2020 has brought us a new reality with our vacation mindsets. With many vacation plans put on hold or completely cancelled, the pandemic has become the impetus for second homes becoming more of a reality.

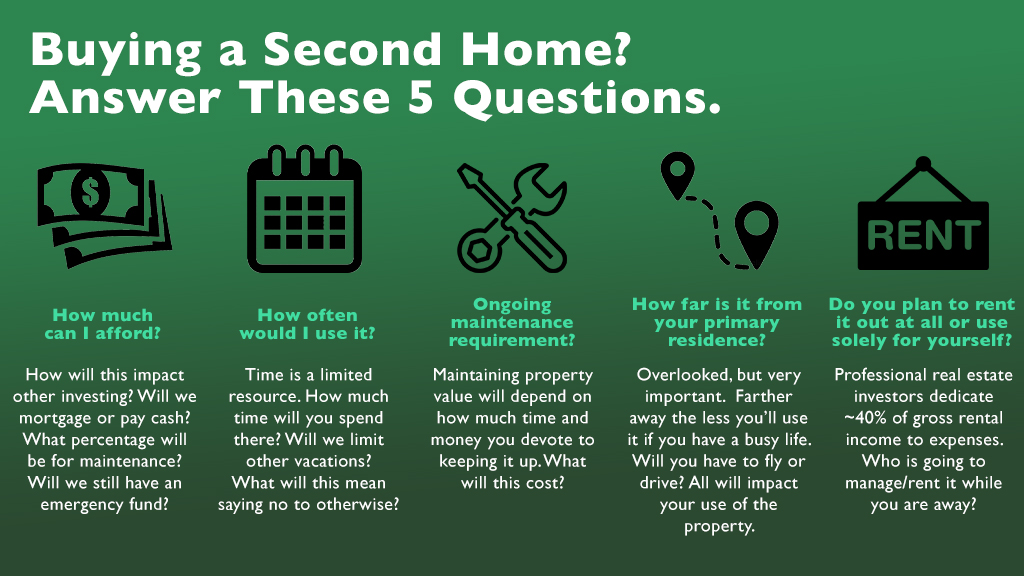

If you have been considering purchasing a second home, we lay out 5 questions to consider as you’re analyzing your purchase decision.

Questions to ask yourself before buying a second home

Have you ever considered buying a lake house, beach house, or mountain house? Vacation home purchases have surged this year, quadrupling the sales of last year at this time. After an amazing vacation, people often get the urge to jump right in and buy. But before you apply for that second mortgage there are some questions you need to consider.

How much can you afford?

Many people only consider the cost of the mortgage, but with a second home, there is much more to consider. Where will you get the down payment? How will you pay two sets of utilities? Will you have two HOA’s to pay for? If you or your spouse lost a job, how would you continue to pay for this second home? Remember, typically a second home is not a great investment. They can be hard to sell and generally do poorly in recessions. Another important consideration is: how will this purchase impact your other financial goals?

How often will you use it?

When will you use your new home? Every weekend? Winters? Summers? Will you rent it out? Consider whether you really want a second home, or 2 nice beach vacations a year.

How much time will you use it? Will you feel like you have to go there? Will it limit other vacations? Is this really where you want to spend all of your time?

Many people end up selling their vacation home because they realize that they didn’t use it as much as they had envisioned. How close is it to your primary residence? Oftentimes, the amount of use a vacation home gets is based on proximity to one’s house.

How will your life be affected by a second home purchase?

Remember there are not only the financial costs to consider but the time cost as well. Another house means more maintenance. This upkeep requires a financial cost but it could also mean that you have to spend your own personal time fixing up the place. What will you be giving up in return for the new house?

Walking through a thorough analysis and approaching big purchases with a framework, can minimize emotional mistakes.

Outline of This Episode

- [2:37] This year second home purchases have increased

- [4:19] How much can you afford?

- [7:40] How often will you use it?

- [9:16] How will your life be affected by this purchase?

- [10:32] What about the ongoing maintenance?

- [13:07] Describe your ideal second home

- [13:45] How far is it from your home?

- [15:47] Do you plan to rent it out?

- [20:57] The key takeaways from today

Resources & People Mentioned

- Michael Hyatt’s Vacation Optimizer

- Article – For Wealthy West Coasters, Working Remotely Means Home Can Be Anywhere

- WSJ Article – East Coasters Are Snapping Up Vacation Homes Amid Coronavirus

- WSJ – What to Consider Before You Buy a Vacation Home

- Humbledollar.com – No Vacation

Connect With Chad and Mike

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh@TeamFSINC

- Follow Financial Symmetry on Facebook