Retirement comes with its own set of financial intricacies. Specifically, how do you set up a retirement withdrawal strategy to ensure a comfortable, sustainable, and tax-efficient lifestyle?

A well-crafted retirement blueprint is essential. This plan should outline your long-term goals and the steps needed to achieve them. More importantly, your financial plan should be flexible enough to accommodate life’s unexpected expenses, such as healthcare costs or home repairs throughout retirement. Revisiting and updating your blueprint annually—or when significant life changes occur—can help ensure you stay on track.

In this episode, we share the essential steps to develop a retirement withdrawal strategy that caters to your needs. We dig into which accounts to draw from, how to minimize taxes, and how to manage unexpected expenses. You’ll also learn about advanced strategies like Roth conversions, tax-loss harvesting, and the benefits of Qualified Charitable Distributions and Donor-Advised Funds.

Crafting Your Perfect Retirement Withdrawal Strategy

The foundation of a successful retirement strategy is all about understanding the various sources of your retirement funds. Typically, retirees have three main types of accounts:

- Tax-deferred accounts include traditional IRAs and 401(k)s, where taxes are paid upon withdrawal.

- Taxable Accounts are brokerage or bank accounts where you pay taxes annually on dividends and interest.

- Tax-Free Accounts, the Roth IRAs, where contributions are taxed upfront, but withdrawals are tax-free under qualifying conditions.

You must carefully balance what you withdraw from and when.

Strategies for Sustainable Spending

Roth conversions play a critical role in minimizing your overall tax burden. By converting tax-deferred accounts to Roth IRAs, you can pay lower taxes today and enjoy tax-free growth and withdrawals in the future.

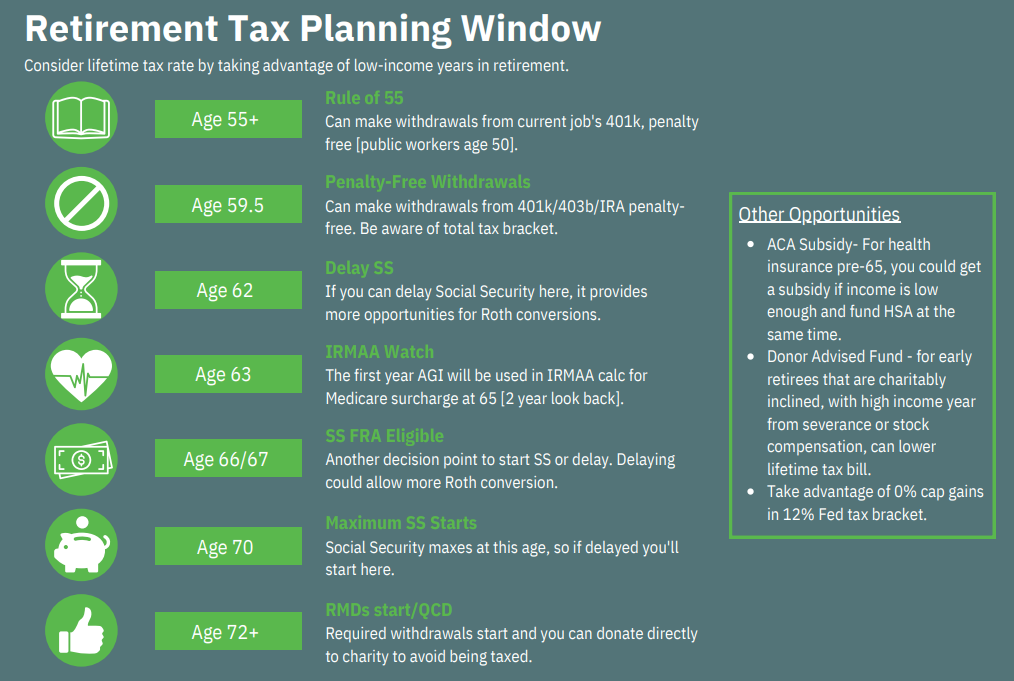

The retirement tax window, referring to the period between ages 59½ and 70½, is usually when you’re likely in a lower tax bracket. This is typically the best time to make Roth conversions to minimize lifetime taxes. For instance, converting funds at a 10-12% tax rate now, rather than a higher rate later, can yield significant long-term benefits.

Understanding Qualified Charitable Distributions (QCDs)

If charitable giving is part of your plan, tools like Qualified Charitable Distributions (QCDs) and Donor-Advised Funds (DAFs) can offer significant tax benefits. A QCD allows individuals aged 70½ or older to donate up to $100,000 directly from their IRAs to charity. This helps you avoid income tax on the distribution, benefiting those who might not itemize deductions.

DAFs are particularly useful for those with high-income years nearing retirement or those expecting to sell a business; you can donate appreciated stock or mutual funds to a DAF to avoid capital gains taxes and receive an immediate tax deduction. These funds can then be distributed to charities over time, allowing for flexibility in your charitable planning.

If you’re looking for more details on crafting your ideal retirement withdrawal strategy, check out the episode above.

Outline of This Episode

- [5:06] Your options for retirement tax strategies

- [8:32] Utilize early years to make strategic financial moves

- [11:30] Plan your retirement for peace of mind

- [17:12] Lower RMDs with Roth conversions and reduce the tax impact

- [19:42] Consider tax loss harvesting, capital gains, heirs’ basis

- [21:30] Use a QCD to reduce taxable income

- [26:12] Exploring blind spots in retirement withdrawal strategies