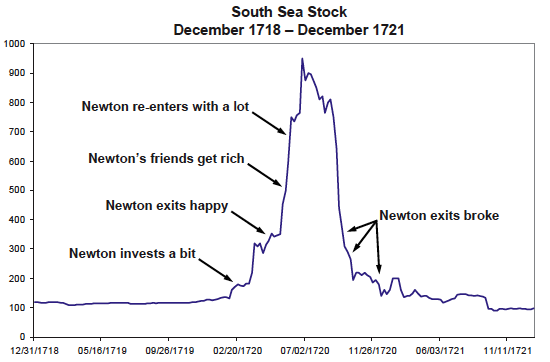

“I can calculate the movement of heavenly bodies but not the madness of men.” – Sir Isaac Newton

In Jeremy Grantham’s latest quarterly letter, he profiled a story about Sir Isaac Newton in which one of the most highly regarded intellects in human history was lucky enough to enter the South Sea stock bubble rather early. He stayed in long enough to make some money and then, most likely feeling good about himself, sold his holdings at a nice profit. After the stock continued to rapidly appreciate, his friends began to brag more and more about how rich they were becoming from investing in South Sea stock. Kicking himself for having made such a foolish mistake by cashing out at such a paltry profit, Sir Isaac dumped much more than he had invested the first time into the stock. Of course, this time the bubble was perilously close to the top and he made the fateful mistake of riding the bubble burst all the way down before selling out on three separate occasions with hardly anything left to show for his original investment.

There are several lessons in this story.

- Don’t get carried away no matter what type of circumstances surround an investment.

- Remember that even smart people get burned by stock bubbles.

For these reasons, we’ve designed our strategy to help fight these feelings. The stock ranges we establish for each of our clients (and ourselves) act as a discipline, helping to control those visceral responses to booms and busts in the markets. Making calls of where we should be at a given time within those ranges is a large part of our research process. So the next time your emotions make you feel like you want to act, remember Mr. Newton’s experience. With a sound and solid investment strategy, you can fight these very human urges that are born out of the fear and greed that dominate the average investor’s decisions.