Did you know the account you hold your investments in can make a meaningful difference in taxes over your investing lifetime?

Did you know the account you hold your investments in can make a meaningful difference in taxes over your investing lifetime?

This is called asset location, and Vanguard has found that it can save you up to 0.60% annually in after-tax returns.

One way we can add value to our clients, outside of our investment strategy and the investments we select, is how we manage the types of accounts those assets are held.

Two distinctions create this opportunity:

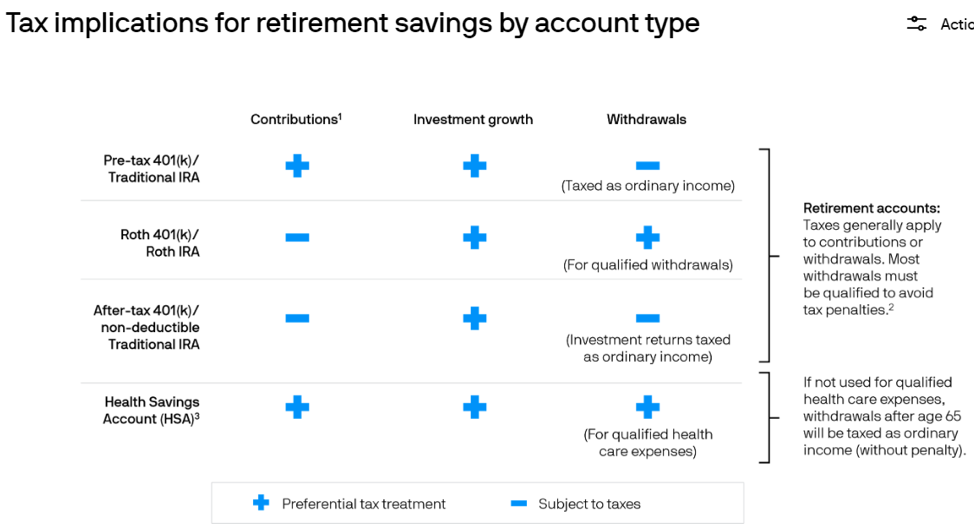

- Not all account types are taxed the same way

- Not all investment income is taxed the same way

For example, Traditional IRAs are tax-deferred until you withdraw the assets and then taxed as ordinary income, Roth IRAs are tax-free, assuming you meet the requirements, and earnings on taxable accounts are taxed as they’re paid out.

A JP Morgan chart below includes tax characteristics by account.

Source: https://am.jpmorgan.com/us/en/asset-management/adv/insights/retirement-insights/guide-to-retirement/

It is important to note that we manage all accounts holistically, so we’re focused on your overall portfolio return and are less concerned about short-term performance by account unless used for a specific goal (i.e. college savings).

For example, this is why our clients may see different investments in each account, resulting in different returns. Therefore, this approach aims to increase your after-tax returns which matters more than pre-tax returns in the long-term.

Generally, you benefit the most from asset location if you’re in a high tax bracket or there’s a significant difference between your current tax rate and the one you expect for the future.

Expected Return and Tax Efficiency

In summary, the optimal location of an investment depends on its tax efficiency and its expected return, as detailed below:

- High Expected Return/Tax Efficient = International and US Stock Funds

- High Expected Return/Tax Inefficient Investments = Tax Inefficient Stock Funds (i.e. Emerging Markets or REITs)

- Low Expected Return/Tax Efficient = Municipal Bond Funds

- Low Expected Returns/Tax Inefficient = Taxable Bond Funds

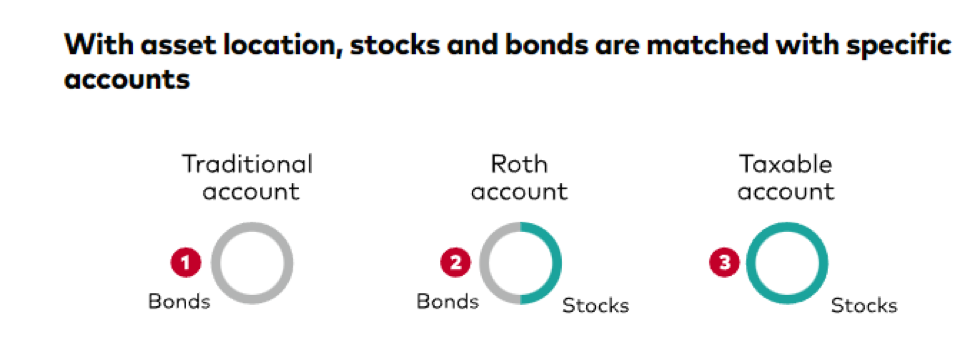

A basic asset location strategy would be to hold bonds in tax-deferred accounts while you have stocks in taxable accounts. Going to the next level, we would consider Roth/HSA accounts, as this would add another level of complexity regarding where to place the assets. Then, consider the subset of stocks between the breakdown of US and International equities.

Once we know the investment’s expected return and tax efficiency, we’ll determine the best type of account (401k, Roth IRA, Brokerage, HSA, etc.) to invest in.

In general, we’d use your brokerage account for high expected return/tax-efficient investments, your Roth IRA/HSA for high expected return/inefficient investments, and pre-tax IRA/401k for low expected return options.

The specific location of each investment will be determined by the type of accounts you own, your tax situation, the timing of when you need the money, and the balance in each account.

That said, although it would make sense to hold all stocks in your brokerage account to be perfectly tax-optimized, it is not uncommon to hold some bonds in your taxable account for expected or unexpected withdrawals.

Other Tax Benefits

A few other considerations of tax-efficient investing are outside the scope of this article. We’ve included a summary of each below with a link to an article if you’d like to learn more:

- Tax Loss Harvesting – the process of selling securities in your taxable account at a loss and using the proceeds to purchase similar securities

- Equity Asset Location – why international stocks may be better off in taxable accounts to realize the foreign tax credit

- Investment Income tax rules – the type of dividends received (qualified vs. non-qualified) could determine the optimal account for that investment

- Interest on Treasury Bills/Bonds – interest is exempt from taxation at the state and local level but is fully taxable at the federal tax level making them preferred for taxable accounts

© The Vanguard Group, Inc., used with permission

Summary

There are essential points to identify when implementing an efficient asset location strategy.

First, the critical factor, that will drive the majority of your returns and the highly crucial part of achieving long-term goals is your portfolio’s asset allocation. If the asset allocation doesn’t match the long-term goals, the importance of asset location strategies is diminished. When working with FSI, we derive this percentage directly from your financial plan, which is based on each client’s unique situation and goals.

Second, because of the holistic management of clients’ accounts, not all accounts will be allocated similarly and will perform differently. This can cause perplexity when viewing a single account in seclusion compared to viewing it as a part of the total portfolio.

Finally, it’s worth leaving a bit of flexibility in the portfolio when implementing asset location because the client’s goals and timeframe for needing cash can change quickly.

Although it is more difficult to analyze, the additional after-tax performance of asset location, compounded throughout the plan, can make a significant difference. Considering all of these factors is why we believe in a holistic approach to portfolio management for clients.