Two wildcards continue to cause us to be somewhat cautious- Europe and US politics. In Europe, it appears more and more likely that the European Union’s austerity drive is continuing to depress the weaker nations and thus actually make their debt problems worse, while Germany continues to be barely affected- in fact they may even be benefiting from the weakness of the Euro. This does not appear to be sustainable, and we think that one of two outcomes is likely- higher inflation or breakup of the Euro. Either of those outcomes eventually paves the way for recovery for their economies, though the timing is very uncertain.

US politics are still a significant risk, as some politicians may recreate the debt default threat like in 2011, or allow very contractionary tax hikes and spending cuts to take effect at the start of 2013. Both parties have good reasons to compromise, but that doesn’t mean they are certain to.

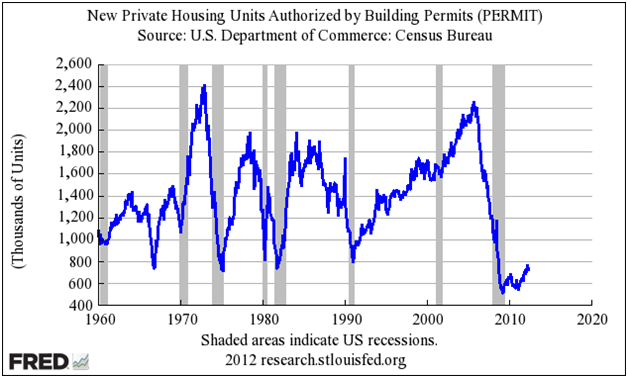

Neither of these wildcards changes our longer term outlook for the US economy, which we believe will improve once residential construction is again building at a sufficient pace to keep up with population growth as we discussed in last year’s post here . We are in fact seeing what could be the beginning of a return to those levels as discussed here.

Car sales and production continue to do well as we expected from last year’s post here. US auto makers are running their plants at a very high level as discussed in this story.

We should also be approaching the point at which local and state governments’ tax revenues are stabilizing and starting to improve, which should lead to the end of large scale government layoffs which have added quite a bit to the unemployment rolls over the last couple of years. If they merely stop cutting jobs, it will actually be a boost to GDP growth.

These themes are why we remain optimistic about the five year outlook for the US economy. The wildcards may create a recession and stock market sell off in the short term, so we have gotten a little more defensive, but we are also mindful that the longer term outlook is good so if we do get a sell off, we will use that opportunity to buy stocks with funds from sales we made earlier this year.

Keep an eye out, as we’ll be posting more detailed analysis soon on the two wildcard themes, Europe and US Politics.