There is a companion podcast for this post available. You can listen through the player above, or subscribe to our podcast on iTunes or Stitcher.

Summary

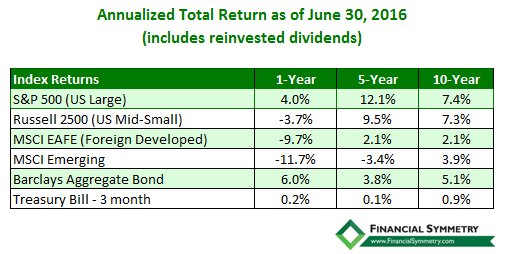

After a relatively calm start to the quarter, it ended with the unexpected “Brexit” vote. The S&P 500 index suffered two of its worst single-day losses of the year immediately after the “Brexit” vote, followed by two of its largest single-day gains. Due to the uncertainty regarding the Brexit fallout and upcoming U.S. elections we’d expect volatility to continue for the rest of the year. That said it is important to look beyond the short-term swings in the stock market and stay focused on your long-term plan. Our market update on June 24th, 2016 titled “Brexit just happened. What should I do?” provides further clarity regarding our views on current market conditions and how you should act. Chad Smith and I recently did a podcast titled, “What Do You Do When the Market Panics” that can be found here here on Stitcher and iTunes.

International Investing

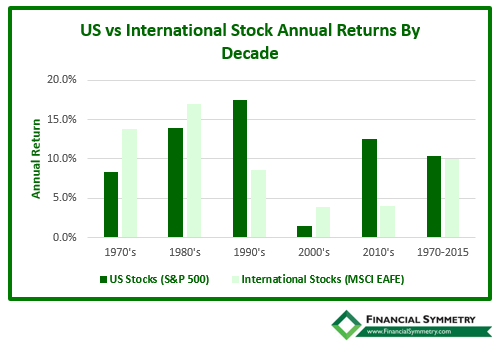

Due to the strong U.S. stock market returns over the last seven years and recent news in Europe, many wonder why we invest internationally. Historically, a well-diversified portfolio with a mix of U.S. and International stocks have provided a better return with less risk than an U.S. only portfolio. This is because companies based outside the US are exposed to an array of economic and market forces that may cause the performance patterns to their stocks to differ (good or bad) from those of the US companies. A good example of this is reflected in the graph below showing annual decade returns for US vs. International stocks. As noted below from 1970-2015 their returns were almost identical, but each decade resulted in materially different results. This is the benefit of diversification as you don’t know when US or International stocks will have better returns.

Fixed Income

Ten-year Treasury bonds yields continue to decline to hit an all-time low in early July. Across the globe, more than 70% of sovereign bonds currently have yields of 1% or lower. Since bond returns are highly correlated to starting yields we are not optimistic about future bond returns, therefore, high-quality bonds with short to intermediate term maturity provide the best value today. This safe approach to bonds reduces return, but also reduces the risk of losses if we had a sudden rise in rates. The one bright spot is these lower rates are good news for individuals looking to buy a new home or refinance an existing mortgage.

Conclusion

This remains a challenging investing environment. U.S. stock market valuations are above average, but not in bubble territory yet. International stock valuations are at or below historical levels so provide the best long-term opportunity, but not without short-term volatility. Fixed income (bonds and cash) yields remain unattractive as discussed above. Patience remains the key to a successful long-term investment strategy and that is never more true than today. Focus on things you can control and not on things you cannot like recent investment performance.