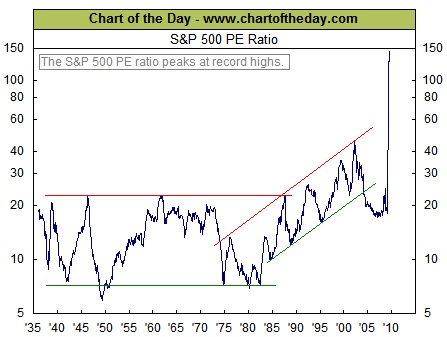

The Post-Great Recession Economy

The CFP® board requires financial planners to attain a significant amount of continuing education to keep their designations current. This week, Allison and Chad attended the FPA of the Triangle’s 2009 Annual Symposium. One of the presentations by fellow FPA…