If you’re wondering who this cute little puppy is, his name is Samson, and this photo was taken at the vet about an hour after he jumped out of my car window.

If you’re wondering who this cute little puppy is, his name is Samson, and this photo was taken at the vet about an hour after he jumped out of my car window.

Don’t worry, after a few weeks of crate rest he was back to his normal, crazy self and just recently turned 4 years old.

While I was relieved that he would be just fine, my bank account was not ready for the $500 out-of-pocket costs from this incident. Not to mention future costs for follow-up x-rays and medication refills.

For many of us, our pets are like family, and we’d do anything to make sure they live the best lives possible.

According to the ASPCA, routine care for cats costs about $634 annually and between $512 – $1040 for dogs, depending on size.

The costs can add up to thousands depending on the specific circumstances. The drawings below display some of the common occurrences you can expect during the lifetime of your pets.

While we may be able to handle the more routine expenses out of pocket, how can we better plan for unexpected emergencies and the costs that come with them?

If you are in a strong financial situation presently and have large taxable savings or investments built up, self-insuring may be fine. You may also want to consider buying pet insurance. This is an option that can give you peace of mind and financial security when faced with a major vet emergency or illness. Let’s discuss how it works and what to consider when deciding if pet insurance is right for your financial plan.

How Does Pet Insurance Work?

Essentially, if your pet gets sick or injured, you’ll need to take them to the vet for treatment. After paying your bill, you’ll file a claim with the insurance company which will reimburse you for a portion of the costs.

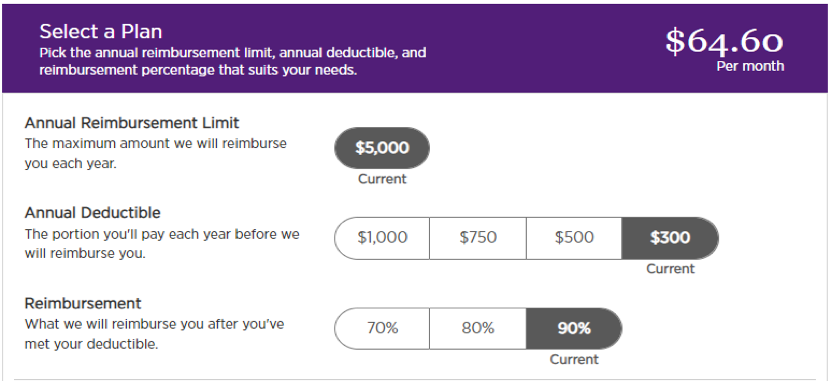

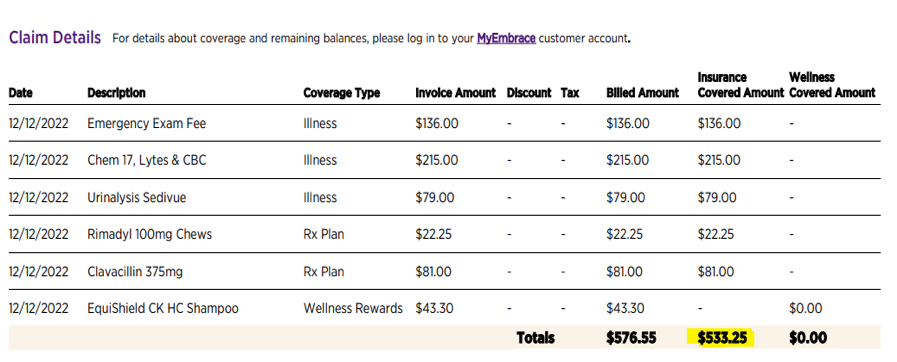

Typically, there’s a monthly premium, maximum reimbursement limit, and annual deductible. Some plans will also offer reimbursement for routine care like vaccinations and monthly protectants. Here’s an example of what your options and reimbursement might look like.

