It takes a lot of discipline to stick to an investment strategy that calls for patience while stock prices are falling.

The urge to do something, to take action, can be overpowering. Unfortunately, many investors take actions that prove harmful to their wealth like selling stocks at low prices or waiting to invest cash until things look better.

Thankfully there are actions you can take during a bear market that will improve your long-term financial situation. One of these is tax loss harvesting.

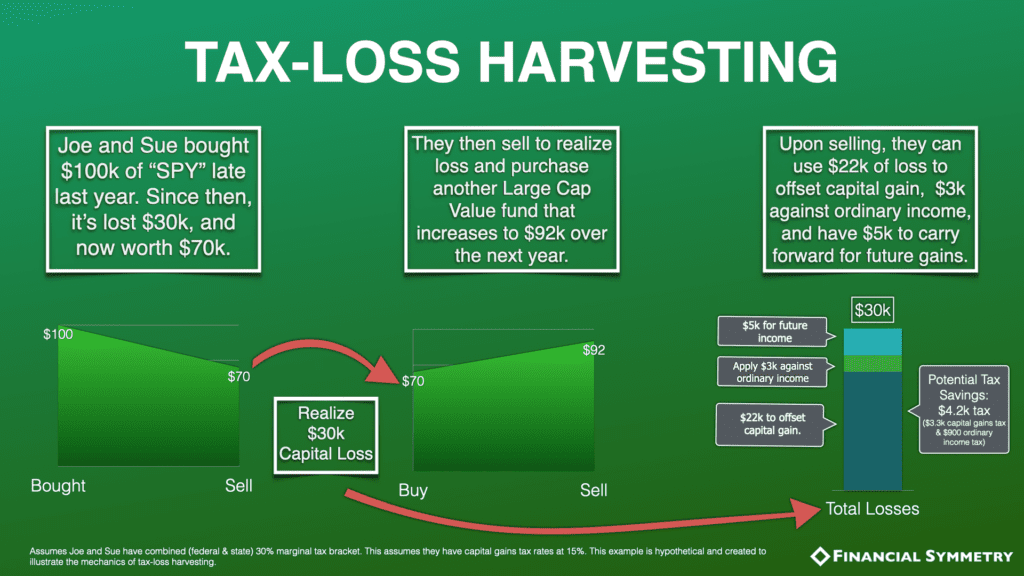

Essentially tax loss harvesting is the process of selling securities in your taxable brokerage account at a loss and using the proceeds to purchase similar securities that are in line with your overall investment plan. Realizing these losses allows you to offset capital gains and up to $3k income annually on your tax returns.

Any losses you don’t use this year can be carried forward to future years. This saves you tax dollars now and allows you to realize future capital gains with a potentially lower tax bill. Doing this periodically in bear markets is a tool that can accelerate after tax wealth accumulation.

Why would I want to lock in losses?

Selling stocks at a loss goes counter to the basic investment philosophy of buying low and selling high, so why would I sell low?

Consider you were shopping for new clothes and found a shirt you really liked, so you paid the full price of $100. The next month you go back to the store and find it is now 30% off. “I should have waited,” you think. Maybe if you haven’t taken the tags off yet you can return the shirt and buy it back for $70. Now you have the shirt you wanted all along and $30 extra dollars. If you have already worn it, you may be out of luck.

Fortunately, with investments the tax code allows you to exchange into something else and write off the losses. The savings simply come a little later in the form of lower tax bills, potentially even over a multiyear period. Tax loss harvesting allows you to “write it off” just like big companies:

What’s the Catch?

The caveat here is that you cannot sell and repurchase the exact same security. You will have to replace the security you sell with something similar. For example, you sell an S&P 500 Index fund and purchase a large cap US stock ETF. This helps you avoid the wash sale rule. This rule prohibits you from taking a deduction for a loss on a securities sale if you buy “substantially identical” securities within 30 days before or after the sale. In other words, you can’t sell stock at a loss when it’s down, turn around and buy back the same stock, and then deduct the loss. You can’t avoid the wash sale rule by simply buying the stock in a different account, either. This is tricky, so you must take care to avoid selling something at a loss in your brokerage account and rebalancing into it in your IRA or 401k.

When should I do this?

Just because you are able to take a loss doesn’t necessarily mean that you should.

The security might still fit into your long-term investment goals, even at its lower price. There may be a replacement investment that fits equally well — but if there isn’t, you are changing your asset allocation. You run the risk of reducing the effectiveness of your portfolio over time, negating the benefit of taking the loss in the first place.

The following times are when we find this strategy makes the most sense:

- Trimming concentrated stock positions: This can be a huge opportunity for individuals holding a large stock position in their employer. In many cases employees have multiple positions purchased through an ESPP or RSU plan over different years and at various prices. Weeding through these to identify positions at a loss can allow for tax free gains on others. Obviously, you cannot repurchase the same stock back immediately, but this also presents a great opportunity to diversify your holdings and reduce the risks inherent in individual stocks.

- Rebalancing: Over time your asset allocation can drift from your intended targets. Bringing your portfolio back into balance may also present the opportunity for tax savings.

- Dumping high cost funds: The cost of investing has continued to decline over the years. While that is the case, we still see portfolios composed of very high cost funds. A bear market is a great time to realize losses on these funds and shift into lower cost choices that are likely to post better performance over the long term.

How do I know if this is right for me?

You must also consider the “tax bracket now versus tax bracket later” question. A tax loss harvesting strategy is most effective when you expect your tax rate to be lower in the future, such as after you retire and your income drops. Additionally, capital losses offset capital gains before they are allowed as a deduction against ordinary income. (Say you have $5,000 in capital losses and $4,000 in capital gains. The first $4,000 of your losses offset the gains, leaving only $1,000 to deduct against ordinary income.) Also, since long term capital gains are not taxed at all if you are below the 22% tax bracket, tax loss harvesting may be meaningless for taxpayers in lower brackets.

There are other complicating factors that must be weighed depending on your individual circumstances. For example, if you receive Social Security benefits or a health insurance premium subsidy, taking the loss may drastically reduce your tax bill because of the way these items are treated in the tax code.

Tax loss harvesting can be an effective tool for increasing overall portfolio efficiency and saving significant tax dollars, both of which boost your financial well being. It’s also a positive investment activity that can be performed during a bear market to meet the psychological need to do something.

However, it is not appropriate in all cases and requires detailed analysis to make sure you avoid the potential pitfalls buried in complex tax rules. Working with a qualified professional may be necessary to put together a plan for managing the risks. If you have questions about how this strategy could benefit you during this current crisis, please contact us to learn more.