This has been a spooky year for stock and bond returns. For those of you who are near, or already in retirement, you may feel like this year is a part of some retirement horror story.

Which reminded us of a common retirement tale from one of Halloween’s favorite fictitious characters, Michael Myers.

After 40+ years of scaring audiences, the Halloween movie franchise is coming to an end. Now that Michael has reached 65, we thought it fitting to envision that everyone’s favorite murderer is finally done chasing victims and is ready to settle down into retirement.

Has he prepared well enough, or did he chase returns the way he chased his victims? Listen in to hear the retirement horror story of Michael Myers.

Michael starts his investing journey based on a stock tip he read

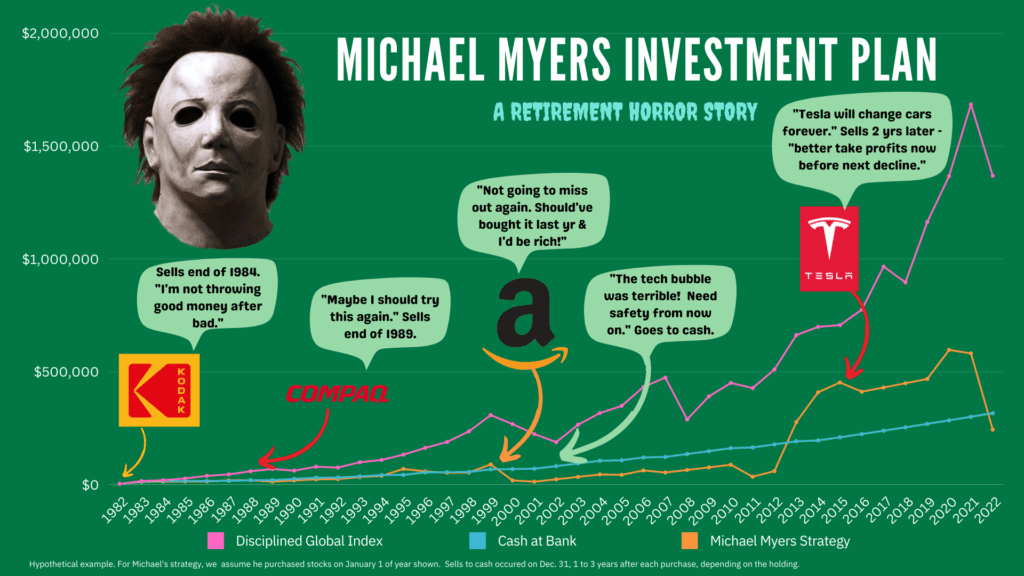

Let’s assume that Michael starts his investment journey at age 25 in the early 1980s. Following a similar strategy to chasing his victims, Michael chases the hot stocks of the day. He first reads a tip that Kodak was an up-and-coming stock to watch, so he dedicates $200 per month in addition to a $10,000 bonus.

Michael starts to develop a pattern in his investing. He buys a particular stock, holds it for a few years, and then sits out the next few years. He develops a decent history of picking some winners: Compaq, Starbucks, Netflix, and Tesla. However, Michael takes frequent breaks from the market, jumping in and out based on emotion.

Michael doesn’t have much of a plan and lets the emotional impact of FOMO, or the fear of losing it all, guide his decision-making.

Jumping in and out of the market impacted his earnings

In 2020, while he is taking a break from investing, Michael realizes that he is getting close to retirement, so he is ready to make up for lost time. Since he has chosen so many winners, Michael decides to put his money into Bitcoin.

What Michael, and many investors, forget is that his picks weren’t always on an upward trajectory. There were many low points in his investing journey. Michael experienced Black Monday, the savings and loan crisis, Y2K, the dot-com bubble, Brexit, and the Covid-19 pandemic.

In total, Michael invested $226,400 and he ends up with $243,275 in 2022. If he would have kept that money in cash at the bank earning 2% he would have wound up with $316,471. Michael didn’t have much of a plan for making his investment decisions along the way.

Here are several emotions he may have felt along the way and how they could have influenced his decisions.

How could Michael have changed his story?

Michael is now faced with making some tough decisions. He may need to work longer, cut spending, downsize his house, get a reverse mortgage, or even rely on support from his children (lets hope he developed those relationships!).

What if he would have had a plan?

Listen in to hear how Michael might have fared if he had set his emotions aside and relied on a disciplined investment strategy that was built from the details of a customized financial plan. Along with other planning benefits around taxes, estate planning, and cash flow, creating and sticking to a careful investment strategy can bring comfort and help you weather uncooperative markets.

If bear markets have you worried, check out our guidebook to handling market volatility.

Outline of This Episode

- [3:25] Michael Myers starts his investment journey

- [9:45] Emotions can control investing if you don’t have a plan in place

- [10:48] What Michael ended up with after all his investing

- [14:38] What if Michael would have had a plan?

- [18:55] Today’s progress principle