It’s easy to see the savings in hindsight, but how do you decide if paying the monthly premiums will be worth it for your pet? Here are some things you should consider.

Age

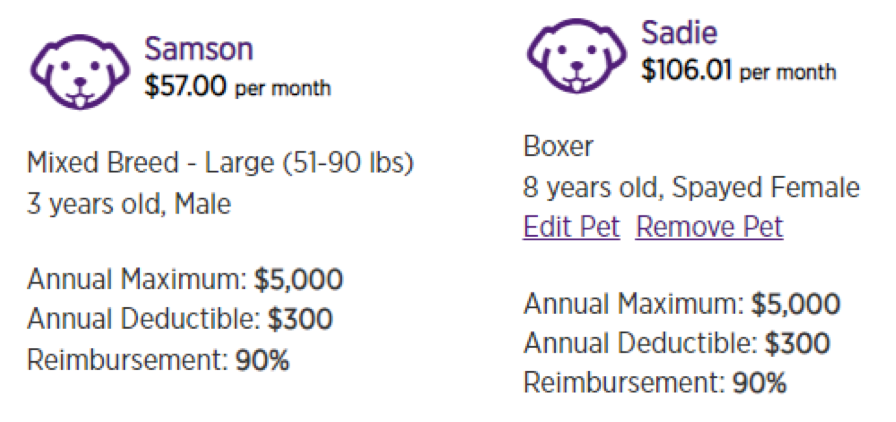

The age of your pet is one key factor in determining your monthly premium. Typically, the younger they are the lower the premium. Take Samson and Sadie for example.

You can clearly see the difference age makes for the same type of coverage (almost double in premiums). While it may feel pointless to get health insurance for a perfectly healthy puppy or kitten, that is the perfect time to plan and invest early to get the most coverage for the lowest price.

Current Health and Breed

If your pet is a bit older already, that doesn’t necessarily mean you shouldn’t get insurance. It is important to understand your pet’s current health status and what health risks their breed is predisposed to. Also, consider your preferences when it comes to medical procedures for your pet. You may be hesitant to proceed with a life-saving surgery, even with pet insurance, if it could potentially keep your pet alive but significantly decrease their quality of life. When faced with a decision like this, discuss the pros and cons with your veterinarian as well.

Most pet insurance companies will not cover pre-existing conditions. This means that if your pet is already sick/injured or has been in the past, any future related condition will likely not be covered. Insurance companies reach out to your vet for health information, so it is also recommended that you double-check that your veterinarian has the most up-to-date and accurate information on your pet.

Cash Flow

Your financial capacity can determine whether pet insurance is right for you. If a pricey vet bill would deplete your savings or force you into taking on debt to cover a payment, an affordable monthly premium could be a more manageable, stress-free option.

If your pet has already had some health issues and is older, you may not fully benefit from an insurance plan and may be better off incorporating the cost of a large vet bill into your emergency fund through monthly and automated savings.

Here are some other budget-friendly options for self-insuring:

- Look into accident-only pet insurance

- Consider crowd funding

- Search for low costs vet clinics in your area

- Ask your vet about pet wellness programs which may be able to save you money on basic care/vaccinations and routine preventatives

- Ask your vet about payment plan options to help cover the costs of an emergency

Key Takeaways

Our pets bring us joy and help us relieve stress. While we can’t put a price on their health and quality of life, there are unfortunately real-life costs to raising a pet that can add up quickly if we are not prepared.

When looking at how you will pay for the care of your pets, looking at your financial plan and other goals is a great place to start. This can help you determine if self-insurance or pet insurance are the right tool for your situation.

Age, health, and cash flow are factors you should consider in your decision.

You can compare popular pet insurance providers here. We would also recommend checking with your bank, credit union, or current auto/ homeowners insurance provider to see if they offer pet insurance at a discount.

Planning for your pet’s happy and healthy life is just one aspect of your financial plan. If you have questions about how to accomplish your personal financial goals, reach out to us and let’s have a conversation!