International stocks have not done well recently compared with U.S. stocks. The 2024 return of international stocks (as measured by the MSCI World ex USA Index) was just under 5%, lagging by nearly 20 percentage points the return of U.S. stocks (as measured by the MSCI USA Index). And the annualized return of international stocks during the recent 10 years lagged the U.S. by 7.2 percentage points. It is no wonder that many American investors doubt the wisdom of including international stocks in their portfolios.

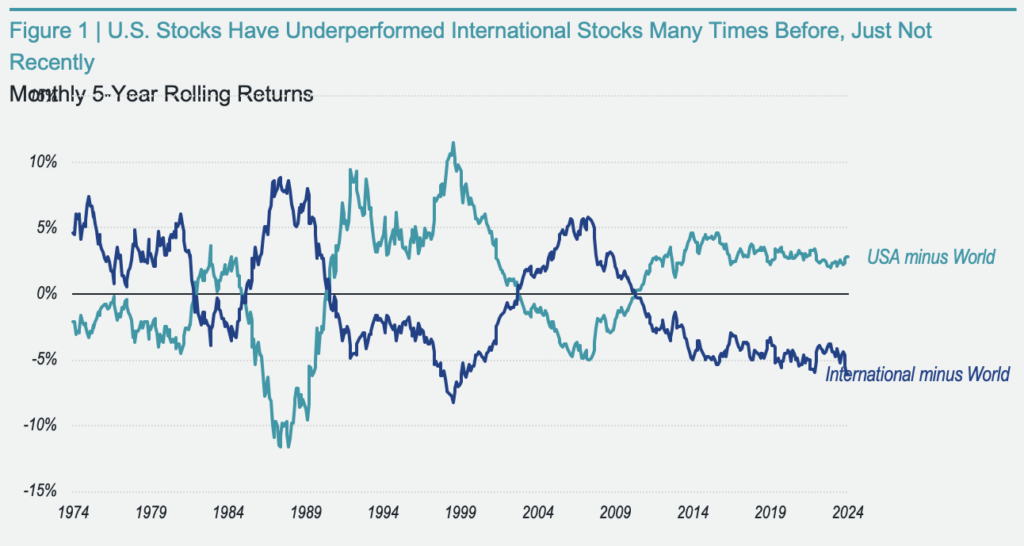

Yet, as we contemplate excluding international stocks from our portfolios, we should be aware of our tendency to commit recency errors. Stock returns are volatile, and 10 years or even longer are short periods in the lives of stock markets. As shown in Figure 1, U.S. stock returns exceeded international stock returns during some short periods and lagged them during other short periods.

Source: MSCI. Returns in USD. US stocks are represented by the MSCI USA Index. World stocks are represented by the MSCI World Index. There are 600 monthly five-year rolling periods from December 31, 1974 – December 31, 2024.

“Recency” errors are part of the broader set of “representativeness” errors. Amos Tversky and Daniel Kahneman described representativeness errors as belief in the “law of small numbers,” a tongue-in-cheek offshoot of the robust “law of large numbers.” The latter is an important law of statistics. It teaches us, for example, that the percentage of heads in a sequence of coin flips is likely to be closer to 50 percent when we flip a coin many times, such as 60, than when we flip it a small number of times, such as 10.

One manifestation of believing in the law of small numbers is that 10 years of international stock underperformance are interpreted as representative of markets where international stocks always underperform.

“Hot-hand” and “cold-hand” errors are representativeness errors. They involve extrapolation of recent returns. In a hot-hand stock market, where recent returns were high, we tend to predict high future returns. In a cold-hand stock market where recent returns were low, like the low returns in the recent international market, we tend to predict low future returns.

While it may feel as if the U.S. market has the hot hand today, let’s rewind the clock to 2011 — the last (but not only) example from Figure 1 when a prolonged stretch of non-U.S. stock outperformance occurred. In Figure 2, we see that in the 10 years ending in 2011, U.S. stocks underperformed international stocks by more than 2.50% annualized. At that point, U.S. stocks had underperformed international stocks since the start of 1970 — a more than 40-year period! We know today that U.S. stocks have done pretty well since then, but do you think you would have predicted that at the time?

Source: MSCI. Returns are annualized in USD. USA is represented by the MSCI USA Index. World ex USA is represented by the MSCI World ex USA Index.

Insensitivity to predictability exacerbates representativeness errors. Variation in the quality of meals at a restaurant tends to be small, whereas variation in stock returns tends to be large. We can predict quite accurately the quality of future meals at a restaurant by the quality of 10 past meals, but we cannot predict nearly as accurately future stock returns by 10 past returns.

Indeed, the large annual gaps between the returns of U.S. and international stocks indicate the large benefits of diversification between them. Imagine that we are at the beginning of 2024 and know that one of the two 2024 returns, U.S. or international, will be 24.6% and the other will be 4.7%, but we do not know which stock market will be the winner and which will deliver the loser. A 50-50 diversified portfolio is sure to deliver 14.6%. Yes, that is not as high as the winning return, but it is higher than the losing return.

One more thing. There is something unique about the U.S. and international pair, distinguishing it from other pairs, such as U.S. large-cap and U.S. small-cap stocks. Think about driving from home to work on your usual route and getting into an accident. Now, think about choosing to drive to work by an unusual route and getting into an accident.

You would be disappointed about the accident on your usual route but not feel the extra pain of regret because you would not shoulder responsibility for choosing that route. It was your usual one. But you would feel the extra pain of regret about the accident on your unusual route because you would shoulder responsibility for having chosen that route.

Both U.S. asset classes, large and small, are domestic and familiar to American investors, whereas the international in the U.S. and international pair is foreign. Recall that until recently, we referred to international stocks as foreign stocks.

We tend to think of diversification between U.S. large and small-cap stocks as usual. We are disappointed when the returns of one lag the other, but we do not feel the extra pain of regret. But we tend to think of diversification between U.S. and international stocks as unusual. So, we feel the extra pain of regret when international stocks underperform U.S. ones because we shoulder responsibility for choosing them. Yet the remedy for this extra pain of regret is not in excluding international stocks from our portfolios but in familiarizing ourselves with international stocks and making their choice usual.

Source: Avantis Investors is an investment advisor registered with the Securities and Exchange Commission.