We acknowledge that Russia’s war on Ukraine has caused a tragic humanitarian crisis and loss of life. Events are unfolding quickly, and there is much uncertainty. We are monitoring the situation with heavy hearts.

That said, Russia’s invasion of Ukraine is an important reminder that geopolitical risk is a part of investing in global markets.

Investors often ask whether a link exists between current events and financial market performance.

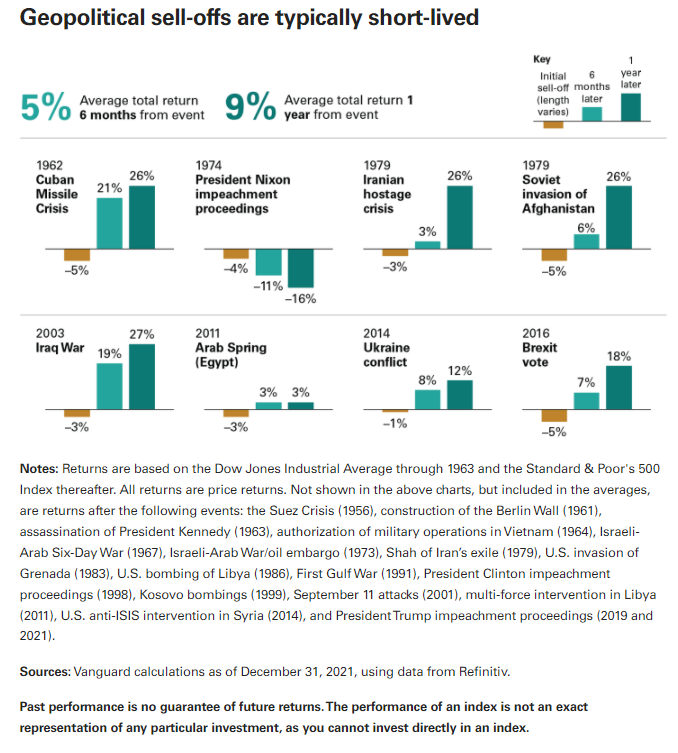

Vanguard examined major geopolitical events over the past 60 years (see below), and found that while equity markets often reacted negatively to the initial news, geopolitical sell-offs were typically short-lived and returns over the following 6- and 12-month periods were largely in line with long-term average returns.

On average, stocks returned 5% in the 6 months following the events and 9% in the 12 months after the events as shown below.

With volatility spiking in recent weeks, it’s natural to feel the need to do something with your investments.

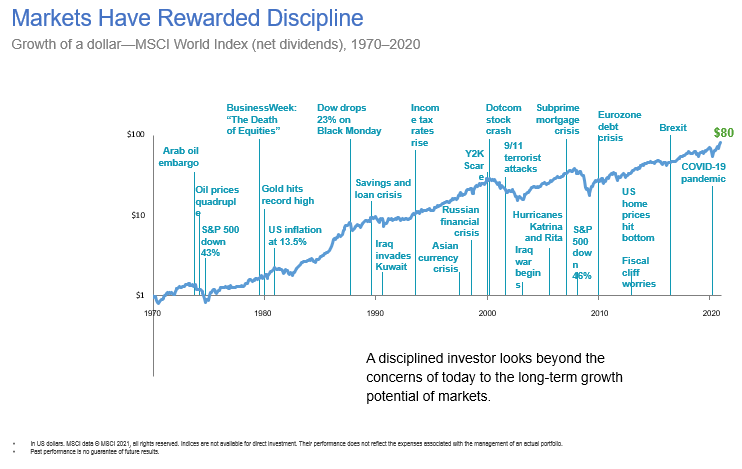

But uncertainty is a persistent characteristic of investing and allows for the opportunity to experience higher long-term returns. As noted in the graph below, the world stock index increased 80x from 1970 through 2020, but there were many events, uncertainty, and bumps along the way.

FSI Update:

Russian Holdings in FSI Portfolios

- The investment company we primarily use (Dimensional Fund Advisors (DFA)) plans to divest all Russian holdings as market conditions allow.

- As of March 7, 2022, the FSI preferred equity portfolio had ~.04% exposure to Russian stocks so almost zero. DFA was underweight in Russian stocks compared to the indexes prior to the invasion which has helped their recent performance against these benchmarks.

- Our bond holdings do not include Russian bonds.

What Are We Doing?

- We are focusing on things we can control. This includes opportunistic rebalancing and potentially taking advantage of market turbulence to reduce your tax bill through tax-loss harvesting (for clients with taxable accounts).

- The Financial Symmetry Investment Committee will continue to analyze the impact of the war and make any portfolio changes we feel are in the best interests of the people we serve.

If you are feeling uncertain about the risk you are taking and not yet a Financial Symmetry client, reach out to one of our advisors who can help you develop a customized approach for your situation.