In the realm of estate planning, many people in the United States have heard of the estate tax but think it does not apply to them, instead seeing it as an issue for the “1 percenters.” They are partially correct regarding the federal estate tax, with exemption amounts for 2024 being $13.61 million per person or $22.36 million per married couple (with portability), which very few households fall into post-2016 Tax Cuts and Jobs Act.

What they may not realize is that several states have their own estate taxes with much lower thresholds than the federal government and their own tax schedules. In many of those states, depending on where you live, your home value or family farmland alone can put you over the exemption amount. Many may also think any inheritance they receive is tax-free, but that could be a costly assumption depending on where they live.

What Is the Difference Between the Estate and Inheritance Tax?

Both of these taxes can be imposed on the transfer of assets and property whenever a loved one passes away. The difference is that the estate tax is levied on the loved one’s estate or “whole” of what the decedent owned, whereas an inheritance tax is levied on that loved one’s heirs and beneficiaries.

Which States Have an Estate or Inheritance Tax?

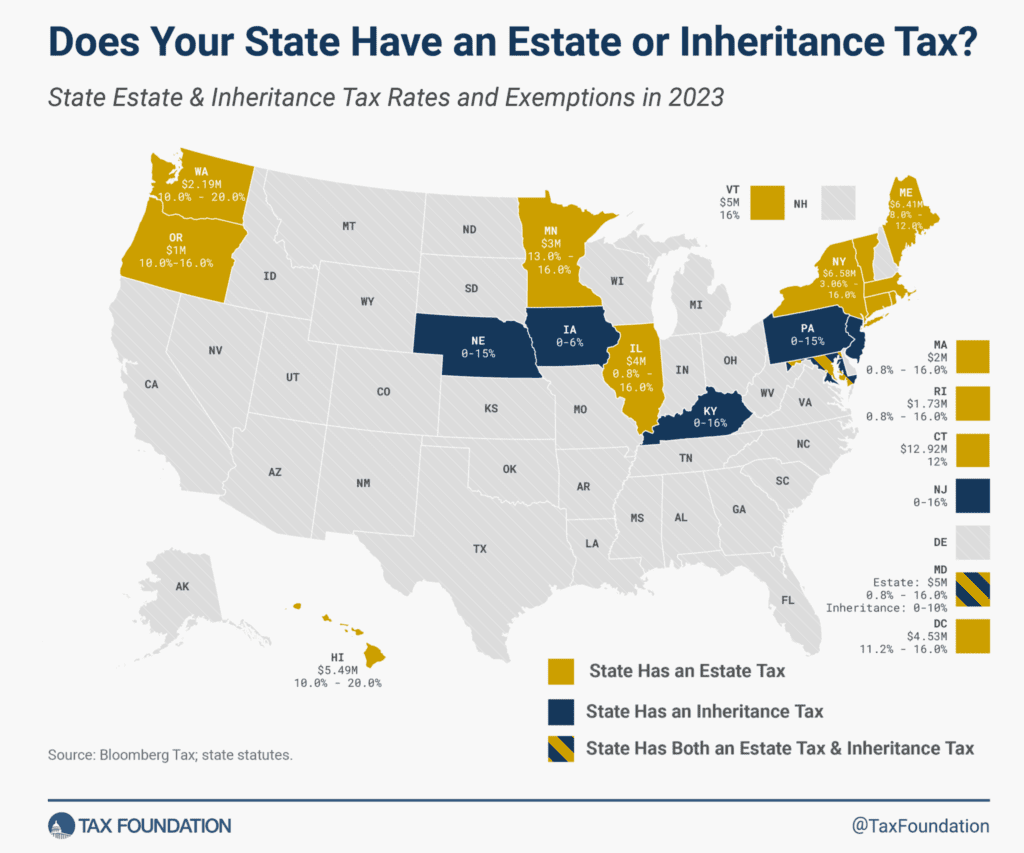

Although you may be well below the federal exemption amount, as of 2024 there are 17 states plus the District of Columbia that have their own estate or inheritance taxes. In Maryland’s case, it has both. The remaining 33 states have neither tax. This is illustrated in the Tax Foundation’s 2023 map here:

Source: https://taxfoundation.org/data/all/state/state-estate-tax-inheritance-tax-2023/

As you can see, each state has its own exemption limits and tax schedules (you can find the links to these at the end of this article). For example, Minnesota’s estate exemption limit is a flat $3 million per person, whereas Connecticut’s adjusts in unison with the federal exemption. Other states increase theirs with an inflation adjustment or require new legislation to change.

One key benefit that the federal exemption has over a state’s exemption is allowing portability between spouses, meaning when one spouse passes away, they can transfer their unused exemption amount to their survivor to lessen or eliminate potential estate taxes. Besides Hawaii and Maryland, the ones that have an estate tax do not allow portability of a spouse’s unused exemption under any circumstance.

