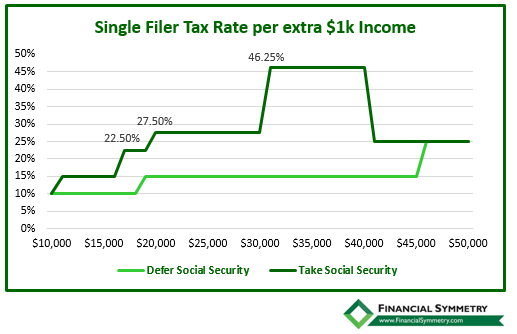

Determining the Taxable Amount of your Social Security Benefits

Did you notice the Social Security tax you paid on your return this year? While not all of the benefits are taxable, up to 85% can be. You can see this on the front page of your Form 1040 of your tax return on…