How closely did you look at your Medicare premium notice letter this past December?

If it mentioned an IRMAA adjustment, and you experienced a life-changing event, you may want to look again. There are a few steps you can take that can save you thousands of dollars in Medicare premiums.

In this episode, we are breaking down the tax cliff known as IRMAA, and how proper planning can help you avoid overpaying for your Part B and Part D Medicare premiums.

What is IRMAA?

This often misunderstood or overlooked area of the tax code is how Medicare determines the premiums that are automatically taken from your Social Security check. IRMAA stands for Income Related Monthly Adjustment Amount. Understanding the IRMAA threshold is key to understanding your Medicare premium.

Watch out for the IRMAA tax cliff

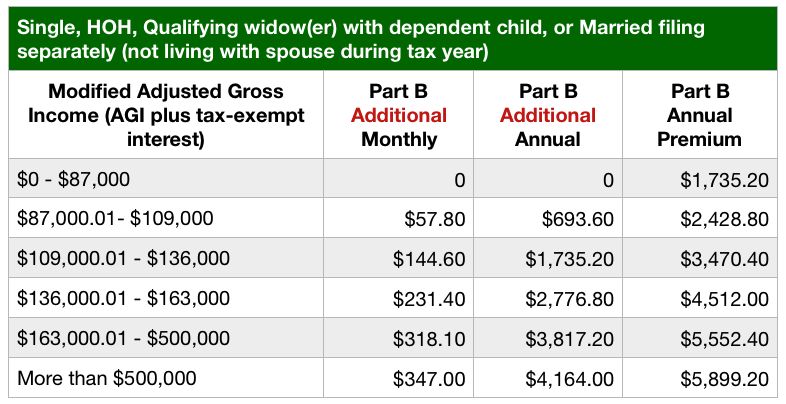

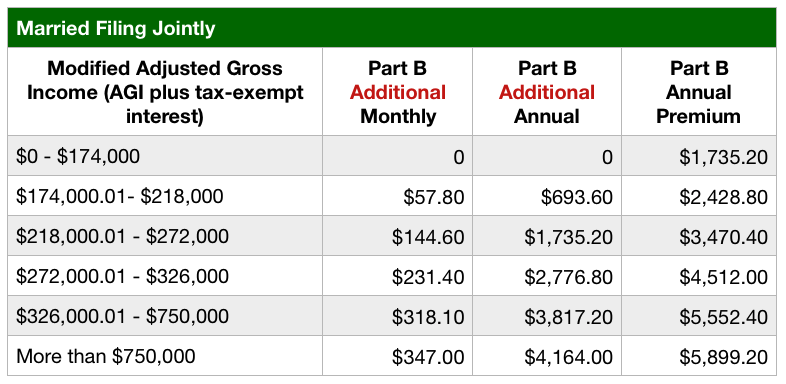

Generally, when you think about Medicare, you think about age 65 and above. It’s actually important to begin thinking about Medicare when you are 63. Your Medicare premium at age 65 is based on your Modified Adjusted Gross Income (MAGI) that you made 2 years prior. Your MAGI will be your AGI plus any tax-exempt interest. So if you were in one of the higher income brackets before you retired, your Medicare premium will reflect that. There are 5 tiers of IRMAA and if you go even $1 over, you will be knocked into the next bracket. If you end up in the highest tier, you could be paying over $4000 in extra Medicare Part B premiums.

How can you plan ahead?

Planning should begin a few years before you hit 65 to avoid an IRMAA hike. If your AGI is $87,000 or less for singles or $174,000 or less for a married couple, then you will qualify for the Medicare Part B baseline premium, which is $144.60 per person per month. But if your income falls above these levels, there are planning strategies to consider in order to avoid the higher premiums. It’s important to understand your income sources and whether they are taxable or not. For example, the full withdrawal amounts from a brokerage account will not all count as income, only the capital gain portion.

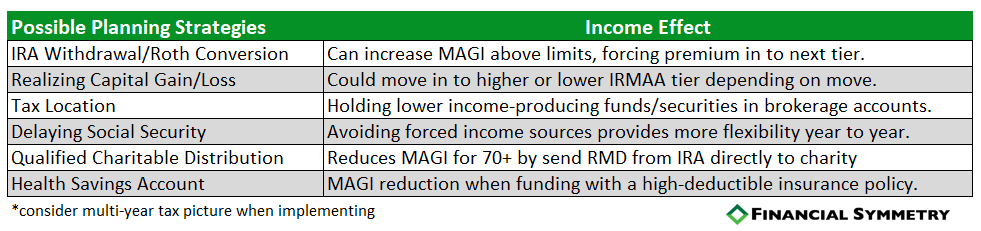

Here are six potential planning strategies to consider when evaluating your income plan:

All of these planning strategies should be evaluated within the context of your multi-year financial plan. Knowing where your MAGI falls in the IRMAA tiers, can save you money. Listen in to hear more about IRMAA and you can make the best decisions with your retirement income plans.

What can you do to appeal?

If you didn’t plan ahead and are stuck with high premiums you may be able to complete an IRMAA appeal. You can appeal based on marriage, divorce, death of a spouse, work stoppage, work reduction, or loss of income. If you qualify for an IRMAA appeal, then you’ll need to fill out an SSA-44. There are 5 steps to follow in the IRMAA appeal process. Listen in to discover what you can do if IRMAA has boosted your Medicare premiums.

Outline of This Episode

- [3:27] Which parts of Medicare does IRMAA affect?

- [7:20] An example

- [9:55] How can you appeal?

Resources & People Mentioned

- IRMAA Tables

- Investment News – Medicare Premium Increases and IRMAA surcharges for 2020

- Form SSA-44 – Medicare IRMAA Life Changing Event Appeal Form

- WSJ – Tiny Tax Moves Can Save You Big on Medicare Premiums

- Boomer Benefits – How to Appeal a Higher Medicare Part B Premium

Connect with Grayson Blazek

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook