So far, the 2024 election has provided the suspense and drama we have come to expect in presidential election years. For investors, the same questions continue to plague us as we await the winner in November.

- Are there signals in the movement of markets that we, as investors, should be taking advantage of?

- Who is better for markets? Republicans or Democrats?

- Will the market collapse if one candidate is elected?

- Are there specific market segments or industries we should focus on/move away from depending on the election outcome?

- Is this the same conversation we have every 4 years, or is this time different?

The political heat and differences of opinion have been extraordinary this 2024 election season. It is no wonder many are feeling anxiety about how the outcome may affect their financial health.

Reflections on Democracy and Capitalism

While democracy and capitalism do not require each other, they do go together like peanut butter and jelly. While they are complementary, there is something psychologically challenging about both. On some level, they are both messy processes. Capital markets can feel chaotic. No one individual oversees where the stock or bond market should be. No one fully controls the ongoing auction of every share of every company that is for sale around the world. No one congress, president, central bank, or other body controls the stock market. This lack of central control can lead to stress and anxiety. The same can be said for democracy.

Image source: https://www.dimensional.com/

The same is often said of capitalism. While capitalism is messy and sometimes disappoints us, it seems to be the best way to allocate resources in a successful way. A positive way to think about this is that both democracy and capitalism are dynamic, respond to pressure and forces in society, and benefit us as citizens and investors.

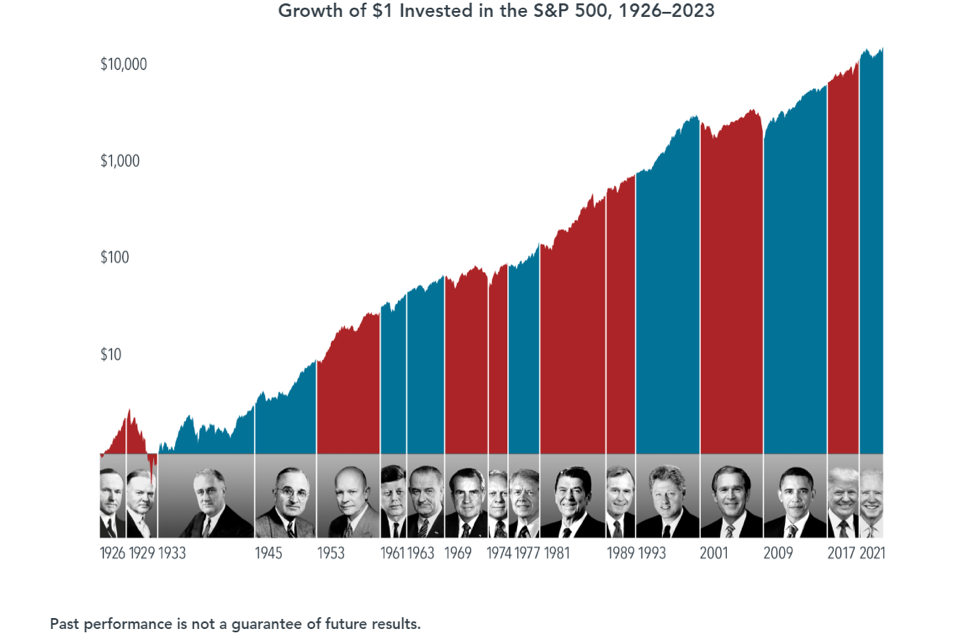

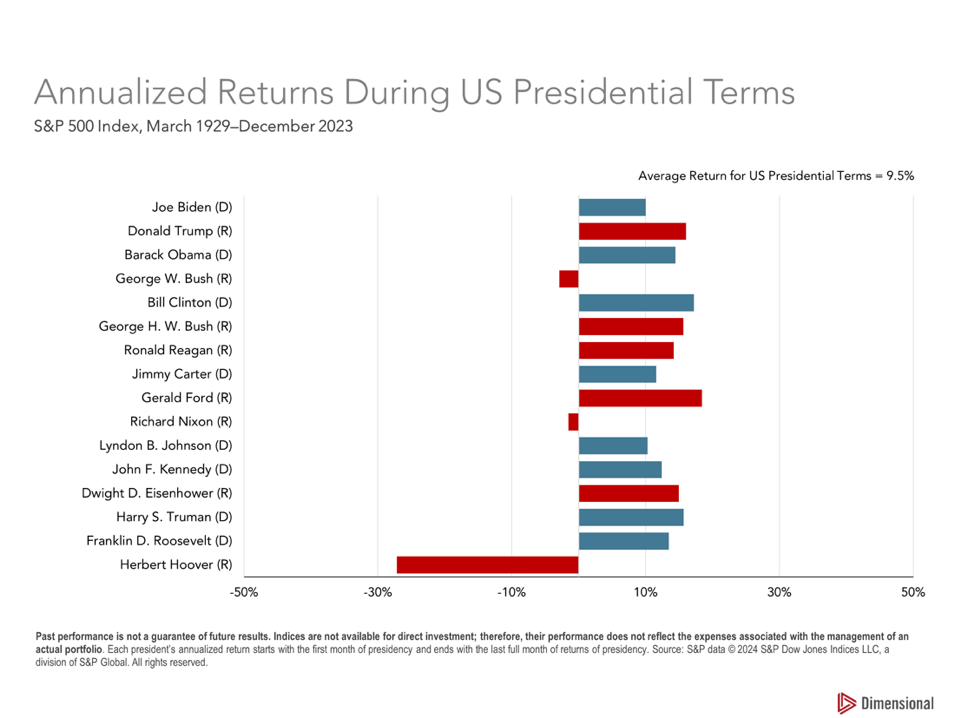

Who Is Better for Markets? Republicans or Democrats?

