There’s always more to learn when it comes to the world of finance. A great way to squeeze in some extra know-how this summer is through reading. So on this episode, we have a list of 13 great titles that you may want to add to your reading list, no matter where you are financially or what interests you have.

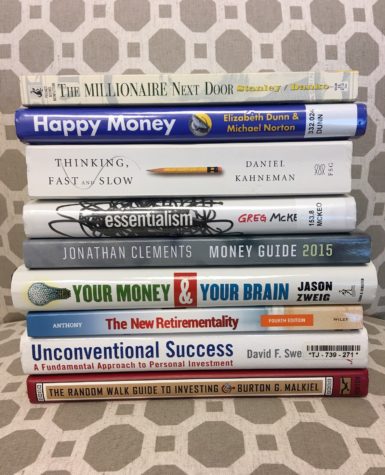

These books are read & approved by us and have helped build our own financial knowledge over the years. We highlight 8 of our favorites, but all 13 books cover a whole range of really important topics that will make an impact on how you manage your money.

Dive into the mechanics of the mind, see finances from an angle that you may not have seen before, or read stories of financial successes and failures from top players who have tons of life experience in business and finance. From older books that cover timeless principles to the newer books on the list that provide more up-to-date tips and tricks, there’s a little something for everyone to learn.

Facts and Links Mentioned In the Show

- Money Guide 2016 by Jonathan Clements

- The Wealthy Barber by David Chilton

- A Random Walk Down Wallstreet by Burton Malkiel

- Your Money and Your Brain by Jason Zweig

- Thinking Fast and Slow by Daniel Kahneman

- Essentialism by Greg McKeown

- Unconventional Success by David Swensen

- Shoe Dog by Phil Knight

- The New Retirementality by Mitch Anthony

- The Opposite of Spoiled by Ron Lieber

- Where Family and Finance Meet by Cameron Hendricks

- Happy Money by Elizabeth Dunn

- The Millionaire Next Door by Thomas Stanley

- Blog Post: Burned by Bubbles by Chad Smith

What You’ll Learn in This Episode

- The basics of how to earn more, save more, and make smart financial decisions.

- Through stories and a fun conversational approach, learn the importance of paying yourself first, creating a will, paying off debt and more.

- Get your foot in the door and off to a good start with some solid beginner investment knowledge and tips.

- Take a look at how the way your brain is wired can get in the way of your financial success.

- How to avoid common mistakes by using simple principles and processes.

- How to hit paradox success by playing to your strengths and prioritizing your goals.

Connect With Chad or Mike

- Connect with Chad [csmith@financialsymmetry.com]

- Connect with Mike [meklund@financialsymmetry.com]

Subscribe and Listen to the Podcast Here

iTunes <-> Stitcher <-> Spotify <-> Google Play