Waiting Until Things Look Better

Have you ever been in a situation where you spot a news item that you know will make the market drop? At that point, the temptation is to act on this feeling and make the appropriate changes to your investments…

Have you ever been in a situation where you spot a news item that you know will make the market drop? At that point, the temptation is to act on this feeling and make the appropriate changes to your investments…

Everyone wants to feel special, and unfortunately there are those who take advantage of that desire in order to sell questionable products and services. The psychology is based on what is called the Scarcity Principle, and we are subject to…

Are you making the most of the employer match in your 401k plan? Getting the full employer match in your retirement plan is one of the closest things to free money in our economy. Forbes recently ran an article titled…

With the campaign season in full swing there has been a lot to catch our attention lately. Mitt Romney has been under particular scrutiny as he is one of the front runners for the Republican Party’s nomination to face President…

Have you made your 2011 Roth IRA contribution? If you have not yet made the maximum contribution, you still have time! Tax payers have until April 17th of 2012 to make their Roth contributions for the 2011 tax year. If…

Today I was contacted by Woman 2 Woman Breast Cancer Foundation seeking a contribution. They had a compelling message, which is listed on their website. It says that they provide financial assistance to breast cancer patients who are struggling financially….

A central discussion in 2012 will be the possibility of inflationary and deflationary economic outcomes around the world. Several of the deflationary threats that made news in 2011 continue to raise significant questions as we move in to 2012. Potential…

The start of a new year is often when we tell ourselves “This year I am going to [insert resolution here].” Maybe last year you decided to really start tracking your expenses (you know, with a budgeting tool, like Mint.com…

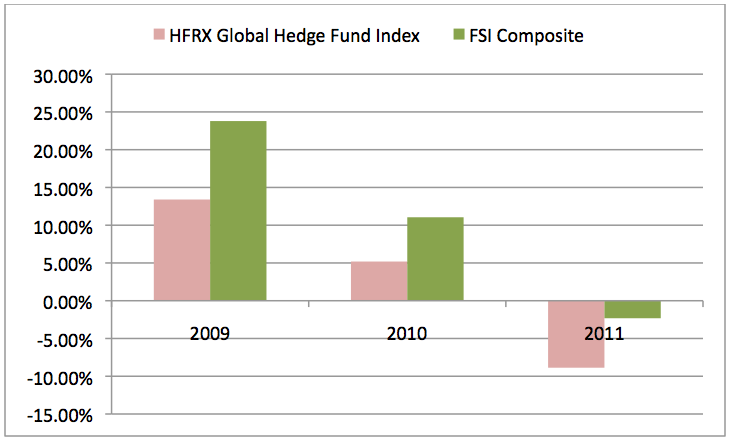

As we look towards the New Year, we pause to reflect on all the events of the past 12 months. Financial Symmetry has covered several current events on our blog throughout 2011, and here are what we think the Top…

Consider taking capital gains For taxpayers in the 10% and 15% brackets, the capital gains rate is currently 0%. This is scheduled to last through the 2012 tax year. Maxing out your pre-tax retirement contributions or a period of unemployment…