. Bernanke, while pressing for even greater transparency.” She is largely considered a monetary “dove,” more concerned with unemployment than inflation. The Senate is likely to approve Yellen as Chairwoman of the Federal Reserve Board in January.

Photo Credit: International Monetary Fund

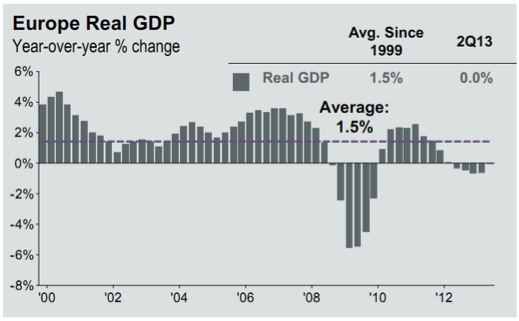

Europe Recovery?

Did we miss the traditional summer crisis in Europe this year? It was not uncommon the last few years (2010-2012) to have a sudden summer event in Europe revolving around Greece or one of the other peripheral countries. Excluding the minor hiccup in Cyprus this spring the news out of Europe has been relatively positive. As of the end of June 2013, the Eurozone showed quarter-over-quarter GDP growth for the first time in seven quarters, ending the longest recession in their history. Estimated third quarter 2013 GDP numbers are positive, but modest at 0.1%. Furthermore, consumer confidence is increasing and manufacturing PMI (Purchasing Managers Index) is implying expansion after 23 months of contraction. Europe is not out of the woods yet as unemployment remains stubbornly high at 12.1%, which equates to approx. 20 million people out of work.

It may be too early to call it a full blown recovery as recent numbers are showing slower growth, but the significant contraction we’ve seen the last few years has seemed to have ended.

Photo Source: JP Morgan 4Q/2013 Guide to the Markets as of September 30, 2013, page 48

Housing Finally Begins Recovery

Since the peak of the housing market in July of 2006 through the end of 2012 housing prices fell by over 30% nationwide. Some areas were hit much harder than that. http://money.cnn.com/2012/09/26/real_estate/home-prices-peak/

Since the beginning of the year prices are up by 13% and the Census Bureau reported that November housing starts are 29.6% above the November rate in 2012.

This is a story we’ve been anticipating for a while as the drastic reduction in new home construction as a reaction to the bursting of the bubble eventually created a shortage of housing.

ObamaCare

2013 was the year that Obamacare kicked in to high gear…. or was supposed to. The great false start to the online health insurance exchanges may have been the biggest story about the ACA in 2013.

The ACA stirs up lots of anxiety and is attacked both for doing too much and doing too little depending on who is discussing it.

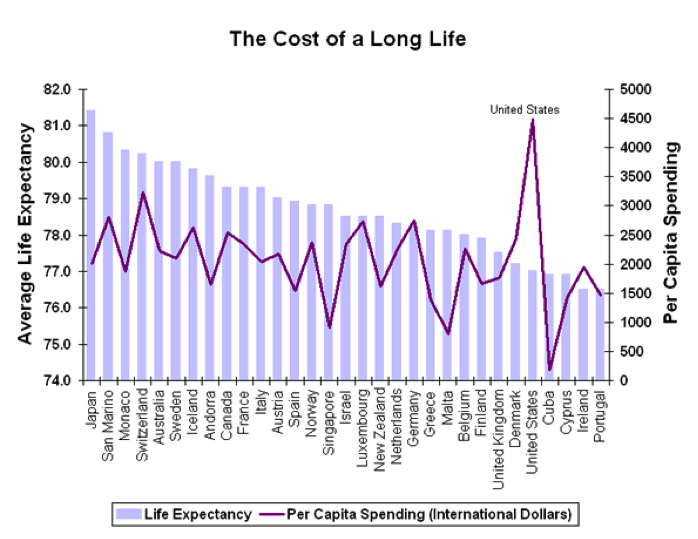

With all the hyperbole it’s easy to lose sight of the fact that the ACA came about because our healthcare system is broken. As this chart shows, we spend magnitudes more per person than any other nation, yet our life expectancy ranks 27th. We simply get very poor value for our healthcare dollars.

Source: UC Atlas, University of California Santa Cruz

It has been said that the ACA is a bit of a patchwork Frankenstein monster. While the idea of universal coverage is viewed mostly as a liberal ideal, the law also includes things like the individual insurance mandate which was an idea from the conservative Heritage Foundation.

While there are components of the law that seem to work well in other nations, it is very likely that there will be some parts that don’t work and some parts that do work. Only time will tell whether the ACA will cure what ails our healthcare system.

Rising Interest Rates

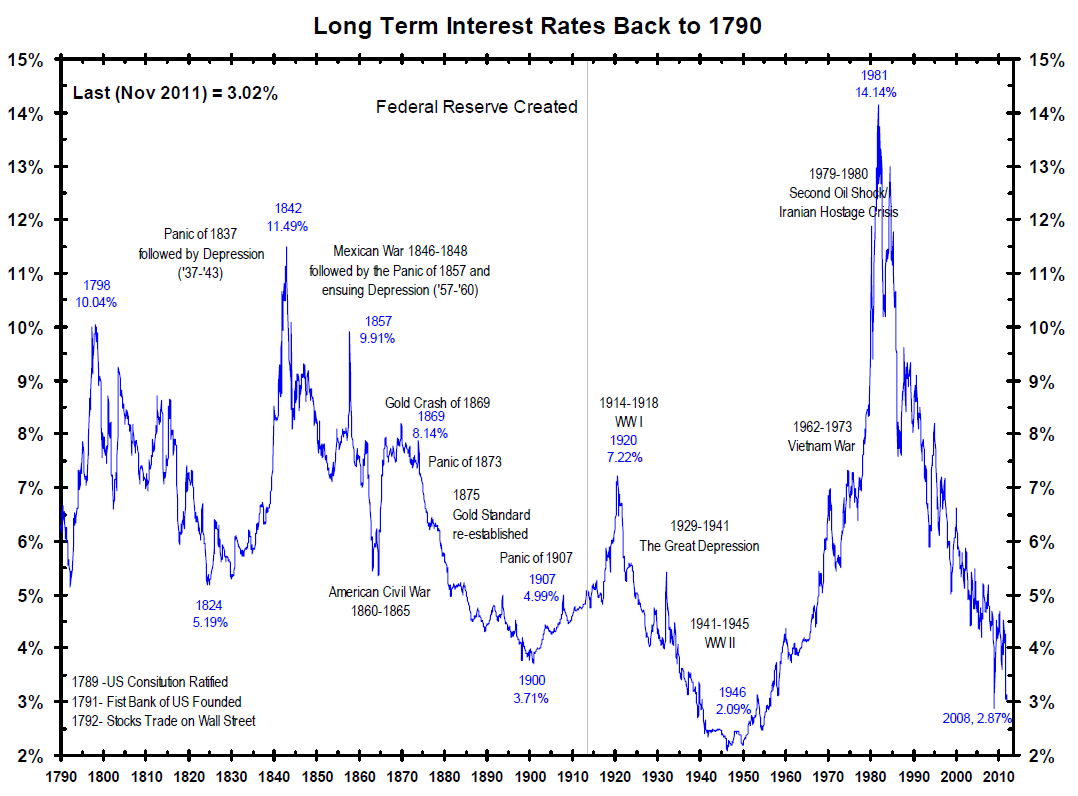

The financial crisis of 2008-2009 was the worst financial crisis the world had seen since the 1930s. It’s no surprise that interest rates went way down just like back in the Great Depression.

You can see that interest rates have tended to cycle from low to high and back to low. These cycles tend to be very long. The lowest point prior to this year was in the 1940’s, so it took about 70 years to go up and back down.

It was not until our economy was doing much better after World War 2 before interest rates rose substantially. It is likely that will be the case this time as well, but 2013 may have been the year that we hit out lowest interest rates for this cycle. If so, we may not see rates this low again in our lifetime.