2018 Market Outlook

Where should you invest now? As I wrote last year in “Should I Own International Stocks?”, in investing it is important to “skate where the puck is going, not where it has been” (Wayne Gretzky). What this means is don’t…

Where should you invest now? As I wrote last year in “Should I Own International Stocks?”, in investing it is important to “skate where the puck is going, not where it has been” (Wayne Gretzky). What this means is don’t…

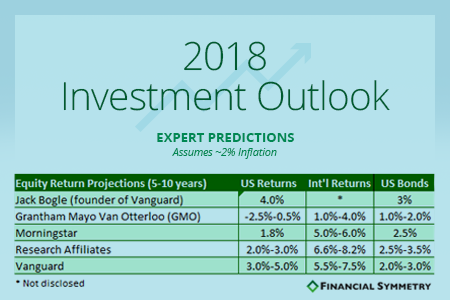

When it comes to investments, too many people take a haphazard approach when what they need is an investment decision process that makes the most of a number of different available resources. This episode is aimed at helping you…

As one individual once told me, their investment portfolio is like an untended garden. An interesting, but accurate analogy. Without enough water and care the plants/flowers in the garden will never grow. The same can be said about your investment…

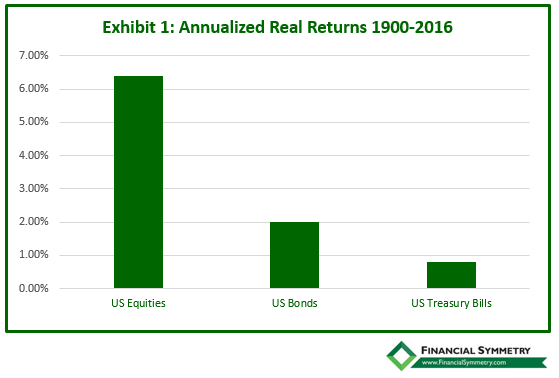

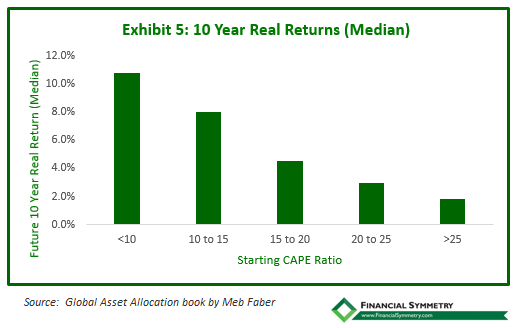

When one thinks about portfolio diversification, bonds, in addition to US and International equities should be evaluated. An investor may be tempted to overlook bonds altogether given that investing in equities tends to lead to higher overall returns (see Exhibit…

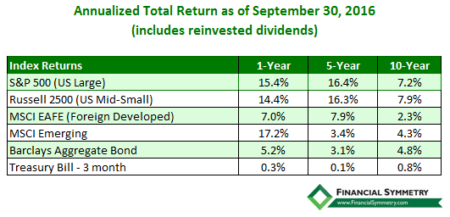

Why own international stocks? Especially when, as noted in Exhibit 1 below, US stocks have outperformed international stocks over the last one, five and ten years, respectively. After all, most investors would have been better off only investing in US…

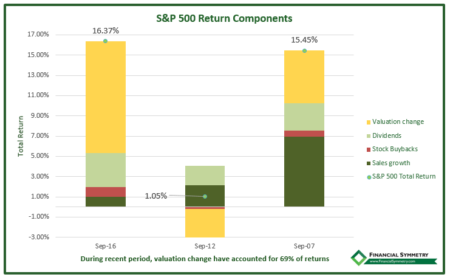

During 2011, in the midst of the federal debt showdown, there would have been very few investors who believed the S&P 500 would return 16% per year over the next five years, especially if they knew that company economic performance would…

Summary Following the Brexit shock in June global markets recovered strongly over the past quarter, with emerging market stocks leading the way. Prior to the recent recovery foreign and emerging markets underperformed US stocks by a wide margin in…

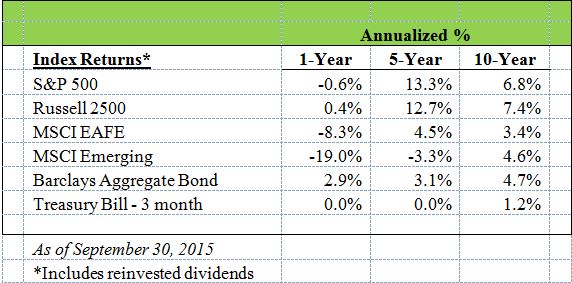

Red ink swept across the major asset classes in November, with one exception: US equities. The markets patiently wait this month to see whether the federal reserve will raise rates at their December meeting for the first time in many…

October Bounce After a challenging stock market over the summer the markets soared in October with all global markets up between 6-8% for the month. What has changed since the end of September to cause this large one-month increase –…

All major equity asset classes are negative for the month and YTD as we have seen increased volatility the last few months as discussed in our last month’s outlook. Investors need to realize the recent volatility we are experiencing is…