For the six inheritance tax states, they usually put potential beneficiaries into different classes or tax rates based on their relationship to the decedent. Typically, if your beneficiaries are your surviving spouse, immediate family, or a charity/nonprofit there is no tax. Sometimes if property is held jointly or in tenancy by the entireties it will not be subject to this tax. Certain account types like 529s, life insurance policies, or donor-advised funds are not subject to this tax depending on the state.

The biggest liabilities are to those who had no relation to the decedent. The tax tables for these will be at the end of this article, but as an example in Nebraska, a Class I beneficiary (parents, siblings, spouses, grandparents) pays 1% on any value over $40,000. In Pennsylvania, a surviving spouse or child under 21 is exempt but if the child is over 21 they have to pay 4.5% on amounts received.

If I Live in One of These States, What Can I Do to Reduce or Avoid These Taxes?

- Move to a state that has no estate and inheritance tax or move to one with a higher threshold than your current state: Sometimes the easiest solutions are the most obvious. If you live in one of these states currently and are above the exemption amounts but are planning to make the move south to Texas, North Carolina, Florida, Georgia, or Tennessee, then that would solve your problem. Another example is if you are over the exemption limit for Massachusetts but have to move for a job in New York or Connecticut where the exemptions are three to six times higher, that can be a solution as well. Wherever you do move, you’ll want to review your estate plan with an attorney in the new state to see if it is still sufficient, especially if you still hold land and property in the former area, since it may or may not be liable to their tax laws or probate proceedings.

- Stay put and work with a financial planner and estate attorney to create a plan: If moving is not an option due to proximity of family, access to healthcare, career, current health, etc., we would suggest finding an estate attorney and financial planner that are familiar with your state’s probate laws and loopholes. The main tools would consist of a variety of trust options, annual gifting strategies, re-titling of assets, adding life insurance policies where necessary to create estate liquidity, etc.

- Stay put and wait for legislative changes: Each state with these taxes has its own tax codes outside of federal taxes with its own exceptions or inclusions. If you do stay put, we still strongly suggest working with an estate attorney. However, these taxes and exemption amounts are subject to change through legislation. Recent examples of this are the Tax Cuts and Jobs Act in 2016 raising the federal exemption limits, New Jersey repealing its estate tax in 2018, Iowa planning to repeal its inheritance tax starting in 2025, and the Illinois House proposing to possibly double its exemption amount to $8 million if it passes. Although it would be very unpopular, the opposite of this can also be true, where a state can create and implement either tax as well. States with consistent budget shortfalls may see these taxes as an additional income stream so it is important to pay attention to local elections, local politicians, proposition votes, etc.

Given the breadth of information regarding this topic, here are links from SmartAsset articles by Ben Geier, CEPF® outlining each of these states’ estate tax, inheritance tax, exemption amounts, and beneficiary classes. Financial Symmetry is not a law firm and this article is not meant to convey any legal advice. However, we can work alongside your estate attorney or trust company to help implement your estate plan.

- Connecticut Estate Tax: Connecticut Estate Tax: Everything You Need to Know | SmartAsset

- Hawaii Estate Tax: Hawaii Estate Tax: Everything You Need to Know | SmartAsset

- Illinois Estate Tax: Illinois Estate Tax: Everything You Need to Know | SmartAsset

- Iowa Inheritance Tax (will be repealed Jan 1, 2025): Iowa Inheritance Laws: What You Should Know – SmartAsset | SmartAsset

- Maine Estate Tax: Maine Estate Tax: Everything You Need to Know | SmartAsset

- Massachusetts Estate Tax: Massachusetts Estate Tax: Everything You Need to Know | SmartAsset

- Kentucky Inheritance Tax: Kentucky Inheritance Laws: What You Should Know – SmartAsset | SmartAsset

- Maryland Estate & Inheritance Tax: Maryland Estate Tax: Everything You Need to Know | SmartAsset

- Minnesota Estate Tax: Minnesota Estate Tax: Everything You Need to Know | SmartAsset

- Nebraska Inheritance Tax: Nebraska Inheritance Laws: What You Should Know – SmartAsset | SmartAsset

- New Jersey Inheritance Tax: New Jersey Inheritance Laws: What You Should Know – SmartAsset | SmartAsset

- New York Estate Tax: New York Estate Tax: Everything You Need to Know | SmartAsset

- Oregon Estate Tax: Oregon Estate Tax: Everything You Need to Know | SmartAsset

- Pennsylvania Inheritance Tax: Pennsylvania Inheritance Laws | What You Should Know – SmartAsset | SmartAsset

- Rhode Island Estate Tax: Rhode Island Estate Tax: Everything You Need to Know | SmartAsset

- Vermont Estate Tax: Vermont Estate Tax: Everything You Need to Know | SmartAsset

- Washington Estate Tax: Washington Estate Tax: Everything You Need to Know | SmartAsset

- Washington D.C. Estate Tax: Understanding the Washington, D.C. Estate Tax | SmartAsset