Roth IRAs offer exceptional financial benefits for those who take advantage of them. A recent study found that just 1 in 4 households in the United States hold Roth IRAs; which represents about 1.4 trillion dollars.

Roth IRAs offer exceptional financial benefits for those who take advantage of them. A recent study found that just 1 in 4 households in the United States hold Roth IRAs; which represents about 1.4 trillion dollars.

To refresh your memory, the main benefits of a Roth IRA are:

- Your earnings grow tax-free and can be withdrawn tax-free at age 59 ½

- Contributions can be made at any age if you have qualifying income

- There are no mandatory withdrawals

- A Roth IRA can serve as a backup emergency fund or be a funding source for paying for college

However, there are annual contribution limits to consider, and high earners may face restrictions that prevent them from contributing directly to a Roth IRA.

For 2024, the maximum contribution is $7,000, with an additional $1,000 allowed for individuals age 50 or older. If your Adjusted Gross Income (AGI) is below $146,000 for single filers or $230,000 for married couples filing jointly, you are eligible to make the maximum contribution. Anything at or above those limits allows for a partial contribution, eventually phasing down to $0.

Let’s discuss some Roth IRA tips you can use to make contributions, even if your income exceeds the standard thresholds.

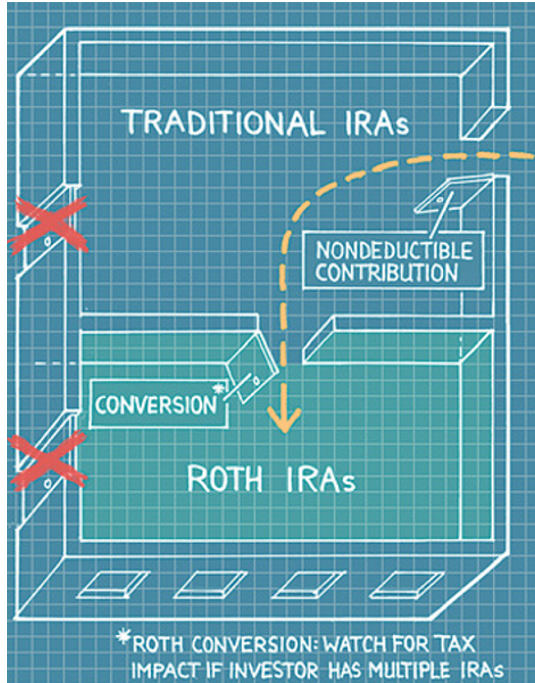

Backdoor Roth IRA

A backdoor Roth IRA uses current tax laws to circumvent the income limit restriction on direct contributions. To effectively execute this strategy, you must make a non-deductible contribution to a Traditional IRA and then convert the Traditional IRA to a Roth IRA.

Source: https://www.wsj.com/articles/ineligible-for-a-roth-ira-maybe-not-1393439730

Note that it is not as easy as it sounds. Without the proper knowledge and attention to detail, you could report this incorrectly on your tax return or dilute the tax benefit if you have an existing balance in a Traditional IRA.

Roth Conversions

The objective of this strategy is to move a calculated amount from a pre-tax account to a Roth IRA during years of lower income and benefit from lower tax rates in the future.

Typically, the best time for Roth conversions is after retirement, especially if you haven’t begun receiving Social Security or required minimum distributions (RMDs). Even if you’re not retired yet, this strategy can still be advantageous if you anticipate that your income will be lower in the current year compared to future years.

Source: https://money.com/traditional-vs-roth-ira-conversion/

Remember that you’ll have to pay taxes on the funds you convert. You should aim to complete Roth conversions before December 31st of the current tax year.

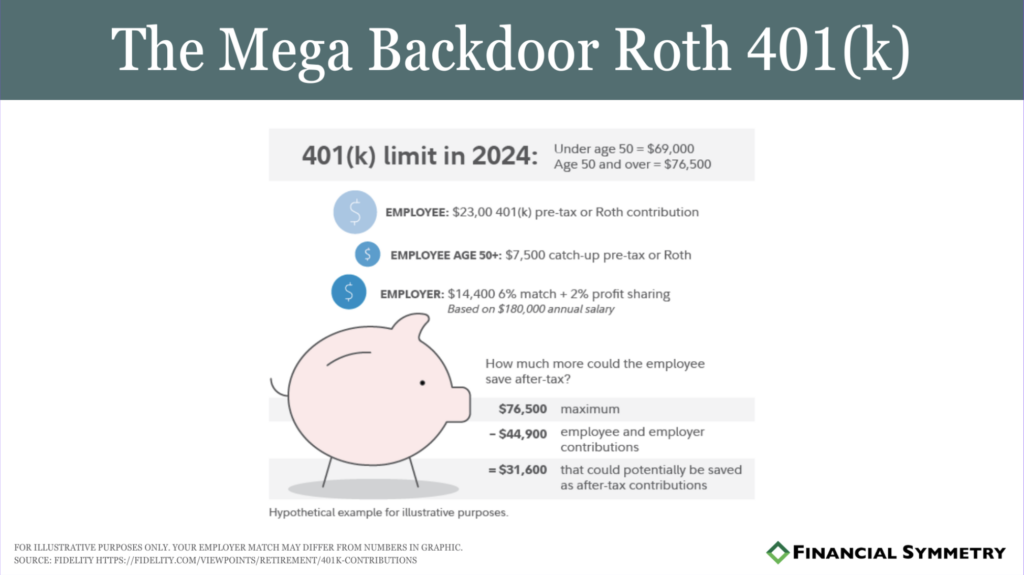

Mega-Backdoor Roth

Maybe you’re not able to make Roth IRA contributions or you’re already contributing the max.

For those maxing out their employer retirement plans ($23k for 2024), the Mega Backdoor Roth (MBD) presents an opportunity to contribute above the employee limits. This strategy involves making after-tax contributions to the pre-tax portion of your plan. Then, the after-tax contributions are converted into the Roth portion of your plan.

Not every plan offers the option for an MBD. It can also be confusing to keep track of your pre-tax vs after-tax contributions along with what your employer is matching. Check out our Mega Backdoor Roth Guide for additional considerations and limits.

In summary, Roth IRAs provide many financial benefits, such as tax-free growth and withdrawals, flexibility in contributions, and no mandatory withdrawals. High earners can fully benefit from Roth IRA contributions with careful and consistent planning. We recommend working with a fee-only financial planner who can take these Roth IRA tips into consideration with your long-term goals.

Talk to an advisor today at Financial Symmetry to get started.