We know how important it is to save for retirement, but at the same time, focus on enjoying life now. In this episode, we walk you through how to set up a framework for your investment strategy.

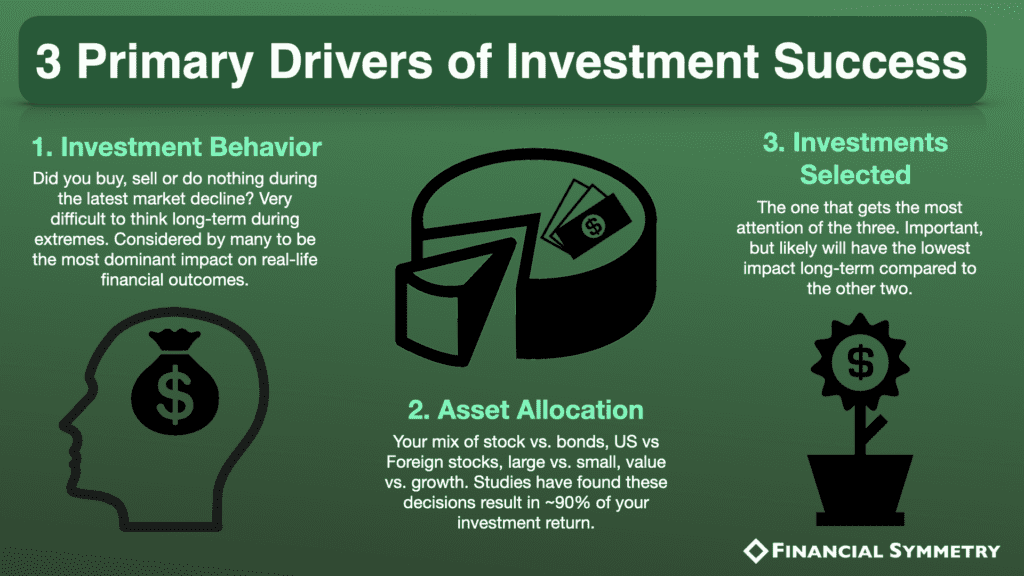

You’ll learn how important your behavior is to your investment success, how to think through your asset allocation choices and finally how to implement a process for selecting the investments themselves.

Investment behavior matters more than any investment you pick

What is your investment approach? How you make decisions with your investments can make or break your investment success. You may think your returns are mostly influenced by which investments you choose, but the reality is that your investment behavior figures into your returns much more than any specific investment that you choose.

Think about last March. What was your reaction to those head-turning market swings? Did you buy, sell, or do nothing? Even though it’s challenging to know how to react in those moments, in a volatile market, every move you make counts.

The dominant determinant of long-term, real-life financial outcomes isn’t investment performance; it’s investor behavior. –Around The Year with Nick Murray

Instead, having a customized financial plan can help you best manage your behavioral instincts. Defining your needs and desires beforehand, allows you a higher likelihood of staying disciplined through volatile market swings. Without a plan, avoiding emotional impulses about what you think will happen becomes next to impossible.

Asset allocation has a sizable impact on investment return

The second driver to success in investing is your asset allocation. Asset allocation is simply the measure of how your portfolio is dispersed. How much do you have invested in stock and bonds? What percentage of your stocks are US-based? What percentage are international? Asset allocation also takes into account whether your stocks are large-cap, small-cap, etc. Vanguard has found that 88% of the volatility you encounter and returns you earn can be determined by your asset allocation. That’s because you’re choosing investments that can complement each other. Meaning when some of your investments zig, the others zag.

Using the spending assumptions from your financial plan provides reasonable timelines of when you may need withdrawals from your portfolio. This allows you to keep money you may need in the short-run in safer assets. Taking these steps will help you determine the amount of risk you need to take in different asset classes.

Questions we ask when picking investments

It’s important to have an independent mindset to help you pick your investments. You don’t want to just follow the pack and do what everyone else is doing. For example, if looking at a mutual fund or ETF, you’ll want to consider several key areas including:

- ethical company culture?

- low costs?

- evidence-based?

- tax-efficient?

- is it repeatable?

We continually ask questions about the investments we choose. And if we don’t like the answers, we don’t invest in those companies. In the podcast episode, we break down how we analyzed one of the mutual fund companies we work with, Dimensional Fund Advisors.

Do you have an investment plan in place?

What is your investment plan? Think about the strategy that you have used to make decisions about investing. An investment plan includes more than investments, it encompasses behavior and asset allocation. If you don’t have one consider working with a fee-only financial advisor.

Having an investment plan could be the difference between a successful retirement and an uncertain one.

What is your investment strategy? Try taking the quiz below to take the first step by helping to determine your investment composure.

Investor Composure Quiz

Outline of This Episode

- [2:25] Investment behavior matters much more than any investment that you pick

- [5:28] How to pick investments

- [9:41] Active funds vs passive funds

- [14:41] Process is important

- [19:50] Think about the strategy that you have used to make decisions about investing

- [20:12] Progress principle of the day – take the quiz

Resources & People Mentioned

- Dimensional Investing

- Vanguard’s Principles for Investing Success

- Our Investment Strategy and Historical Results

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook