Reaching your financial goals builds confidence and peace of mind, which are essential for making informed decisions that benefit your entire family.

In this episode, we’re following a fictional pop culture couple from newlyweds to pre-retirement, to demonstrate how their thought process around an emergency fund could evolve with their changing circumstances.

The Historic View of an Emergency Fund

Having an emergency fund in place is a critical first step on the path to building wealth and financial security.

Most of us know the generic rule of thumb to maintain 3-6 months of fixed and variable expenses on hand to cover unexpected changes to our planned income and/or expenses. Some financial pundits might even argue for a 12-month cushion if your income is variable or you are a single-income household with a career in a volatile industry.

However, as you build real wealth, continuing to sit on a big pile of cash begins to raise some questions:

- Is this money working for me in the context of my long-term financial plan?

- Is this money losing purchasing power?

- Am I missing opportunities that I could otherwise take advantage of with these funds?

- Is it possible this cash balance could hinder my ability to meet some of my long-term goals?

While an emergency fund is essential for individuals and families living paycheck to paycheck, as you transition to greater success and financial wellness, these are questions worth asking.

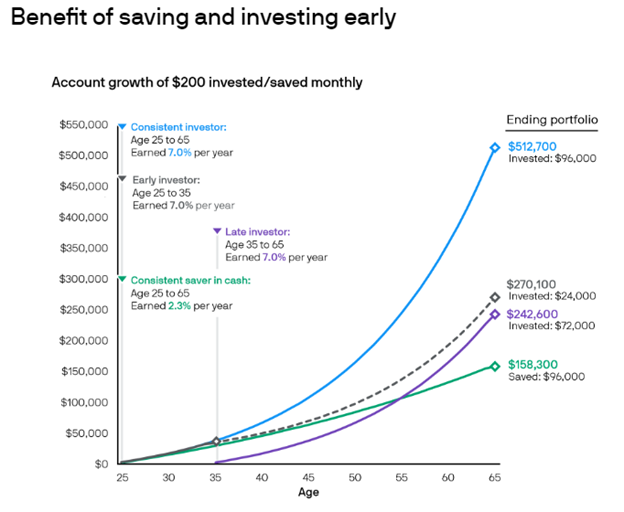

After all, as illustrated in JP Morgan’s Guide to Retirement, keeping too much in cash can be more detrimental to your wealth than skipping 30 years of saving and investing:

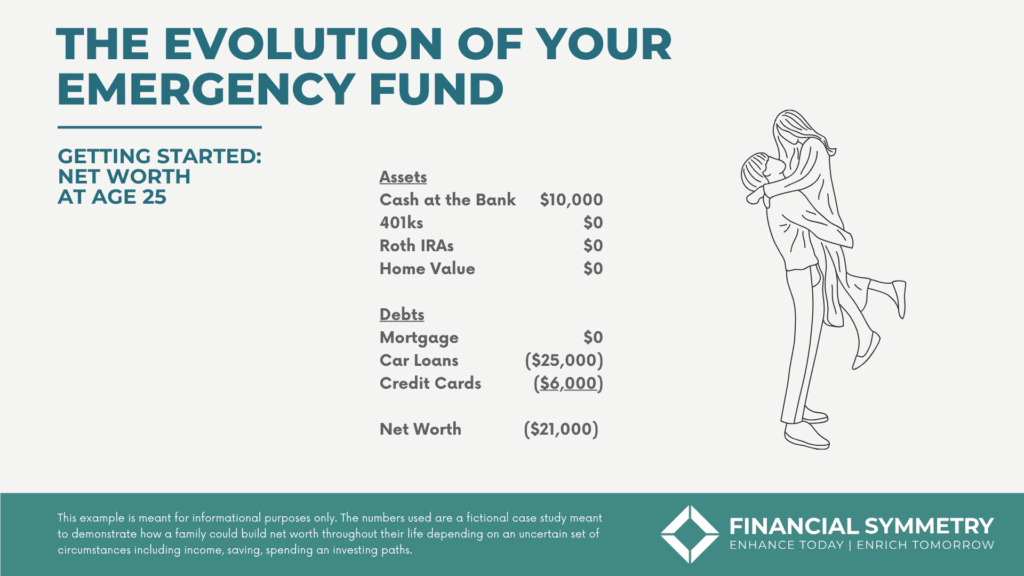

Getting Started: The Blank Space Era

In the Blank Space Era, our couple, Taylor and Travis, are 25-year-old newlyweds who have just embarked on their careers. Like many young couples, they have a negative net worth, grappling with car loans, credit card debt, and modest cash reserves of $10,000.

But what about their emergency fund?

It’s important to maintain 3 to 6 months’ worth of expenses, and for newlyweds like Taylor and Travis, this translates to saving $15,000 to $30,000 in cash reserves. This cushion protects unforeseen expenses or emergencies, such as medical issues or unexpected relocations.

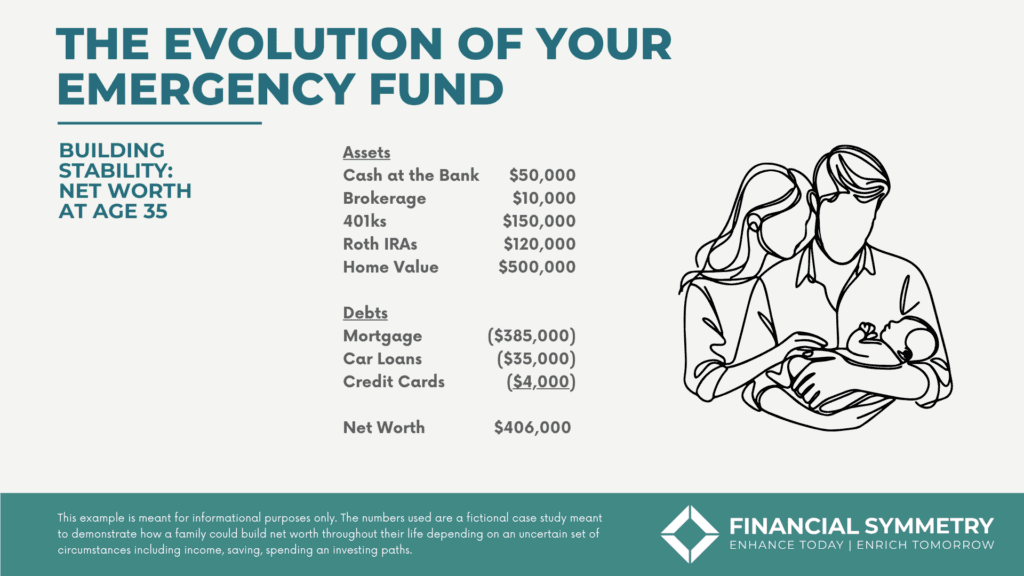

Building Stability: Your Wildest Dreams Era

Fast forward ten years, and Taylor and Travis are now 35-year-old homeowners and parents. They have successfully accumulated a net worth of over $400,000. Their emergency fund has grown to $60,000, held primarily in cash and a small brokerage account.

Wow, a lot has changed in 10 years. Taylor & Travis have clearly made tremendous progress. In just 10 years they have grown from a negative net worth to over $400k. We can see they now have 5 months of planned expenditures at the bank plus $10k in a brokerage account that is likely liquid, so they have a comfortable 6-month emergency fund at the ready. Great work!

What else do they have that they might be able to access in the event of a true emergency?

- Roth IRA Contributions (~$60k; these can always be withdrawn tax and penalty-free)

- Home Equity (Currently ~$115k; they could take out a HELOC for 80-90% loan to value, accessing $15-65k of low-interest debt)

- They may also be able to access a 401k loan through one of their employers.

- Total additional emergency access funds: $125k

In this stage, maintaining flexibility is crucial. By leveraging these diversified assets, they can confidently navigate financial uncertainties and ensure their wealth continues growing.

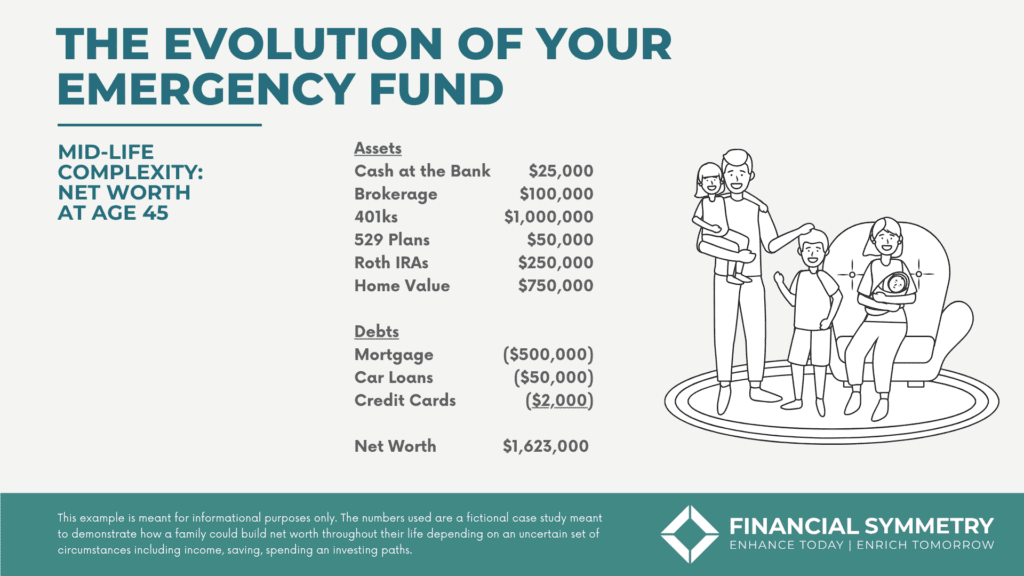

Mid-Life Complexity: The Cruel Summer Era

At 45, Taylor and Travis have three children, higher incomes, and consequently, larger expenses. Despite their net worth soaring to $1.6 million, their cash reserves have dipped to $25,000, causing a sense of financial strain.

Another 10 years of rapid growth and change. Their net worth has more than tripled, but their cash at the bank balance is well under the recommended 3-6 months emergency fund of $45-60k most rules of thumb would call for.

But, Taylor and Travis are feeling very stressed. They have not had a bank balance this low since their 20s, and cash flow is tight. What else do they have access to?

- Brokerage Account $100k

- Roth IRA Contributions (~$60k; these can always be withdrawn tax and penalty-free)

- Home Equity (Currently ~$250k; they could take out a HELOC for 80-90% loan to value, accessing $100-175k of low-interest debt)

- 529 Plan Contributions ($30k; contributions can be withdrawn tax and penalty-free; earnings need to be used for qualified education expenses otherwise a tax and penalty may apply)

- They may also be able to access a 401k loan through one of their employers.

- Total additional emergency access funds: $365k

Even though their liquid cash has diminished, Taylor and Travis have substantial assets in brokerage accounts, home equity, and retirement savings. These diversified investments offer a safety net exceeding traditional emergency fund recommendations. It’s important to recognize the importance of utilizing these resources effectively to maintain financial stability.

