Defending the 401k

We have written extensively about the pitfalls of 401k investing, the high fees in some plans, and other details to be aware of. However, the fact is that 401k plans are one of the most powerful tools available for building…

We have written extensively about the pitfalls of 401k investing, the high fees in some plans, and other details to be aware of. However, the fact is that 401k plans are one of the most powerful tools available for building…

My grandmother loved to gamble. While she was a child of the depression and extremely frugal, she also loved putting a little money on bingo with friends, buying the occasional lottery ticket, or even playing the slots in Atlantic City. …

As financial advisors, we typically focus on building and managing wealth. However, it’s also important to point out impediments to building wealth and financial security, like consumer debt. While low interest debt can be a useful tool and offer benefits…

Our recent post on Social Security noted that about one-third of all people claim benefits at age 62. In an age where the future of Social Security is uncertain and the subject of constant political debate, claiming benefits as early…

As we did last year, Financial Symmetry has covered several current events on our blog throughout 2013, and here are what we think the Top 10 Economic Stories of the Year have been:

This month’s issue of Money magazine features an article entitled Busting the 5 Myths of College Costs. The landscape of saving and ultimately paying for college has been constantly changing over the past several years and it is important to…

“Hidden fees are eating away at your retirement!” “Say no to hidden fees!” “It’s YOUR money, why are you losing it to fees?” Do these messages sound familiar? Hidden Fees Fear Based Selling They are common rhetoric in ad campaigns…

Last year we wrote about new 401k fee disclosure requirements and the evidence suggesting that most 401k participants did not know they were paying for any plan costs. The structure of the investment industry has kept many investors in the dark…

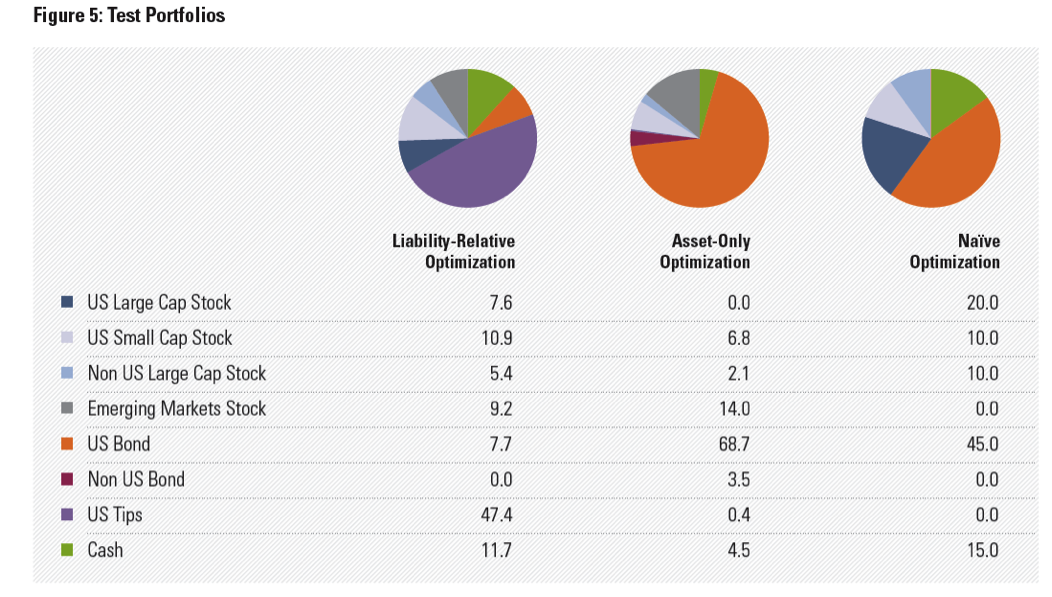

For many people, evaluating their financial situation means just reviewing investment performance against the Dow Jones Industrial Average. Now, Morningstar has produced new research they call Gamma, which highlights the value of smart financial planning. This post will summarize the last of the five strategies, liability…

While the Morningstar Gamma research found that a dynamic withdrawal strategy has the greatest impact on retirement income, the strategy above was a close second. Asset Location Asset Location refers to where asset types are held. For example, a general…