The Danger in Rushing to Safe Investments

Back in March, many investors were wrestling with the emotions of wanting to preserve whatever money they still had.

Back in March, many investors were wrestling with the emotions of wanting to preserve whatever money they still had.

There are two primary types of client relationships in the world of financial advice. The sales model represented by brokers and insurance agents versus the fiduciary model represented by Registered Investment Advisors.

The inherent problems and conflicts of interest with the sales model is why we choose to operate exclusively as Registered Investment Advisors.

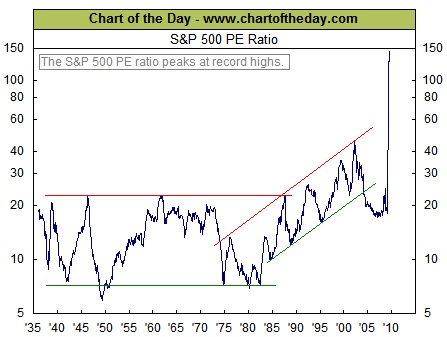

All data is not created equal. This chart from Chart of the Day would seem to indicate that US stocks are more expensive and overvalued then they’ve ever been. The rest of the story is that the last 12 months of earnings…

To be successful as an investor, you have to know which type of sources you can trust. It’s also helpful, to not let recent past performance color your predictions of where the best future returns will arise. In a recent article…

For me, one of the neatest things about living in the Avent West community has been observing the transformation of homes through remodel, refurbishment and even reconstruction. In fact, the same could be said about the entire city of Raleigh…

Finding the motivation to save can be just as difficult as motivating yourself to diet and exercise. In both cases you know the outcome will be worthwhile — financial security and better health. However, taking the steps to get there is easier said than done.

On July 27th, people in the market for a new car can qualify for the “Cash for Clunkers” program otherwise known as the Car Allowance Rebate System (CARS).

Distributions from your retirement accounts are not required by the IRS for 2009 but does that mean that they aren’t necessary? For those who have other sources of cash flow, this waiver does present opportunities for tax planning purposes.

If you haven’t noticed, budgeting is hip these days. This is thanks to the economic uncertainty caused by the stock market’s second worst bear market in the last 100 years. People’s fear of losing their jobs and significant losses in their investment accounts has shifted the importance of financial planning and knowing how to budget back into the spotlight. But there are still people resistant to both of these ideas.

Naturally parents want to provide the best for their children. For many parents today this means paying for them to earn a college degree. This is an admirable goal, and one that their children will greatly appreciate when they graduate free from student loan debt. But what does saving for the ever-rising cost of college tuition mean for their other lifestyle goals?