So many of us have strong feelings about our legacy but put off planning it out. The conversations are unpleasant. Dealing with loss,

So many of us have strong feelings about our legacy but put off planning it out. The conversations are unpleasant. Dealing with loss,

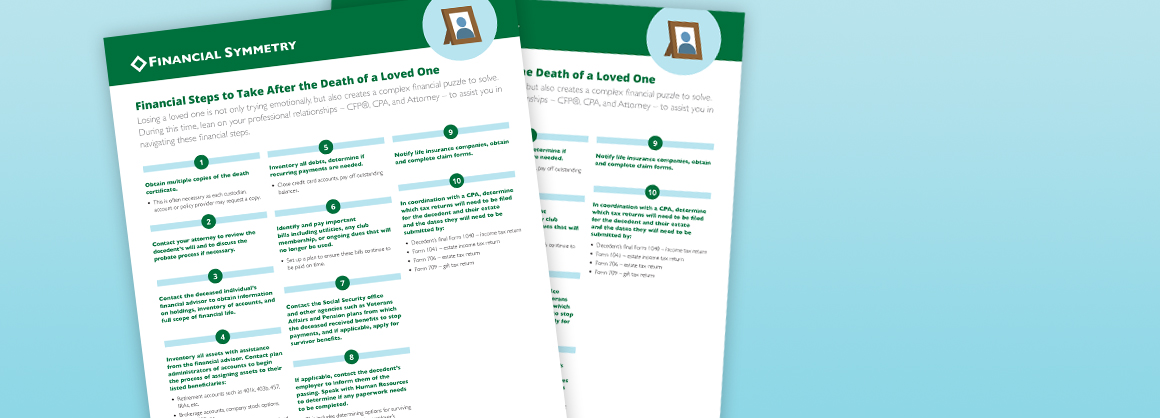

uncertainty, and coming to agreements gets emotional. Our emotions then becomes our roadblock, helping us to push off finalizing our estate plans. Handling this for a loved one can be just as tough. Ironing out financial details and completing tax returns while grieving adds extra complexities that can be avoided if discussed prior to death. Which is why we’ve created a checklist to help you get started on this process. You can download it free with the button on the right.

Other Tax & Estate Posts

- Guide to Preserving Yours or a Loved Ones Legacy, Ep 87

- What Happens When You Have No Estate Plan? Ep 57

- You Have Two Months to Live…

- Is Your Estate Plan Keeping Up with the Digital Age

- How Old Is Your Estate Plan?

- Prince’s Estate Issues Underscore the Importance of Having a Will

- What You Need to Know About the Gift Tax Limit

- I Would Like to Gift Money to My Child or Grandchild

- Estate Planning in Your 60s

- Estate Planning in Your 50s

- Estate Planning in Your 40s