No one can argue that the stock market has been tumultuous lately.

During times of market uncertainty, investors seem to become even more certain about their predictions of the next stock market moves. As people make these predictions, over time the stakes get bigger and bigger.

It’s a strange reality that times of great uncertainty actually lead to *heightened* overconfidence. Rather than sitting with a protracted period of not knowing, our hubris kicks into overdrive to protect our fragile egos.

This thin veneer of certainty is everywhere right now.

— Daniel Crosby (@danielcrosby) June 18, 2020

Listen to this episode to hear five steps you can take to fight prediction hubris.

Wealth isn’t determined by investments selected but by investor behavior

When markets become more volatile, the desire to control our outcomes becomes stronger. Our bias pressure us to make predictive moves of what we feel or hope is going to happen. This is when the ability to stay disciplined can have the biggest impact.

Otherwise, we find ourselves sweating out extreme buy and sell decisions that could cause you to miss the biggest market moving days. There was a good chance of this with our latest examples over the last 3 months, when you saw 3 of the worst 25 single day losses and 2 of the largest 25 day gains, happen in the S&P 500.

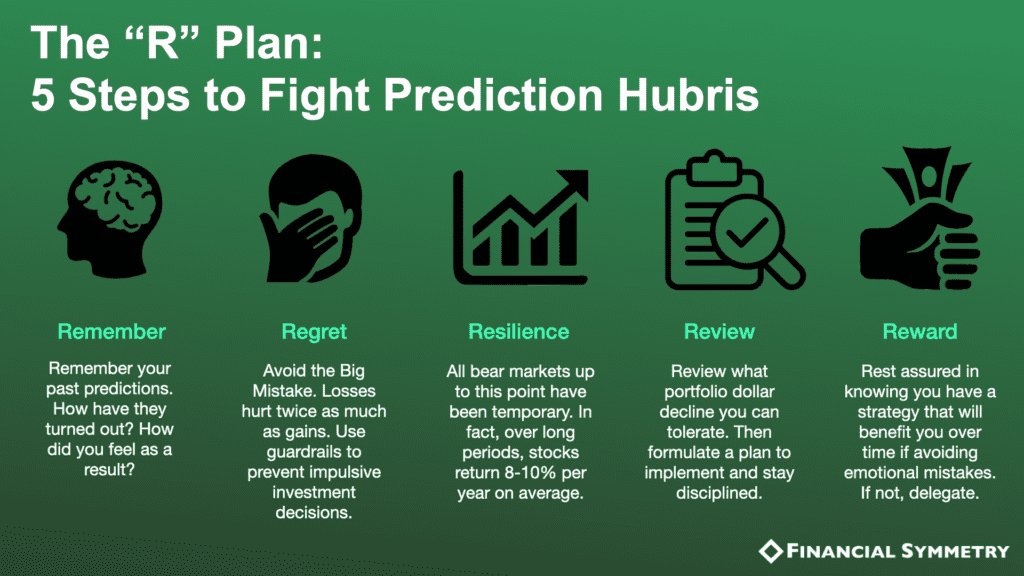

This is why we created a thought exercise to help you reflect on your investment strategy during times of market stress. We’re calling it the “R” Plan, where we provide five steps to fight the inevitable prediction hubris that occurs during these periods.

The “R” plan: 5 Steps to Fight Prediction Hubris

Remember your past predictions. Think about the predictions that you made over the past few months. How did those turn out? Do you remember that overwhelming fear we all felt in March? Do you remember 2008? How about the tech bubble? How did your stock market predictions turn out during those tricky times?

Regret – Imagine the regret you may feel if the decision you are about to make goes against you. The decisions you make in the short term can have a big impact on your long-term wealth. The day to day swings can be huge when the market is volatile. Retirees often feel that they don’t have the time or ability to make up for losses and many decide to sell and flee to the safety of cash. But deciding not to ride the wave can lead to serious regrets.