While there are a lot of theories about whether Republican or Democratic policies are better for the stock market, what we see in the data is that over the long term, the stock market has rewarded investors regardless of who is in office. There is not a dramatic difference. If we really want to choose a political party with better stock market results, we see that until the end of 2019, Democratic administrations have had a slight edge. Why is that? This is mostly a result of Republican presidents governing through strong negative events such as the Great Depression, 9/11, and the Great Financial Crisis:

While political activity influences growth, the sum of the economy, GDP, and capital markets are larger than what any president, congress, or political party can control. Most presidents preside over strong market returns. For these reasons, we see no clear evidence around which to build a strategic investment thesis based on who will win the election.

Why Doesn’t the Market Have a Preference?

The daily auction in the markets reflects all future opinions-both informed and uninformed in the form of a value for all positions going forward. The net result is that the competitive market is so good at pricing assets that it is the best repository of what is going to happen going forward. Those prices can be harnessed to give us a sense of what will happen going forward. This gives us the choice as investors of how we respond to the 24-hour news cycle. You can allow the market to price in all that uncertainty and maintain your investment plan despite it. That is a powerful choice.

How Do Our Political Opinions Color Our Views on the Economy and Investing?

Many of our strong opinions are reinforced by the media and news sources we choose to consume. We tend to select media sources that support the biases we already hold. Watching the news, as they say, can be expensive. It is critical to remember that the goal of most media outlets is not for you to be a successful long-term investor; it is to keep you engaged and increase the odds you buy products and services from their advertisers and/or donate to their chosen causes. The old adage, “If it bleeds, it leads,” reminds us that stories that breed fear, anger, and uncertainty are likely to receive the most airtime and keep viewers in a vulnerable state.

Is There Any Overlap Between Politics and Investing?

While diversified investors typically do not need to worry about political change influencing their long-term expected return, some business owners and highly compensated employees may have a much higher exposure to this risk. If you have that kind of human capital risk, there may be choices that you have to make. There may also be new tax strategies to evaluate and other considerations for your overall wealth. However, there is a big opportunity cost to making significant changes inside your investment plan. While it may feel good to sit out of the market while your team is not in the office, if, at the end of that period, the market has not suffered, you have lost money on that trade. Emotionally you may have felt better, but you paid the price in the form of lower lifetime wealth.

Is This the Same Conversation We Have Every 4 Years? Or Is the 2024 Election Different?

When we are in the fever of an election, it is easy to view today as the most intense period ever. While political opinions are extremely far apart right now, this is not the first time this has happened in our history. Capitalism has always kept going. There are no indicators to believe the country is on the verge of something dramatically problematic. Capitalism encourages people to make careful, safe decisions that benefit themselves, and good things tend to happen even with volatility. Nothing in today’s political noise would suggest Warren Buffett’s sentiment that the US is a great place to invest is wrong or negate the immense progress that has continued through election cycles, recessions, and bear markets.

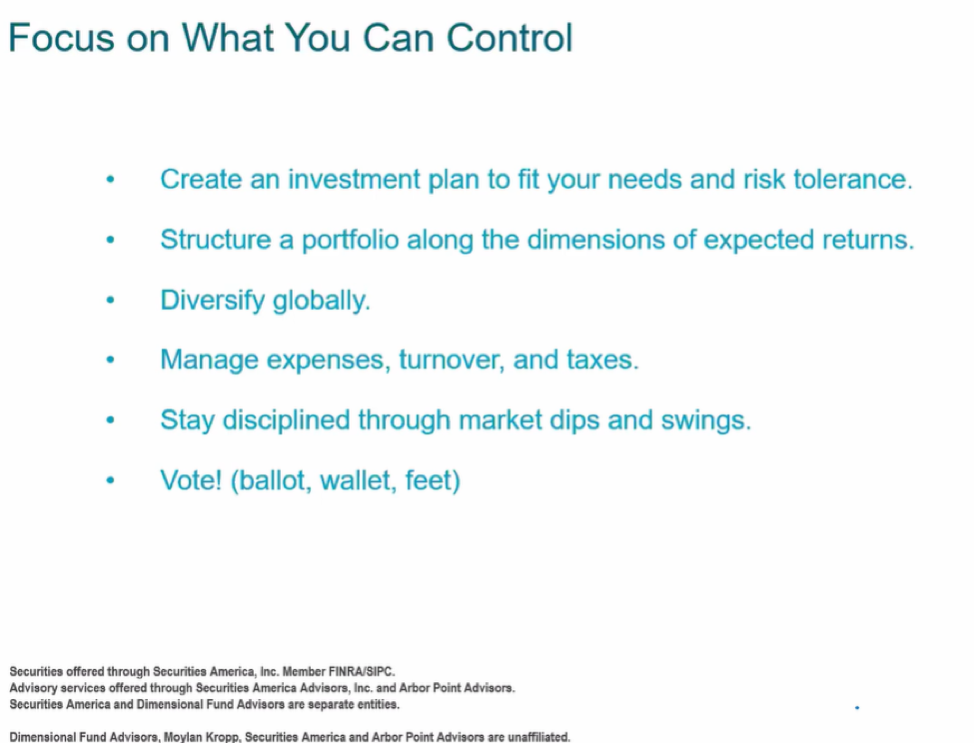

What Should We Do Next?

While we have made the case that the current situation does not warrant significant investment changes, often in periods of tumult and volatility, it is helpful to focus our attention on areas where we can have the most positive impact:

We will be here patiently awaiting the 2024 election results and understand that you may have concerns about the current environment. Please contact us if you would like to discuss how these events impact your personal financial situation.