As a huge Seinfeld fan, I relate most life experiences back to an episode of my favorite show. The recent market volatility has me thinking about Kramer’s battle with gambling addiction.

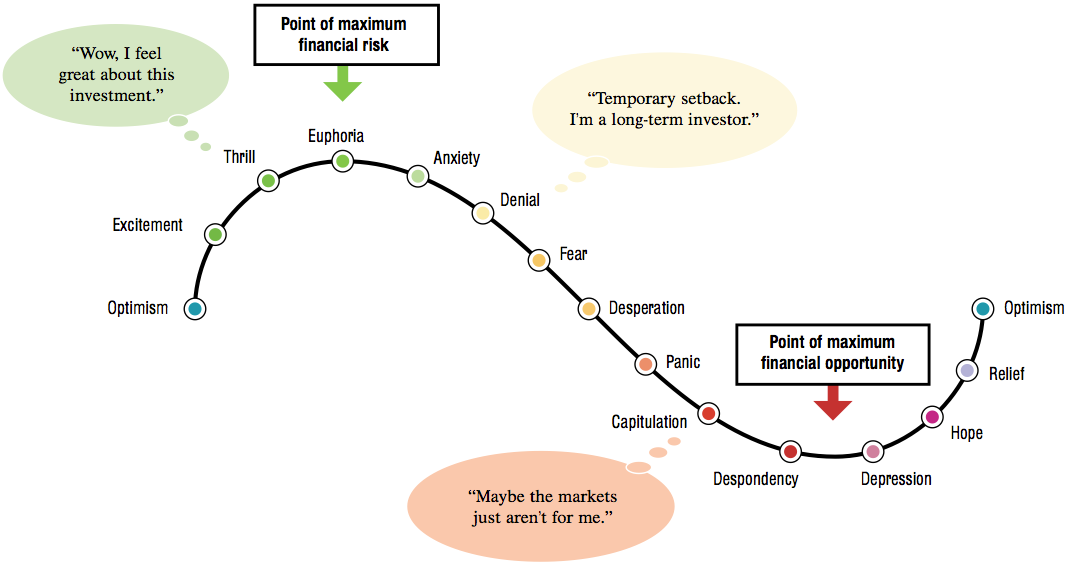

The attached clip shows Kramer’s exaggerated reactions to his bet on a horse race. In less than 60 seconds Kramer experiences the fear, panic, despair, and euphoria that accompanies having a lot of money on the line.

Riding the FOMO Roller Coaster

Many so-called investors ride this roller coaster as they bet on individual stock positions in hopes of hitting it big on the next FAANG stock (Facebook, Amazon, Apple, Netflix, Google).

Why do we put our hopes on these individual companies to improve our financial futures?

It’s the same reason Kramer finds it nearly impossible to resist betting on horse races. We have seen others get rich this way and we don’t want to miss out.

It’s important to make the distinction between gambling and investing.

The recent market volatility can bring out these emotions in even the most seasoned investors. This is when it is important to remind yourself of the WHY.

Why are you investing in the first place? What is this money for?

Utilizing a long term, diversified strategy might not shield you from emotional turmoil during a market downturn, but it does lend perspective. Having a plan in place allows you to assess the potential risks and decide the best ways to manage them.

Gambling vs. Investing

Stock market losses are a part of investing. The equity risk premium earned that title for a reason.

Higher returns come at a cost, and it is periods of losses and underperformance. These are to be expected and incorporated as part of your long-term plan. If they are not, then you are gambling, not investing.

While we have as much control over the stock market’s daily movements as Kramer has over his horse, we do have control over how we react to market gyrations. Instead of making investment changes in light of stock market losses, we recommend revisiting your financial plan and asset allocation and asking yourself (or your advisor) the following questions:

- How much of my portfolio is really exposed to risk assets?

- Is this amount still appropriate for my age and stage of life?

- How much is in safer/shorter-term investments?

- How long will those short-term funds meet my cash needs?

- What are the odds that I might need to change my lifestyle or plans as a result of a market down turn?

Addressing these questions can bring you back to the WHY and help you stay the course toward your long-term goals.