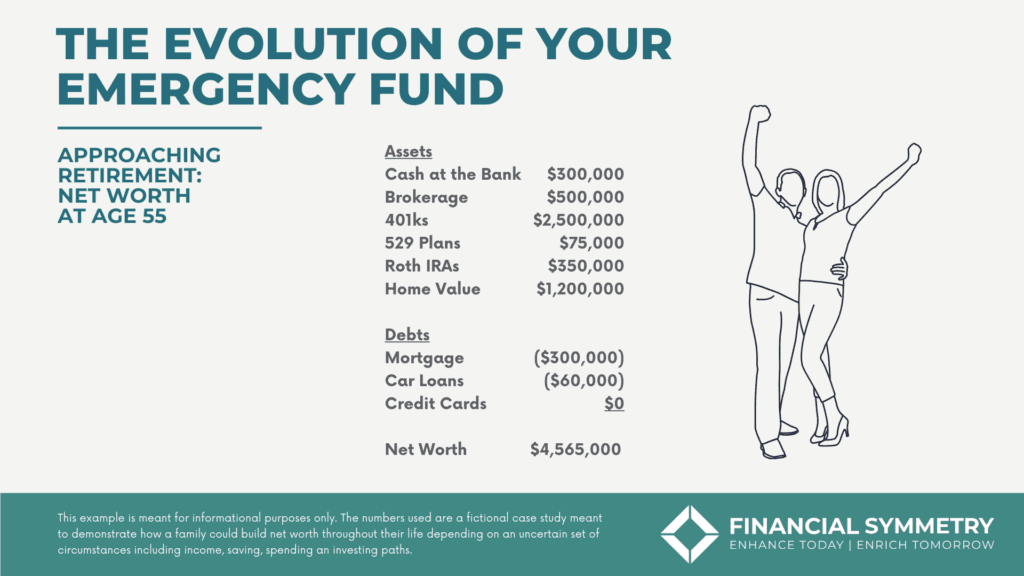

Approaching Retirement: The Shake It Off Era

Now in their mid-50s, Taylor and Travis have accumulated significant wealth, including $300,000 in cash reserves. They are preparing for major life transitions, such as retirement and becoming empty nesters.

Their careers have grown considerably, they have received modest inheritances from their parents, and they have been receiving cash bonuses well above their monthly outflow of ~$15k.

They are feeling great because they have a healthy emergency fund and enough to buy their next car in cash if they want to.

While their cash balance is well above the typical recommended 3–6-month emergency fund of $45-60k, Taylor and Travis are hesitant to send any of that excess to their brokerage account or use it to fund back door Roth IRA contributions.

It feels good to have such a large cash cushion. However, this cash could be becoming a drag. After all, what else do they have access to?

- Brokerage Account $500k

- Roth IRA Contributions (~$60k; these can always be withdrawn tax and penalty-free)

- Home Equity (Currently ~$900k; they could take out a HELOC for 80-90% loan to value, accessing $660-780k of low-interest debt)

- 401k Rule of 55: $2.5M

- Total additional emergency access funds: $3.84 Million

While it is true that some of the additional account balances are invested and subject to market fluctuations, they are also invested for long-term growth, helping Taylor and Travis build wealth and purchasing power in retirement. Cash at the bank is likely losing purchasing power to inflation the longer it stays there.

What Era Will Be Next?

Travis and Taylor have clearly done a lot of things right over the years to amass their nest egg.

At this stage, efficient management becomes critical to achieving their long-term goals and leaving a lasting legacy for their families. The net worth they have built affords them many opportunities like:

- Early Retirement

- Paying for children and grandchildren’s educations

- Traveling

- Maintaining and/or increasing their standard of living

- Giving to their favorite causes

There are also pitfalls they could fall victim to if they focus on safety instead of growth or rules of thumb that no longer apply to their situation such as:

- Losing purchasing power to inflation

- Overspending

- Overpaying in taxes

Taylor and Travis have built an enviable financial position, but no plan is bulletproof. Good planning and careful consideration can be the difference between thriving in retirement and leaving a lasting legacy for the next generation or living in fear of watching those asset balances fall in the next bear market and losing what they worked so hard to build.

Too often we see retirees fall victim to this fear and shift to a more conservative posture than necessary. Over time, holding a large cash allocation only increases the risk of running out of money in retirement as you can expect the cost of goods to more than double over 30 years.

In many cases a mindset shift is required for the next era as operating from old playbooks can be the Anti-Hero to achieving what is possible.

After a certain point, it may be time to tell your old emergency fund rules that you are never getting back together.

Outline of This Episode

- [03:22] Starting an emergency fund in your 20s

- [04:40] Strategies from when income and expenses rise in your mid-30s

- [06:11] Places to put your cash to work but keep it accessible as an emergency fund

- 07:28] Managing and balancing finances in the mid-40s era

- [07:28] Strategy for actively managing finances in midlife

- [10:18] Feeling financially squeezed despite net worth tripling over 20 years

- [15:07] Wealth strategies in your mid-50s and why to maintain liquidity for flexibility

- [17:41] Creating a personalized financial plan as you move toward retirement