You can listen through the player above, or subscribe to our podcast on iTunes or Stitcher or Google Play.

As we approach year end, we are also closing in on the first major tax overhaul in over 30 years, which will become effective January 1, 2018. As financial planners, we are focusing a great deal of our attention on the changes that are coming and how they are going to affect each of our clients in the coming years. The reform creates new opportunities for some, and closes the door on others. So, what are the major changes that are coming and how do they affect you?

As we approach year end, we are also closing in on the first major tax overhaul in over 30 years, which will become effective January 1, 2018. As financial planners, we are focusing a great deal of our attention on the changes that are coming and how they are going to affect each of our clients in the coming years. The reform creates new opportunities for some, and closes the door on others. So, what are the major changes that are coming and how do they affect you?

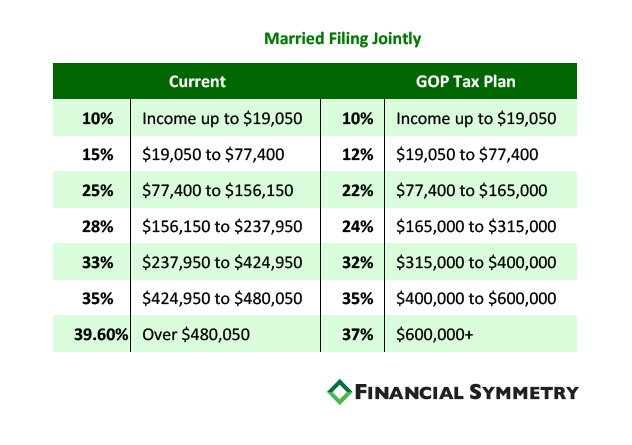

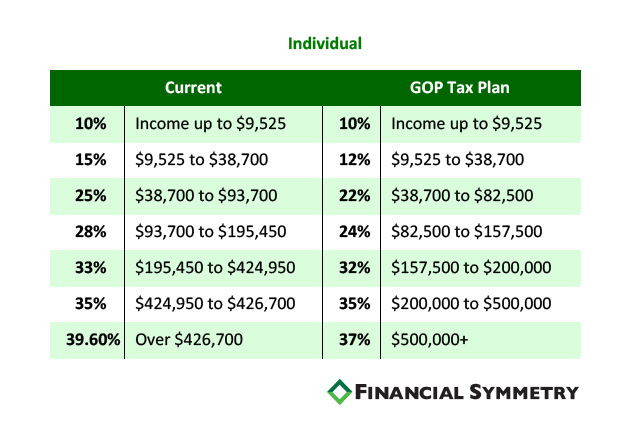

Tax Bracket Changes

In early reform proposals, the plan was to reduce the number of federal tax brackets from seven down to three. In the final bill seven brackets remain, but most taxpayers will see a reduced marginal tax rate as shown in the tables below.

The link below is to a calculator which has been released to help quantify the impact of the tax bill on your personal situation. Keep in mind that this calculator is to be used as an estimation and to fully understand the impact on your situation a comprehensive look at your tax plan should be completed.

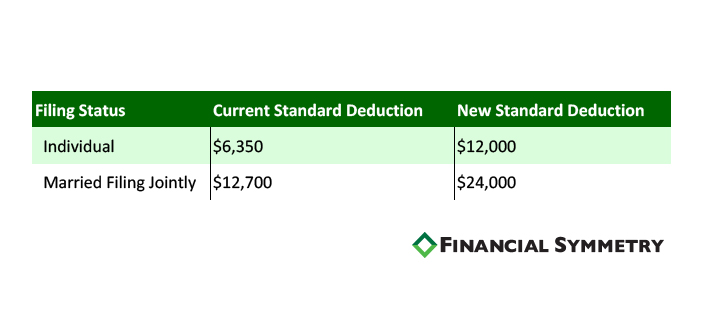

Increased Standard Deduction and Elimination of Personal Exemptions

One of the key aspects of the tax reform is an increased standard deduction and the elimination of personal exemptions. The table below outlines the increase in standard deduction based on filing status.

For those who currently do not itemize deductions and have no dependents, the increased standard deduction will result in a reduced taxable income. Those with numerous dependents or that itemize, may end up with a higher taxable income (all else being held equal).

In 2017, the Personal Exemption was $4,050 per taxpayer and for each dependent. The repeal of these exemptions will be most felt by families with at least one dependent in addition to the taxpayer(s) themselves as the family will be left with a smaller deduction when taking into consideration the old standard deduction in addition to personal exemptions. In some cases, this reduced deduction amount will be offset by reduced tax rates depending on where your income falls in the new tax bracket.

Itemized Deduction Changes and Limitations

The increased standard deduction decreases the number of taxpayers who will be itemizing their deductions going forward. For those of you who’s itemized deductions eclipse the new standard deductions levels, there are changes in your ability to itemize certain deductions that need to be considered.

- State Income and Property Taxes: Currently, you can deduct all state income tax and property tax paid on your federal tax return. As part of the tax reform, there will now be a combined limit of $10,000 for state and property tax that you are able to deduct. Depending on your level of income and the state in which you reside, this limit may have a profound effect on your tax burden.

- Mortgage Interest: the tax plan adjusts the cap on mortgage interest deductibility to the first $750,000 of debt principal. This is down from the current limit of $1,000,000 (although those with current mortgages will be grandfathered in with the current limit). The mortgage interest deduction now applies only to your primary residence and the ability to deduct home equity line interest has been discontinued.

- Miscellaneous Itemized Deductions: the tax plan repeals taxpayer ability to deduct such items as tax preparation fees, unreimbursed employee expenses and investment advisory fees. Prior to the tax reform, these items were subject to a 2% of AGI floor.

IRA Recharacterizations

Up to this point, funds that were converted from a pretax IRA to a Roth IRA could be ‘undone’ or recharacterized in the following tax year if it was later determined that that conversion was no longer optimal from a tax perspective. i.e. the conversion pushed the taxpayer into a higher income bracket or reduced their ability to take certain deductions or qualify for certain credits.

The ability to recharacterize funds converted has been repealed through tax reform. While this repeal does not end one’s ability to implement a conversion, it does increase the importance of analyzing the conversion comprehensively.

Child Tax Credit Expansion

Under the GOP tax plan, the child tax credit has been doubled to $2,000 per qualifying child under the age of 17. The income threshold has also been raised so more taxpayers will be able to take advantage of the credit. Currently the current thresholds are $75,000 for individuals and $110,000 for married couples. These income levels will now be increased up to $200,000 for individuals and $400,000 for married couples. Given that the Child Tax Credit is a dollar for dollar credit, tax savings for those with qualifying children may be significant.

529 Plans

529 plans, which up until now have been reserved for expenses associated with college, can now be used save and pay for K-12 education expenses up to $10,000 per qualifying child. This can be very helpful for those whose children attend private school and in some qualified cases, 529 funds will also be allowed to cover costs associated with home schooling.

It will take time to evaluate all the changes that have come with new tax law and to develop strategies which will be most beneficial for our clients. Tax planning remains a center piece in any successful long-term financial plan and we will continue to provide updates and insights as they are developed.

Want to Know More…

Micheal Kitces detailed write-up on the full Tax Cut and Jobs Act