As mentioned in our previous blog post about the debt ceiling, we said that our long term fiscal problem is heavily influenced by two issues- taxation and health care costs.

There is a school of economic theory that says that the level of taxation has a strong inverse relationship with economic growth. In other words, some believe that low tax rates cause high growth and high tax rates cause slow growth. This is why some believe that we should not use higher tax rates as part of a long term budget solution.

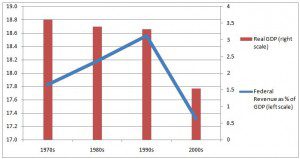

We do not share that fear. The following chart shows average federal revenue as percent of GDP, and real GDP growth by decade.

So tax rates and revenues were lowest in the 2000s, but that was also the weakest decade for economic growth. If a strong inverse relationship exists, than the 2000’s should have instead been our highest growth rate decade of the last four. And the 1990s should have been the slowest growth decade.

Of course we don’t believe that high tax rates cause strong economic growth and that low tax rates cause weak economic growth. We think that the evidence indicates that tax rates simply do not have as much impact on growth as some people believe.

Closing the long term budget imbalance will be a positive for our economic future, and higher tax rates are most likely to be part of the solving the budget problem.