Deciding when to take Social Security benefits is unique because of the way the benefits may be taxed.

There is a formula that the IRS requires Social Security recipients to use to determine if any of their benefits are subject to income taxes. This includes adding up all of your income (even tax exempt income like Municipal bond interest) and then adding 50% of your Social Security benefits to determine if you are above the IRS’s threshold.

Social Security Tax Bubble

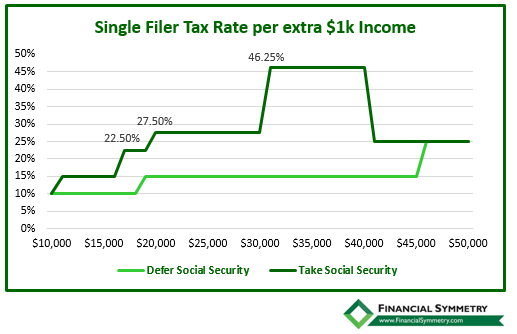

The following example shows just how big of an impact when you take Social Security benefits can have on the recipient’s taxes.

Let’s assume Sue is a 65-year old unmarried retiree. She has a $30k pension income and $5k in interest and dividend income. She is eligible to begin receiving $25k in Social Security benefits.

In addition, Sue has the following investment accounts:

- $400k in a traditional IRA

- $100k in a savings account

- $50k in a taxable brokerage account.

Sue takes the standard deduction on her tax return.

Strategy #1: Take Immediately

Using the formula, it’s determined that $16k of her Social Security benefits will be subject to income tax. Also, if she needed an additional $6k of income from the traditional IRA, it would be taxed at a rate of 46%.

Beyond that, the Social Security benefits will no longer be added to taxable income. This is because the maximum 85% inclusion threshold will have been met. The $6k IRA withdrawal, taxed at 46%, is referred to as the Social Security tax “bubble” and can often be avoided with proper planning.

In this particular instance, the additional $6k should be taken from the savings account rather than the IRA. This approach would avoid bringing in any additional taxable income.

Strategy #2: Defer Social Security

Strategy #2: Defer Social Security

This opens up other options because Sue has flexibility to take withdrawals from her various accounts.

The goal here is to be tax efficient for the current tax year, but to also consider what her tax bracket will be once she begins taking Social Security.

With no Social Security benefits to include, Sue’s taxable income is approximately $13k below the top of the 15% tax bracket. This allows for an IRA conversion opportunity. Converting $13k from her traditional IRA into a Roth IRA uses up the 15% bracket while also lowering the amount of the traditional IRA that will be subject to required minimum distributions when she turns 70-and-a-half.

Any additional cash flow needed could be drawn from the savings account, or potentially the brokerage account depending on the amount of capital gains that would be realized from selling appreciated securities. If she delays taking Social Security until age 70 she will have $78k in a Roth IRA which adds flexibility for being tax efficient in later years.

The chart above illustrates the powerful effect that Social Security benefits can have on tax rates. In Sue’s case it causes a portion of income that would otherwise be in the 15% bracket to be taxed at over 46%!

How Do You Know When the Time is Right?

How Do You Know When the Time is Right?

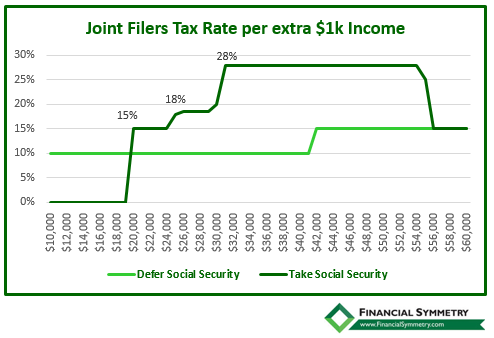

When to take Social Security is a complicated question because it depends on so many factors. Here’s a the situation if you file your taxes married filing joint. The bubble still happens but at a lower rate.

Unfortunately, tax efficiency around Social Security is often under-emphasized. This is because of the confusing method by which benefits may be taxed. Making the best decisions, depend on the impact of your marginal tax bracket. Knowing how your next dollar of income is taxed can help you optimize your withdrawal strategy.

Because of the complexity, we evaluate Social Security tax planning into our continuous service. If you have any questions about the taxation of your Social Security benefits we’d be happy to help.