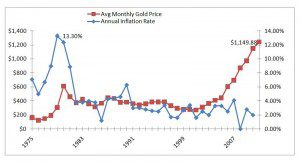

Historically, gold has been used as a hedge against inflation. During the run up in to its peak price in 1980, gold was chasing the inflation rate as investors feared that their purchasing power was going to be destroyed by runaway prices. What they didn’t realize was that the inflation rate had already peaked above 13% at least a year prior to gold and it continued to fall until 1986 where it has remained in a corridor between 0% and 6% ever since.

Historically, gold has been used as a hedge against inflation. During the run up in to its peak price in 1980, gold was chasing the inflation rate as investors feared that their purchasing power was going to be destroyed by runaway prices. What they didn’t realize was that the inflation rate had already peaked above 13% at least a year prior to gold and it continued to fall until 1986 where it has remained in a corridor between 0% and 6% ever since.

Gold as a Deflation Fighter?

Gold’s average annual return (using average monthly price) from 1980 through 1986 as it followed the inflation rate down is a negative 10%; from 1980 to 2005 it is a negative 2%. Meanwhile, gold didn’t hit its average monthly high again until over twenty five years later when it began its recent bull run in 2006.

Since 2006, gold has averaged a return of over 17% per year. However, inflation has hardly been out of control during this time and, in fact, the prevailing fears currently facing the markets are those of deflation. So how is it that a commodity that has a history of being used as protection against inflation is suddenly a haven in a deflationary environment?

Yosemite Sam’s Investment Choice

Gold is also a reflection of the overall faith (or lack thereof) in the economic and political system.

Issues such as the European debt crisis, the Gulf oil spill, persistent joblessness, a housing crash hangover, etc. have created a sense that the problems we face are too big and might lead to widespread economic collapse. Currencies will tumble in value in a collapse scenario, so the hedge with gold is that you will have protected your ability to trade for goods and services through the relative stability of its value. That, in effect, is the bet that is being made by those who are pushing gold up into stratospheric territory. The gold bet in 1980 didn’t break even for another twenty five years (even longer when adjusted for inflation), it will be interesting to see how well today’s gold bet plays out.