Welcome to this bonus episode of the Financial Symmetry podcast with Allison Berger and Grace Kvantas. We bring you this episode as a special preview to the upcoming Women: A Force in Business Conference in Raleigh, North Carolina.

This episode and our presentation are targeted toward female professionals looking to build their retirement nest eggs. We are passionate about helping women achieve investment success and lasting wealth. So, if you are a woman or if you love a woman, listen in to hear how women can achieve more success and improve their financial well-being by harnessing their financial superpowers.

Women are stressed about money

A recent study by Ellevest has shown that women are more worried than ever about their finances. Two thirds of women worry about money at least once per week and 40% suffer physically due to their financial stress. This is no surprise when you discover that the top emotion that women feel about money is overwhelm, whereas for men it is confidence.

The pandemic has made women’s financial worries worse than ever since they were the hardest hit by layoffs. When you compound women’s stress with the gender pay gap, a longer life expectancy, and a predominantly male financial industry, it can seem the odds are stacked against us.

Women are actually better investors

It is a common misconception that men are better investors than women, however, this isn’t true. A recent study from MIT found that “investors who are male, over the age of 45, married or considered themselves as having “excellent investment experience” are more likely to “freak out” and dump their portfolio during a downturn.” Men also tend to trade more frequently than women which can lead to higher trading costs, taxes, and overall lower investment performance.

Women are more likely to do well in the markets for several reasons. They typically spend more time researching investment choices which leads to better selections. Women also tend to buy and hold equities longer than men; this leads to less trading costs and fewer taxes on their investment income. Overall, women are more intentional investors than men.

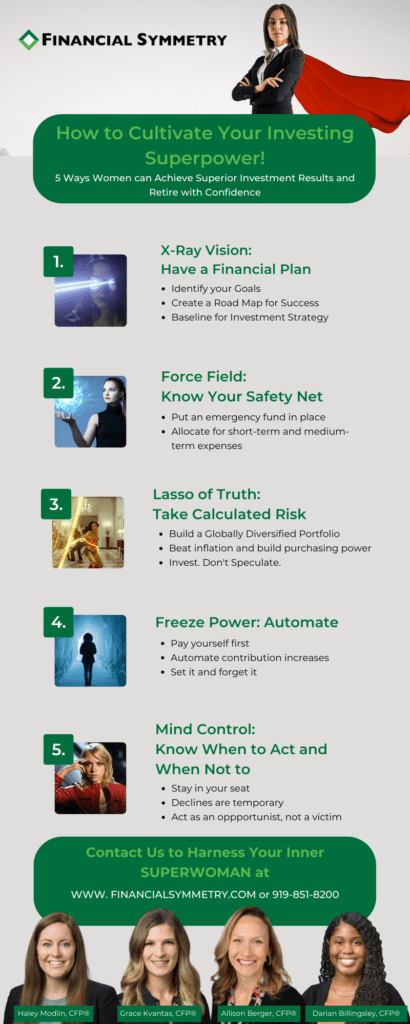

Harness these 5 investing superpowers

While we still face challenges of financial stress and overwhelm, women have the potential to achieve superior financial results. We are here to help you harness your inner investing superpowers so that you have a better investing experience and feel less stress when it comes to finances. Following these 5 principles can help you build the confidence you need to position yourself for a more secure retirement.

- Have a plan. We’ve all heard the saying: “Failing to plan is planning to fail.” This is true with your finances as well. Your financial life will run more smoothly when you have a plan. Having a plan in place helps you identify what your life goals are so that you can create a financial road map for how to achieve them. Your investment strategy will stem from your life goals.

- Know your safety net. Make sure you understand what an appropriate emergency fund for your household is and put it in place. This will help build your confidence so that you can take long-term steps to achieve financial success.

- Take calculated risks. Invest for the long term by building a globally diversified investment portfolio of equities (companies you use every day). This will allow you to build wealth and purchasing power over time.

- Automate your savings plan. Pay yourself first. Women are busy, so creating an automated savings structure will help ease your worries about saving. Make sure that you are contributing at least the minimum amount to get an employer match in your 401K. Another way to automate your savings is to set up monthly transfers from your checking account to a savings or brokerage account. You can dollar cost average and have those contributions automatically purchase shares of a mutual fund or ETF. By automating your saving and investment plan, you will build wealth simply over time.

- Know when to act and when not to. Successful investing is a lot like riding a roller coaster. The only time you will get hurt is if you get out of your seat. Make sure to stay strapped in through times of market turbulence. Unfortunately, our brains tend to have the same reaction to a bear market as encountering an actual bear in the woods. When you encounter a bear market, it is important think like an opportunist, not as a victim. This will ensure that you continue to build your wealth over time.

Listen in to hear what action items you need to take now to improve your financial well-being.

Outline of This Episode

- [1:45] Women are more stressed about money than ever

- [6:03] Why are women better investors than men?

- [7:30] 5 Investing superpowers

- [14:13] Progress principles

Resources & People Mentioned

Connect With Allison and Grace

- https://www.financialsymmetry.com/podcast-archive/

- Connect on Twitter @csmithraleigh @TeamFSINC

- Follow Financial Symmetry on Facebook