Last month I had the pleasure of attending the NAPFA Conference in Phoenix, Arizona. The weekend before I left my 3-year-old was sick with a stomach virus. I was scheduled to leave on Tuesday and by Monday morning he was not well enough to re-join his friends in child care. Off to the doctor we went and while it was likely a virus that we needed to wait out, our pediatrician wrote us two prescriptions so my husband had them on hand and didn’t need to make a return visit in the event his condition worsened in the next few days.

I was told they were submitting a coupon for the medication and the cost should not be more than $20. Of course later that afternoon when we went to the drive-thru pharmacy to pick up the prescription the cost was $45. I mentioned the coupon which the pharmacy technician informed me had expired. I pulled up goodRx.com on my trusty iPhone and found another coupon. They told me it would take at least 20 minutes to reprocess the order. Of course I had a sick toddler in the backseat, needed to pick up my 7-year-old from his after school program, and rush hour was looming. In frustration I gave them my credit card and paid full price. This has been a recurring scenario in our household and likely something most of you have experienced as well. It was timely that I was able to attend a session on reducing your health care costs with Carolyn McClanahan a few days later. Below is a summary of the current state of health care costs and practical strategies you can use to save money on care.

Rising Costs

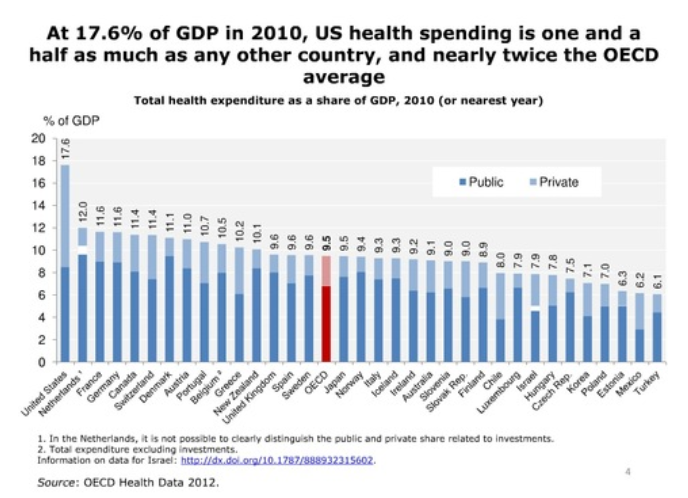

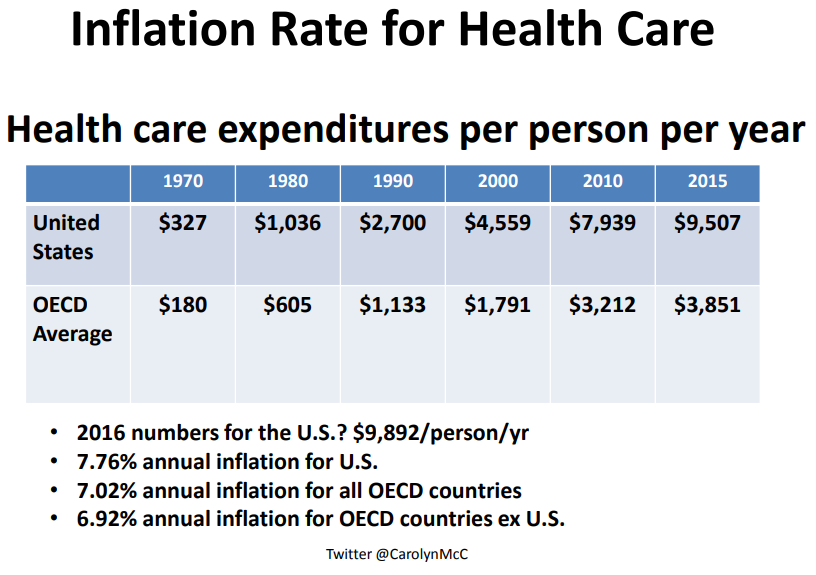

The inflation rate for health care has been huge. The average rate of health care inflation since 1970 has been 7.76%/year. At present health care spending is 17.9% of GDP, higher than any other country.

If health care costs keep rising at the current rate, they will be 50% of our country’s GDP in 30 years. Something will have to give. The current pace is not sustainable.

Under the current fee for service model the health care system is incentivized to do more for patients in terms of ordering tests and avoiding malpractice lawsuits. Being an informed consumer in the health care market is extremely difficult. Without major reform the onus is on patients to navigate the complex system.

Shopping for Health Insurance Coverage

The individual mandate goes away in 2019 so costs will likely increase. Estimates are that insurance premiums will go up by ~20% next year. For single people employer based coverage is still typically the best option. Family coverage depends on several factors including whether or not both spouses are working and how much of the premium your employer pays. If the employer does not cover any costs for family members, it may make sense for other family members to buy separate plans. This can complicate matters when it comes to deductibles. So, for families who are low health care users it may make sense to go on separate plans, but make sure you have money set aside to meet separate deductibles if someone gets sick.

COBRA-Many people get sticker shock when they leave their employer and look at keeping their health insurance coverage since their employer was paying a good portion of their premium. For some people it may be better to get individual or short term coverage if you change jobs. You need to figure this out before you go on COBRA because once you go on COBRA the rules changes. If you have signed up for COBRA, you can’t switch coverage except during open enrollment.

We have frequently talked about the benefits of HSAs. With a Family high deductible plan, lump as much as you can into 1 year if someone gets sick in that year. Once you hit a deductible, get everything done.

If your income is below 400% of the Federal Poverty Level, then your best source of coverage is through the Affordable Care Act. We often find this to be suitable for early retirees who have significant net worth but low taxable income. Using ACA insurance and premium tax credits can save families $10k or more annually on their insurance premiums.

Health Care Sharing Ministries may also be an option in some cases. However, there are many stipulations to these groups and it is important to recognize that they are not traditional health insurance. The companies are under no legal obligation to pay your medical expenses. Also, conditions resulting from “self-destructive” behaviors such as alcohol, tobacco, or drug use are excluded.

Being an Empowered Patient

With insurance in place it can still be very difficult to navigate the health care system and save on medical expenses. Until there is greater transparency the best strategy is to be an empowered patient and advocate for yourself in the doctor’s office, hospital and pharmacy. Below are some tips to keep your costs down:

- Be prepared for your appointments. Write everything down, make 3 copies, send one to the office before your appointment, give to nurse upon arrival, make sure doctor reviews. If you have complicated issues, ask for a longer appointment.

- Ask, “What can I do to improve the problem?”

- Insist on in-network coverage. Ask “Are you in my network?” Document who told you and when.

- On financial responsibility forms write “I will only accept in-network coverage.” Take a picture, make copies

- Ask “Is the testing facility in network?” “Is this prescription covered under my plan? Is there a cheaper option?”

- Know your state laws on balance billing

- Use goodrx.com to save on prescriptions

- Complain to your state department of insurance if necessary

- Choose a primary care physician who is collaborative

With continuously increasing health care costs, alternatives to traditional care are emerging such as concierge and monthly subscription models. Over time new ideas may disrupt the industry and lower overall health care costs. In the meantime, it pays to be your own advocate and know your benefits and rights. One last piece of advice is a phrase my child’s teacher uses before field trips: “Pack your Patience.” This can be a challenge, especially when you are sick, experiencing an emergency, or caring for an ill loved one. However, maintaining composure and following the above tips can help you lower overall out of pocket costs.