Have you been offered an early retirement package?

Early retirement packages are on the rise. Companies are looking for ways to cut costs and one way to do that is to offer seasoned employees an incentive to ease into a voluntary retirement. Usually, these packages offer a one-time payment and sometimes they come with a period of additional healthcare coverage.

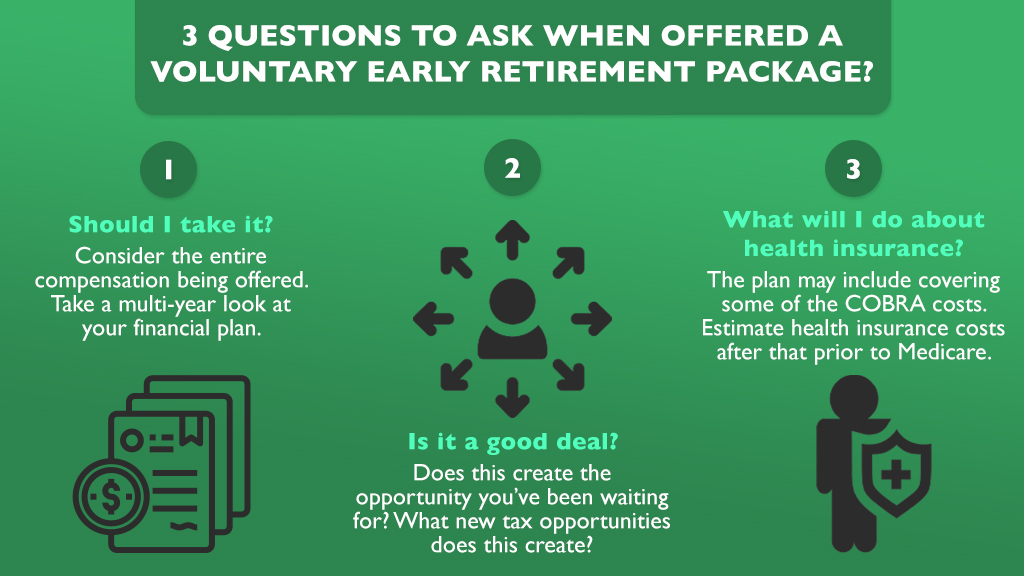

If you are offered an early retirement package many questions will arise, including:

- Is this a good deal?

- Is the package negotiable?

- What will I do about health insurance?

- And, of course, should I take it?

On this episode, we’re giving you the tools to create a framework to think about the questions that early retirement packages bring. Listen in to learn how to weigh this huge decision.

How does this early retirement package affect your long-term financial plan?

Before you consider anything else you need to think about how this package fits into your long-term financial plan. Receiving a lump sum can give you a lottery mindset, so you’ll need to consider what is most important to you. How would this package fit into the bigger picture of retirement?

This is a good time to ask a professional for help. A financial advisor can help you spot risks and opportunities that you may not have otherwise seen. What does this now make possible? How will it change your tax picture? Evaluating on a multi-year basis can provide perspective to help you gain peace of mind with your decision.

What about health insurance?

The main reason that many people decline an early retirement package is the fear of potential astronomical health insurance costs. You first will want to ask if health insurance is a negotiable part of the package. Sometimes the company will offer to pay for your health insurance for a certain period of time.

You’ll also want to compare COBRA coverage to your other options. COBRA will guarantee you 18 months of health insurance coverage under your old plan. Just be prepared for a bit of sticker shock, as your company very likely was subsidizing a large portion of the cost.

Another way to cover your health insurance is to check into the ACA healthcare exchange. Be sure to weigh all of your healthcare options, including specific health conditions and pharmacy costs before signing the deal. If you live in North Carolina, you can get a free quote here. If you live elsewhere, get your quote here.

How will this influence your tax picture down the road?

So many tax opportunities pop up with an early retirement package. You’ll want to consider all the ways that you can save on taxes if you decide to accept it. Some questions to consider are:

- Do you have a health savings account? If so, make sure to max it out.

- Have you maxed out your 401K for the year?

- What about your company stock?

- If you are under 59 ½, where will your income come from?

- When do you plan on taking Social Security?

Now is the time to plan how to build your ultimate retirement withdrawal strategy.

Ask yourself: What’s Next?

Will you be able to transition into retirement successfully? The answer may be dependent upon whether you are retiring from something or to something. This is why it is important to consider what’s next.

Will you relax on a beach somewhere, find another job, become a consultant, or try your hand at entrepreneurship? An early retirement package can bring about myriad choices, but you need to make sure that you are financially prepared to accept them.

Outline of This Episode

- [3:15] How does this decision affect your long term financial plan?

- [8:02] Health insurance often makes or breaks this offer

- [10:02] How will this influence your tax picture down the road?

- [15:04] Ask yourself: what’s next?

- [17:43] Alternate scenarios

- [18:40] The progress principle

Resources & People Mentioned

- WSJ – Should you Consider Early Retirement in a Recession?

- WRAL – Cisco Execs based in Triangle accept early retirement offers

- Episode 91 – The Mega-Backdoor Roth

- Starting Over in Your 50s

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook