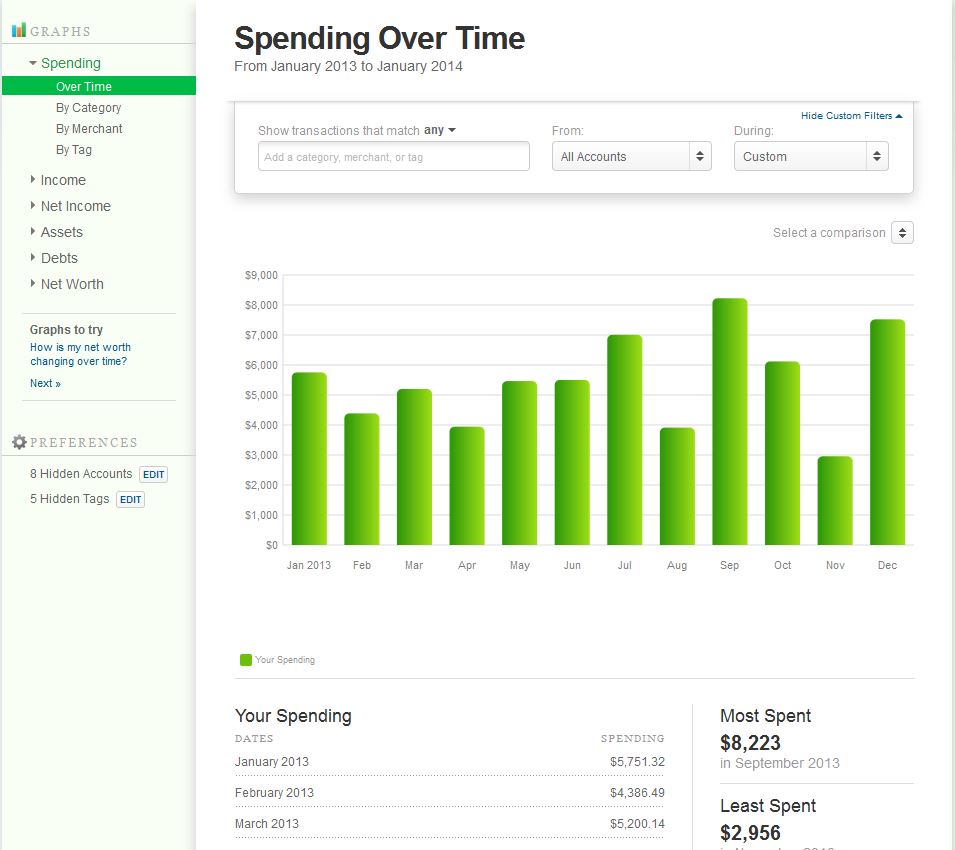

How Much did you Spend Last Year?

The start of a new year is often when we tell ourselves “This year I am going to [insert resolution here].” Maybe last year you decided to really start tracking your expenses (you know, with a budgeting tool, like Mint.com…