When Will the Federal Reserve Raise Interest Rates?

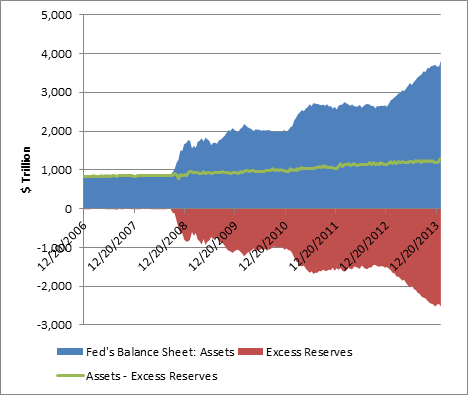

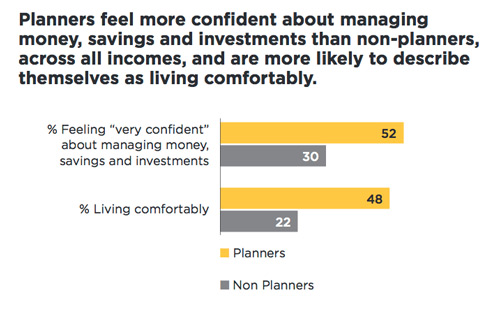

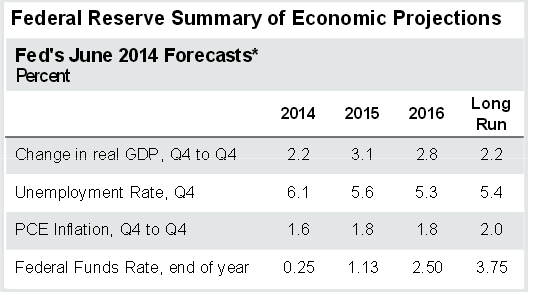

As the economy improves and the Federal Reserve (“Fed”) ends its quantitative easing program in October the next question for investors is when will the Fed raise rates? Which Factors Are Most Important to Raise Interest Rates? The Fed will…