Typically we see clients approach charitable gifting in one of two ways:

- Giving cash

- Giving appreciated stock

While both are good options, there are often times, where a more advanced gifting strategy may be appropriate for those prioritizing charitable giving.

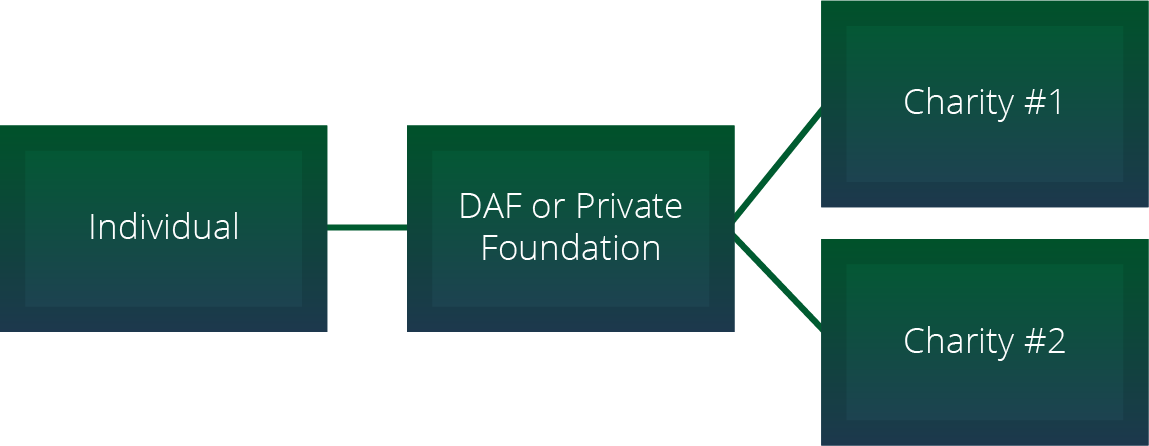

The next step may be just a large amount of cash/stock or even more complex assets such as private company stock, real estate, or shares of a privately owned business. This can be done through vehicles such as a Donor-Advised Fund or a Private Foundation. The essence of these is an individual makes a large tax deductible gift to the giving vehicle and then over time can distribute the funds to various charities as they see fit.

Donor-Advised Fund (DAF)

Key Characteristics

- Giver recommends grants and investment options

- The public charity has ultimate control over decisions

- No annual distribution requirements

- Cannot employ people

- Provides anonymity for giver

- Complete privacy of giver and no tax return required

- Income deduction up to 50% of adjusted gross income (AGI) for cash and 30% for publicly-traded securities

- No tax on investment income

Private Foundations

Key Characteristics

- Control 100% of Board of Directors until giver’s death

- Can employee people at a reasonable compensation

- 5% of foundation assets must be distributed annually

- No anonymity for the giver

- Public record via Form 990 including grants, fees, salaries etc.

- Income deduction up to 30% of adjusted gross income (AGI) for cash and 20% for publicly-traded securities

- Up to 2% excise tax on investment income

When Each Works Best

While each individual situation warrants different needs, overall if you want an additional account added to your current investment portfolio that is intended solely for charitable use, then a Donor Advised Fund may be best for you. However if you want to operate a charitable organization with staff and ability to host charitable events then a Private Foundation would be better suited.

Charitable giving especially in this context often requires a team of professionals to follow through on the donors wishes. This team could consist of an attorney, CFP®, or more especially when considering a private foundation. Discuss with your financial team your charitable intentions and then devise a charitable gifting plan that will live out those desired intentions.