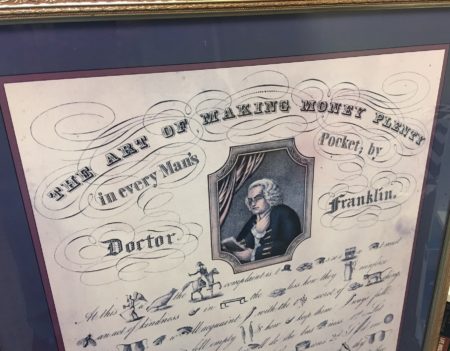

The Art of Making Money Plenty in every Man’s Pocket, by Doctor Benjamin Franklin hangs in my office. It’s a frequent reminder of the simplicity of building wealth and security in today’s complex world. The full text reads:

At this time when the general complaint is that money is so scarce it must be an act of kindness to instruct the moneyless how they can reinforce their pockets. I will acquaint all with the true secret of money catching, the certain way to fill empty purses and how to keep them always full. Two simple rules well observed will do the business. First, let honesty and hard work be thy constant companions; Second spend one cent less every day than they clearly gains. Then shall thy pockets soon begin to thrive, thy creditors will never insult thee, nor want oppress, nor hunger bite, nor nakedness freeze thee; the whole hemisphere will shine brighter and pleasure spring up in every corner of thy heart. Thereby embrace these rules and be happy.

Short Cut to Making Money Plenty?

So often we want to short cut these very simple principles. In our complex world of credit default swaps, FANG stocks, and seminars on flipping houses, many seek out the services of a financial planner to find the next hot investment scheme that will make them rich with little effort, a tax strategy that will significantly increase their take home pay, or an account that will guarantee high returns with little risk. Another new trend is young retirees making enough money off of a website or blog to afford a life of around the world travel and leisure. Since our society is so connected and we are bombarded with a 24-hour news cycle, it can be easy to see stories like these and feel like you are falling behind or missing out. It may also seem that money can indeed buy happiness.

We hear these concerns from clients. And while we have many more tools available to maximize wealth than the two identified by Dr. Franklin, financial planning at its core always comes back to the elegant simplicity of income minus expenses. The beauty in his words are that they don’t advise on the amount of either. He doesn’t say that you should work as a stock broker, invent an App, or work in a job that makes as much money as possible. He also doesn’t advise giving up your daily coffee habit, never leasing a car, or investing in real estate as many financial pundits do. The advice is timeless and amounts insignificant.

Income Doesn’t Matter As Much As You Think

As financial advisors, we see this simple formula work for or against clients on a regular basis. What is always surprising to me, is that the income part of the equation matters very little. I have worked with people of modest professions like teachers, police officers and nurses who have built significant wealth. They are now in a position to generously support their favorite charities and assist with their grandchildren’s college education. I have also worked with those in higher paying positions who make six figures a year while having little savings and living nearly paycheck to paycheck. These cases are the hardest because they require not only a reality check, but also behavioral changes to build a healthy financial position.

Finding the correct balance to the income and expense equation allows more complex financial planning strategies to be applied to help your money grow efficiently. This maximizes not only return on equity, but return on life as well.