Have you ever wondered how your retirement preparations compare with others? This is a common question that we hear as financial advisors. On this episode, we’ll take a look at data from a recent study about the 4 types of retirement journeys that people take. You’ll also hear about the risks and opportunities that stem from these 4 retirement paths.

People’s circumstances, attitudes, and ambitions can greatly affect their retirement experience. So, if you are on the cusp of retirement you may be wondering what type of retirement you will have. You can think of retirement as a Choose Your Own Adventure book. Each path has its own opportunities and lessons to learn.

Which of these retirement journeys will you choose?

The regretful strugglers

Unfortunately, the regretful strugglers are the largest group of retirees. Many of us know someone in this group. They may have encountered unforeseen setbacks or may have been forced to retire early. One theme that this group experiences is the wish that they had saved earlier on.

To prevent yourself from becoming a regretful struggler you can save more now and plan to minimize regrets. Over half of this group have had to make early withdrawals from their retirement funds and most of these people didn’t even think about saving until they reached their fifties.

If you find yourself heading down this path, max out your retirement contributions and add more to the mix with taxable investments in different types of investment accounts. Avoid withdrawing from retirement accounts when you can. Listen in to hear how to use the 72T exemption and the Rule of 55 to avoid becoming a regretful struggler.

Challenged yet hopeful

Even though over half of this group has to make early withdrawals from their retirement savings, they are still hopeful. Many times the difference between happiness and despair in retirement means having the choice of when to retire.

Many individuals in this group didn’t begin their retirement savings until their 40s. Yet they are getting the highest yields on their There are a few things that these retirees can do to make the most of their retirement. Working part-time is a great way to stretch the retirement budget. This way the challenged yet hopeful can delay taking their Social Security benefit for as long as possible.

The relaxed traditionalists

The relaxed traditionalists have worked hard to achieve a state of comfort, and now they want to relax, or they may have a need for change.

This group of people started saving a bit earlier than the previous two and are in much better financial shape. Some have recently become empty nesters and are starting to consider downsizing.

Most of the planning opportunities for this group of people involve tax planning, and they may want to make some Roth conversions or delay taking Social Security.

The purposeful pathfinders

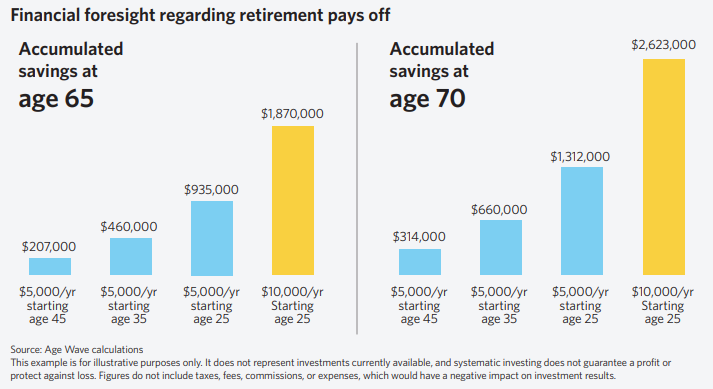

The purposeful pathfinders are active, engaged, and living a fulfilled life. This group of people took advantage of what they could control and started saving earlier in life so have achieved the highest rates of return. Many work with financial advisors to learn how they can use their money to have a happy, purposeful, and productive experience in retirement.

Learn more about the purposeful pathfinders and the other types of retirees on this episode of Financial Symmetry to discover which group you fall into.

Outline of This Episode

- [2:01] Retirement is like a Choose Your Own Adventure book

- [3:13] The regretful strugglers

- [7:34] Challenged yet hopeful

- [11:34] Relaxed traditionalists

- [16:19] The purposeful pathfinders

- [21:41] Choose your own progress principle

Resources & People Mentioned

- Episode 160 – Retirement Trends You Should Know About

- Episode 105 – Retirement Regrets

- Episode 104 – An IRMAA Appeal Can Save You Thousands in Medicare Premiums

- YouTube video – How to Execute a Roth Conversion

- Schitt’s Creek

- Seinfeld

- The Intern

- BOOK – 30 Lessons for Living by Karl Pillemer

- Age Wave the New Retirement Journey Survey May 2022

Connect With Chad and Allison

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh @TeamFSINC

- Follow Financial Symmetry on Facebook