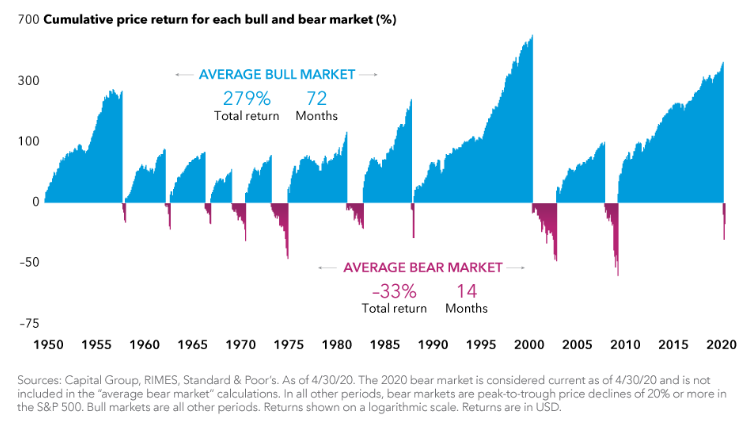

Resilience – In these emotionally charged moments, we can temporarily forget how resilient the stock market is over time. Stock market declines have been temporary and it’s easy to forget that you experience stock market gains three quarters of the time. It’s also good to remember that bear markets are shorter than bull markets. The lesson: declines are temporary but gains are permanent over the long-run.

Review – When markets are volatile, take the opportunity to reflect on your portfolio. Think in dollar figures rather than percentages to make potential losses more real to you. Consider these tips as you review your portfolio:

- Be more conservative if you are uncomfortable with the thought of losing half of your asset value.

- Diversify – we may have mentioned this a few times before.

- Hire a professional an investment planner as well as a financial planner

- Consider all your options

- Implement an investment strategy based on your financial goals

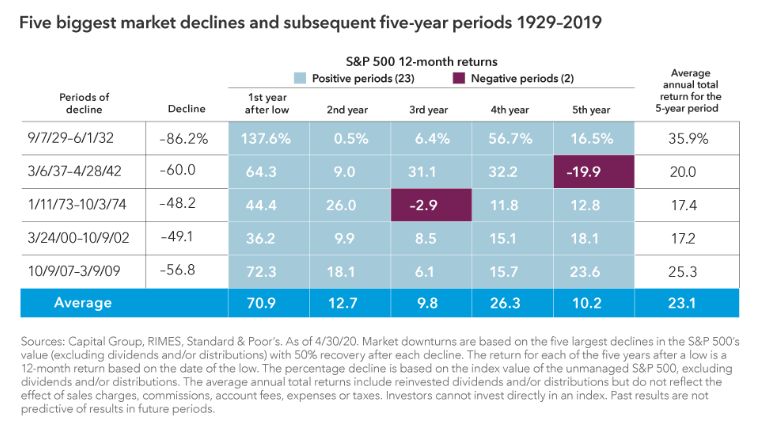

Reward – Staying invested in a balanced portfolio with equity exposure has provided significant long-term rewards. Also, returns tend to be the strongest after the steepest declines. Sticking through the rough periods to get to the rewards is the hard part. Because it’s rarely a smooth ride. Returns in any given year have ranged from as high as 54% to as low as -43%. In fact, the S&P 500 had a return within plus or minus 2% points of this 10% average in only 6 of the past 94 calendar years, according to Dimensional research.

Resources

- Worst Investing Dilemma – Blair Belle Curve

- Guide to Market Recoveries – Capital Group

- Investors Approaching Retirement Face Painful Decisions – WSJ

- Investing in Uncertain Times – Ally Bank

- When Stocks Are In the Red Don’t Make This Mistake – CNBC

- Episode 27 – A Financial Advisor’s Worst Investment Mistakes

- The Uncommon Average: Long-term Context on Annual Returns – Dimensional

Outline of This Episode

- [2:06] How can you fight against your instincts of making predictions?

- [7:04] The decisions you make in the short term can have a big impact

- [10:21] The stock market is resilient

- [14:54] Tips to fight stock market worry

- [20:54] Focus on the reward

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook