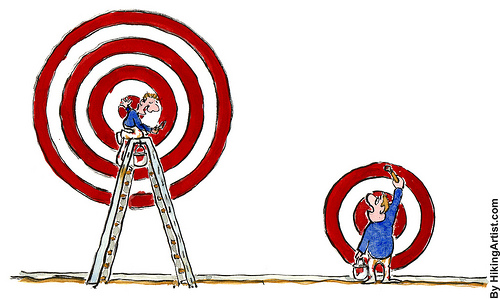

Set It and Forget It

A few years ago I wrote about the rise of target date funds in retirement plans. At the time, the Senate Special Committee on Aging was proposing legislation that would require target date fund managers to take on fiduciary responsibility. …